Jerry Gulke: Are We Facing Inflation Déjà Vu Again?

The inflation genie is out of the bottle and might be as difficult to get back in as it was in the 1970s. As Yogi Berra would say, “It’s Déjà vu all over again!” Or is it?

I’m not as old as Yogi, but I planted my first acre of corn in 1973. I saw high inflation and watched the unfolding of a super cycle in agriculture — and the subsequent crash of the early 1980s.

The land I purchased in 1980 for $3,200 per acre lost 60% of its value as Federal Reserve Chair Paul Volcker raised interest rates one full percentage point — the largest rise in decades. Former President Ronald Reagan’s farm policy slashed deficiency payments, further depressing land prices and rents.

PRICE HISTORY

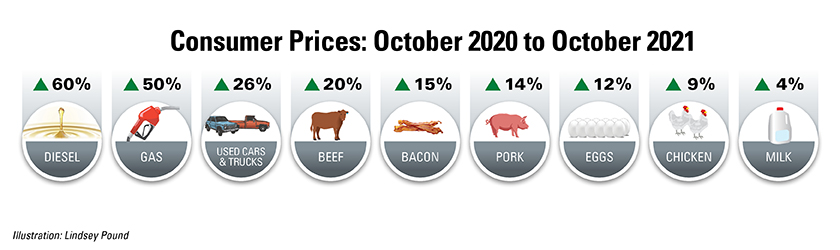

We can argue if today’s inflation is just transitory, but the risk is that it is not. Just look at how prices for basic goods are jumping:

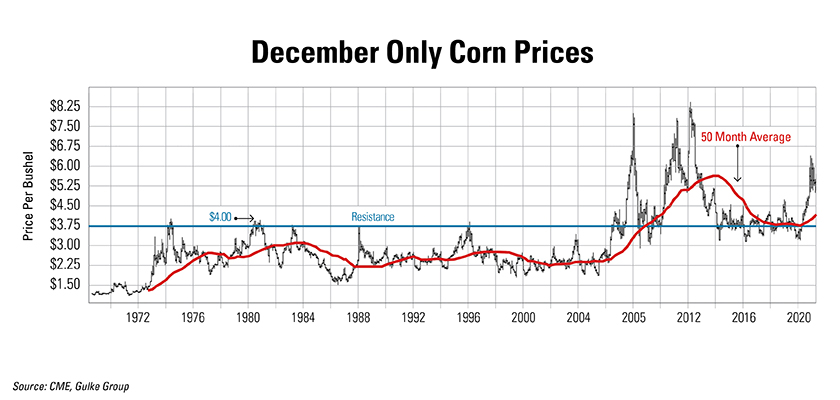

The long-term Gann chart below depicts December corn futures only. When one year ends, a new December futures price comes into play. The concern for obtaining ag inputs at any price has increased global concerns for critical shortages of food itself.

The definition of inflation is more money chasing less product. We certainly have the money allocated, but creating supply is in question.

The market’s function is to ration demand so whatever is produced will be enough. The difference today versus the 1970s is China has the ability to spend whatever it takes to buy products, which significantly affects our inflation.

MOUNTING CONCERNS

Politicians will be forced to do “something,” and history suggests that might not be pleasant. Here’s what could be on the horizon:

- Higher interest rates might come soon. Even a small increase has a big effect on our cost per acre.

- A new Federal Reserve Chairman is slated for February and he or she will make tough decisions for inherited inflation problems.

- The administration will be pressured to curb rising food and energy prices. Food for fuel could be affected, and EPA is sending shivers down the spine of renewable diesel refiners with warnings about lower mandates. And, $6 corn doesn’t work with low cattle prices.

- Regarding China, if they buy too much, they are blamed for global food shortages. But a lack of buying hurts U.S. and Brazilian farmers. The phase-one agreement expires Dec. 31. How will the current administration respond to the remaining outstanding balance?

MANAGE YOUR RISKS

We might be seeing a long-term paradigm shift, where global demand exceeds production.

In the 1970s, 9% to 10% interest rates were a culprit of the crash. Cash flowing high-priced land might do the same this time. If you are equity rich and cash poor, beware.

Agriculture might be too big to fail, but that’s a risk I am glad I don’t have to take, nor should you.

Jerry Gulke farms in Illinois and has interests in North Dakota. He is president of Gulke Group, a market advisory firm. Disclaimer: There is substantial risk of loss in trading futures or options, and each investor and trader must consider whether this is a suitable investment. There is no guarantee the advice we give will result in profitable trades. Past performance is not indicative of future results.