Change of Direction

Market Watch with Austin Schroeder

March 8, 2024

Change of Direction

The NFL Combine (no, not the one you’re used to) took place in Indianapolis last week. Though I did not pay much attention to it, as a fan of the game, clips often appeared on the Twitter feed. Alongside the main bench press or 40 yard dash, is an event called the 20-yard shuttle. In this event, NFL hopefuls are to go in a short 5-yard burst one direction, 10 yards back the other way and ending with a final 5 yard spurt the other way to end where they started. The event is designed to test one’s agility and ability to change direction. Well, it appears that the commodity market traders are running their own version of the shuttle at the moment, or more so testing their ability to change directions. The grains have managed to turn things around and shoot back higher, with the livestock and cotton turning things back lower. And just as the Combine event ends back where things started, the market is mean reverting, meaning prices have the desire to go back to their average.

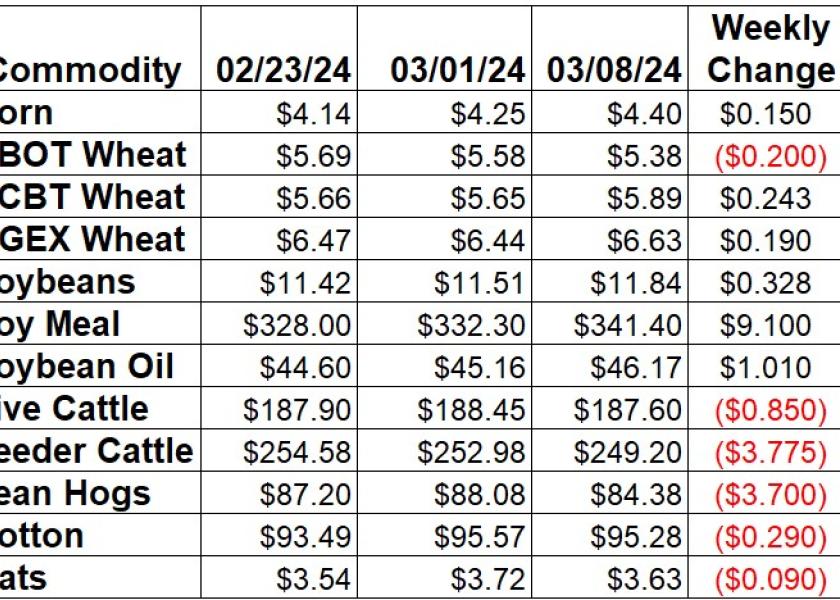

Corn extended the pop from last week as May was up 15 cents since last Friday for a 3.53% gain. USDA’s monthly update to the US and World balance sheets saw the US left alone, with the exception of a nickel reduction to the US cash average price. On the world side, Brazilian production was left at 124 MMT, with Argentina raised by 1 MMT to 56. EIA showed ethanol production coming down a little, dropping 21,000 barrels per day to 1.057 million bpd during the week of 2/23. Stocks were up another 29,000 barrels to 26.051 million barrels. Weekly Export Sales data showed bookings up to a 3-week high at 1.109 MMT during the week that ended on February 29. Shipped and unshipped export commitments for corn are now 74% of the USDA forecast, compared to the average pace of 80% for this time of year. Actual shipments are 40% of the USDA number, still 3% below the average pace. CFTC data from Friday showed managed money adding back just 1,537 contracts to their net short position as of 3/5. That left them 296,795 contracts net short as of Tuesday. Commercials cut their record net long position by another 10,709 contracts to 11,424 contracts as of Tuesday.

The wheat market was mixed this week. The hard classes were higher, as Kansas City was up 24 ¼ cents (4.3%), with MPLS spring wheat 19 cents in the green (2.95%). Chicago held near the lows with a little, pressured by a couple Chinese cancellations, as May was down 20 cents (-3.59%). USDA reported a couple different export sale cancellations totaling 240,000 MT this week. Export Sales data saw wheat bookings dropping to 271,130 MT for the week that ended on 2/29. That took export commitments to 94% of the USDA full year export projection, 2% below the 5-year average pace and 6% larger than the same point last year. Actual shipments are running a little slower, with 65% of the USDA forecast fulfilled compared to the 73% average. That, mixed with the Chinese cancellation was likely a catalyst for USDA to trim the US export projection by 15 mbu on Friday. They raised the projected carryout by the same amount to 673 mbu. The weekly Commitment of Traders report showed spec traders in Chicago wheat futures and options taking their net short back down another 9,213 contracts as of 3/5. That left them with a net short position of 65,539 contracts. In KC wheat, managed money trim 1,236 contracts from their net short, at 40,886 contracts as of Tuesday.

Soybeans continued the climb back higher this week, as May was up 32 ¾ cents (2.84%). Soymeal was 2.74% higher on a $9.10 gain. May soy oil was 101 points in the green on the week. Monthly WASDE data from Friday saw the US balance sheet left UNCH. The world side had a few changes, though Brazil’s production was down less than most thought, with a 1 MMT reduction of 155 MMT. Export Sales data from Thursday saw soybean bookings pulled up to a 7-week high at 615,534 MT for the week of February 29. That was a pretty decent feat, considering Brazilian FOB prices are still ~$1-1.50 below US offers. Export sale commitments for soybeans are now 84% of USDA’s forecast total, 6% below the 5-year average pace. Accumulated shipments are 72% of that total, below the average pace of 74%. This week’s Commitment of Traders report showed spec funds taking their net short in soybean futures and options to a new record as of Tuesday at 171,999 contracts. That was a 11,346 contract addition during the week ending March 5. Commercials were back near their record net long, increasing the current position by another 4,991 contracts to 70,388 contracts, was of last Tuesday.

Live cattle pulled back this week with April 85 cents lower, mainly on Friday weakness. Cash trade shot higher this week, as cattle exchanged hands at $185-186 across the country, up $2-3 on the week. Feeder cattle slipped $3.77 lower on the week, pressured by the weaker fats and stronger corn. The CME Feeder Cattle Index was up another $1.07 this week to $248.07. Wholesale boxed beef quotes continued their ascent this week, albeit on a shallower note. Choice boxes were up $1.76 (0.6%) to $307.04 to their highest level since October, while Select was $1.69 higher (0.6%) to $297.43, the highest since June. Weekly beef production dropped 2.6% vs. last week and was a sharp 7% below the same week last year as packers cut back on kills. Actual slaughter totals in the first several weeks of the year are down 5.5%, with production 4.5% lower. January beef exports totaled 232.6 million lbs, a 4.1% drop vs. last year. The major story of the Census trade data release was the import total, which was tallied at a massive record 503.6 million lbs. that was 38.1% larger than last year’s Jan record, as Brazil was busy slipping in beef to capture the 2024 TRQ allotment. Spec funds in live cattle futures and options continue to rebuild their net long, with another 4,543 contracts added to the overall net position during the week ending on March 5. They took the net long position to 59,364 contracts as of Tuesday.

Hogs dropped off this week, mainly in the April contract as it was down $3.70. June was down just 22 cents. The CME Lean Hog Index was another $1.33 higher this week at $81.48. USDA’s Pork Carcass Cutout was back down $2.34 this week (2.5%) this week to $92.11. The belly (-6.7%) and ham (-9.1%) were the leaders to the downside, with the butt and rib primals the only reported higher. Weekly pork production was down 3.8% compared to last week and was 2.6% below the same week a year ago. Slaughter for the first few weeks of the year is now up 0.9%, with a 0.7% increase in production. Monthly trade data from Census showed pork totaling 587.7 million lbs in shipments during January. That was a 5.8% increase from last year and the third largest January on record. Friday’s CFTC data showed spec traders in lean hog futures and options adding another 2,026 contracts to their net long at 65,090 contracts as of Tuesday. That is their largest net long since August 2022.

Cotton continued the choppy action this week, though May was still down a net 29 points. USDA gave the market friendly info on Friday, with a 300,000 bale cut to ending stocks, now projected at 2.5 million bales. That mainly came from a 330,000 bale reduction to production and lower average yield from the ginnings data. US Export Sales rebounded a little in the week of 2/29, though were still low at 52,012 RB, as China had 30,281 RB in net reductions. Commitments are still running at a solid pace for 23/24 at 10.529 million RB, which is now 91% of USDA’s current cotton export forecast. That is 3% back of the 94% average pace for this point in the MY. Shipments on the other hand were solid at a 5-week high of 330,790 RB, taking the MY total to 49% of the USDA forecast, 1% ahead of the average pace. The FSA trimmed the Adjusted World Price for cotton by 59 cents on Thursday, to 76.88 cents/lb. This week’s Commitment of Traders report revealed managed money spec funds adding another 2,323 contracts to their net long in cotton futures and options. They took that net position to 96,361 contracts as of Tuesday March 5, the largest since October 2021.

Market Watch

Next week starts with the weekly Export Inspections report on Monday morning. Stats Canada will also release Canadian Planting Intentions on Monday. On Tuesday, we will get CPI data. Skip ahead to Wednesday and EIA will release weekly ethanol stocks and production data. The weekly Export Sales report is out on Thursday morning, as well as the PPI data. March corn, bean, and wheat futures also expire on Thursday. Finally on Friday NOPA will release their monthly crush report.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2024 Brugler Marketing & Management, LLC. All rights reserved.