Next Year And Beyond, Challenges For Ag Inputs Realized

Due to the waterfall effect of factors challenging the supply chain, 2022 is shaping up to be the most challenging for row crop producers in recent history.

There are growing concerns over the pricing and availability of crop inputs for the crop year ahead.

Fruit and vegetable producers felt immediate impact from the pandemic, as their demand centers blew up and they had to adjust to major shifts in demand, shares Allan Gray, director of the Center for Food and Agricultural Business at Purdue University.

“But for broadacre growers, we were in the middle of crop production already [when the implications of the pandemic set in],” he said on a recent webinar with Chip Flory and other experts.

Gray was joined by Seth Meyer, USDA; Jeff Tarsi, Nutrien Ag Solutions; and Sam Taylor, RaboResearch Food & Agribusiness for a conversation moderated by AgriTalk host Chip Flory. You can watch a full replay of the webinar, "Supply Chain Chaos" here.

While input supplies in 2020 were relatively unaffected, Gray says ag retailers had inventories built up enough to smooth out any major supply chain wrinkles in 2021, but 2022 is shaping up to be the year it all comes to a head.

“It’s now hitting the farmer, but it took two years for it to get here,” he says.

Why Is 2022 Showing Such Strain on the Ag Supply Chain?

Last fall indications surfaced that input supplies were going to be tight for the 2021 crop season, says Jeff Tarsi, senior vice president of North American Operations at Nutrien Ag Solutions.

“Through 2021 we managed it really well, but this past summer started to show indicators 2022 was going to be a much more challenging year for crop input supplies—particularly crop protection products—than 2021,” Tarsi says. “I could go on for days, but we had multiple things stack on top of each other, including the freeze in Texas, which many people don’t realize its impact.

It was this cascade of influences that are causing supply chain concerns, says Sam Taylor, vice president at Rabobank North America.

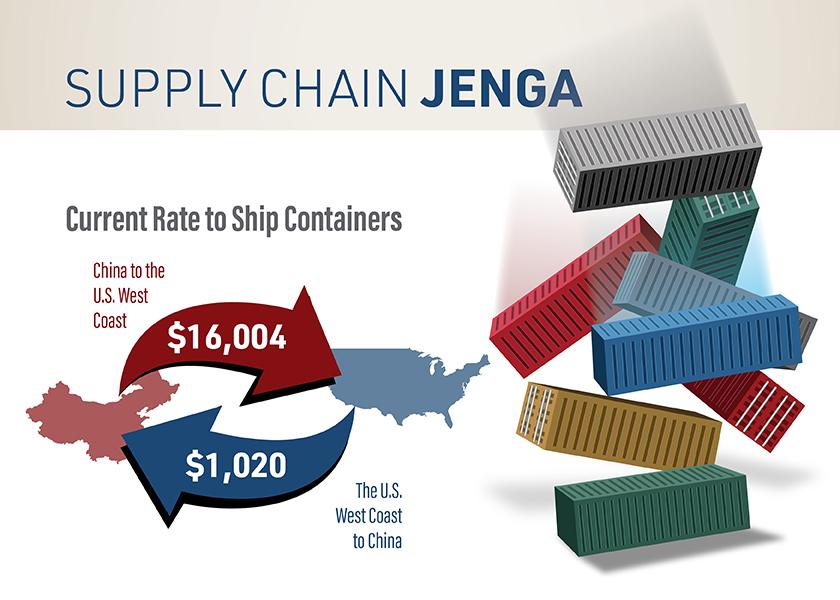

“Even beyond the logistics side, it’s the weather, it’s the geopolitics–there’s a lot of exogenous factors, which are very hard to plan for,” Taylor says. “The other thing that is really a concern and probably bears consideration is the stickability of a lot of these situations. You basically need more than one of these issues to resolve itself to get back into a semblance of normality. We're going to see issues on the supply chain and on the availability for these products for a decent period of time. It wouldn't surprise me if in a year's time, we're still talking about freight issues out of China in particular or logistics issues domestically.”

The Most Stressed Sector of Ag Inputs

The greatest tightness in the ag supply chain is in crop chemistry, Tarsi says. For the crop protection products used in North America, 70% of active ingredients are sourced from China. And 90% of intermediates, which go into the production of active ingredients, are sourced from China.

“I had not really understood well until this summer how short we are on active ingredients and the difficulties of getting active ingredient into these plants,” Gray adds. “Things like crop protection chemicals are a leading indicator not just for the year coming up but for a year after that. Changes take a long time to reset, and we're going to have to be prepared for this for a period of time to come.”

With global sourcing of materials, comes a complicated supply chain that can be disrupted anywhere along the way.

“This is a confluence of factors that created this situation–it is not one single thing,” Gray adds. “And the reality is it's a very, very complicated set of factors, from geopolitics to weather conditions to structural issues. For example, we just don't have enough truck drivers and that's ultimately what's going to be a big, big part of his problem.”

There are challenges stacking up against timely delivery of crop production products—which could lead to challenges in timely application.

Tarsi says truck drivers and applicator operators are the hardest jobs for his business to hire today.

Taylor adds looking onto the horizon, there’s no resolution to the trucking shortage as it’s expected in 10 years the U.S. will have a deficit of 150,000 truck drivers.

What Are Ag Retailers Doing About It?

In mid-2021, Tarsi says Nutrien Ag Solutions started to take product into its inventory from any suppliers who were able to produce, ship and deliver it.

“It was in June and July our strategy was to get product and be in the best place we could be,” Tarsi says. “There are definitely ingredients we as an industry will not have enough product for in the next year, but we have alternatives, and I’m comfortable with those alternatives.”

The team at Nutrien Ag Solutions is having a lot of one-on-one conversations with farmers, Tarsi says, because they believe no two farms are alike, and it’s those conversations which are exploring the options best for each farm.

“We have to flexible in our business, and our growers have to be flexible—and they are,” he says.

He notes this past week Nutrien Ag Solutions adjusted its price on glyphosate, and the company is looking to position the timing of those application where they are most valuable to the grower.

“If we know glyphosate is tight in 2022, we are looking at alternatives and where is glyphosate most valuable. If it’s more important in the over the top, may be for burndown we use paraquat ,” he says. “And we are already seeing a lot more pre-emerge products than last year. We’re seeing more fall pre-emergence products with residuals. We have some older post chemistry that works just fine—and we haven’t forgotten how to use those products.”

How Does the Supply Chain Affect Cropping Decisions?

USDA Economist Seth Meyer says the department is closely watching the dynamics of the supply chain and the economics of farm inputs. He sat down with USDA Secretary Vilsack to discuss the crop budgets for the year ahead.

“We walked through a corn and soybean budget for 2022 talking about input and output prices and the margin squeeze we might see on producers,” Meyer says. “We're trying to deal with the immediacy of some of these problems and what actions government might potentially take and then add the forward-looking potential danger points. In every line of those budgets, you've got this confluence of forces–energy, energy into fertilizer, labor, and they're all pointing the same direction.”

Tarsi is not forecasting farmers pull back on their inputs for the year ahead.

“In 2022, the thing that won’t change is yield is going to be key, and in my opinion, you can’t give up on yield,” Tarsi says, adding farmers are already selecting seed for the best genetics, allotting for the N, P, K their yield goals need, and positioning themselves to protect the crop in season.

He sees farmers applying a keen eye to return on investment, and shares the Nutrien Ag Solutions soil-testing lab, Waypoint Analytical, has seen a surge in soil testing.

Gray agrees that farmers will be in a position to grow strong yields.

“This is not a dire situation where they're not going to get anything done or not going to be able to produce food,” he says. “We're going to do it differently. We're going to choose active ingredients we haven't used before. We're going to do different kinds of production activities that we haven't done before or haven't thought about before.”

Gray sees that long-term being forced to do things differently has some great opportunities and risks for ag retailers. He cautions retailers when customers try something different, they may find products they like better. Or they may find a better way to do things. So on the agribusiness side, be thinking about the changes in products and services that customers are making this year.

What About High Fertilizer Prices?

“The fertilizer piece of this has less to do with shortages in supply versus the weather hiccups, plant shutdowns and input prices. Natural gas prices are up substantially, and with corn prices being higher, those two variables are the predictors for higher fertilizer prices,” Gray adds.

Taylor adds the global dynamics in the fertilizer markets are being expressed in very large-scale impacts.

“If you look at the geopolitics side going into the fertilizer prices, it is whether and when they turn the gas on is Europe, and when will the Chinese enter the urea and global phosphate markets.” Taylor says, adding he doesn’t see fertilizer prices coming down in time to have an impact on the 2022 season.

“I feel like betting on input pricing is basically betting on the benevolence of Xi Jinping and the benevolence of Vladimir Putin and the weather,” Taylor says.

Tarsi sees the fertility space as another area farmers will do things differently in 2022.

“We use a lot of in-furrow type products today, and that brings economics into the picture. We see more spoon feeding of products than we have done in the past,” he says.