Expect the Unexpected

Market Watch with Austin Schroeder

March 22, 2024

Expect the Unexpected

The first couple days of the NCAA basketball tournament can get crazy. There are always a couple games that are shockers. We have come to expect the unexpected like in an underdog run with a double digit seed knocking off their higher ranked counterpart. Working with ag markets on a daily basis, some days the market does what you’d expect and others it doesn’t. You get a bearish export sales report for wheat and are still uncompetitive on the world market and we get a decent rally out of the market. Of course, some of that is built into prices via those expectations. So, you grow to understand the sell the rumor, buy the fact reaction (or vice versa). This is also where technicals come into play, the trade will often tell you via chart action before it hits the news wires. As Alan likes to say, ‘traders open their wallets before they open their mouth.’ Being in my position for going on 8 years now, I’ve learned to expect the unexpected. The market has a way of keeping you on your toes!

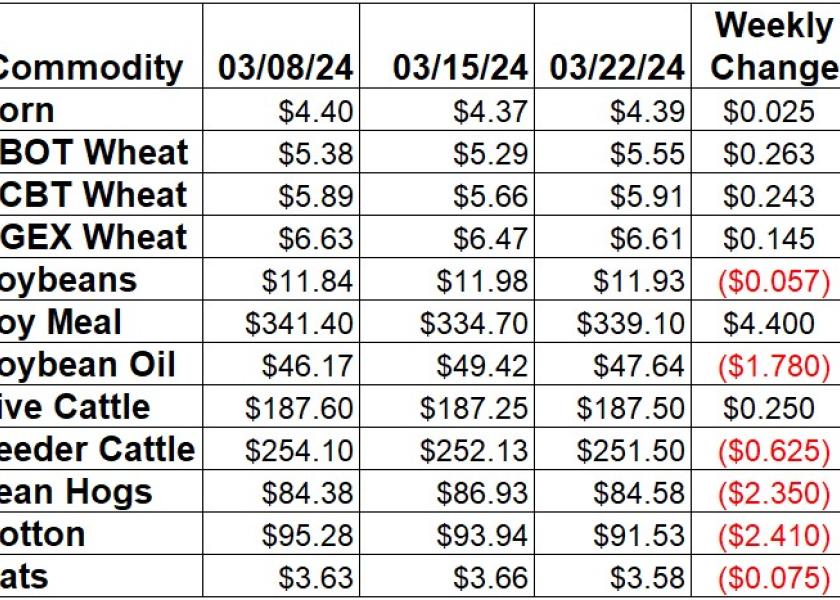

Corn clawed back some of the week prior’s weakness, with May closing with a Friday/Friday move of 2 ½ cents (+0.57%). New crop December ended with a 4 ½ cent gain. EIA showed ethanol production rising 22,000 barrels per day to 1.046 million bpd during the week of 3/15. Stocks were back to building, this week by 227,000 barrels to 26.009 million barrels. Thursday morning’s Export Sales report indicated bookings backing off of last week’s total to 1.19 MMT during the week that ended on March 14. Shipped and unshipped export commitments for corn are now 78% of the USDA forecast, compared to the average pace of 85% for this time of year. Actual shipments are 45% of the USDA number, still 2% below the average pace. The weekly Commitment of Traders report showed managed money trimming 12,940 contracts from their net short position as of 3/19. That left them 242,988 contracts net short as of Tuesday. Commercials added another 14,655 contracts to the new net short position as of Tuesday, taking their position to -45,723 contracts.

The wheat market found some upward momentum this week, as all three exchanges were double digits higher. Chicago led the bull charge, with May up 26 ¼ cents (4.97%). Kansas City was not far behind, clawing back all last week’s losses and rallying 24 ¼ cents (4.28%). MPLS spring wheat futures settled with a 14 ½ cent pop on the week (2.24%). That came in spite of an abysmal, but likely already priced in Export Sales report. All wheat bookings fell on a net reduction of 109,629 MT for the week that ended on 3/14, a MY low. That was mainly from the previously announced Chinese cancellations of 264,000 MT. The US is still uncompetitive on the world market, though futures seemed unconcerned about getting on the same price level as their EU or Black Sea counterpart. US wheat export commitments are now 96% of the USDA full year export projection, 2% below the 5-year average pace and now just 3% larger than the same point last year. Actual shipments are running a little slower, with 70% of the USDA forecast fulfilled compared to the 77% average. Friday’s Commitment of Traders report tallied spec funds in Chicago wheat futures and options adding 1,700 contracts to their net short as of 3/19. That left them with a net short position of 80,570 contracts. In KC wheat, managed money added back another 2,310 contracts to their net short, at 37,857 contracts as of Tuesday.

Soybeans pressed pause on the rally, with Friday weakness erasing any gains for the week. The Friday/Friday move for May beans was down 5 ¾ cents (-0.48%). Meal tried to provide some support this week, with a $4.40 gain (1.31%). Bean oil, however, was the drag on the market, down 178 points (3.60%). With the US not competitive on the world market, the product values are going to play a larger role. Despite the large premium the US has over their South American competitors, Export Sales data from Thursday showed beans at 494,028 MT for the week of March 14. That was the second largest in the last 8 weeks. Export commitments for soybeans are now 86% of USDA’s forecast total, 6% below the 5-year average pace. Accumulated shipments are 76% of that total, now matching the average pace. CFTC data via the Commitment of Traders report showed spec funds trimming another 6,798 contracts from their net short in soybean futures and options as of Tuesday. That took their net short to 148,339 contracts by March 19. The commercials large net long was backed off by 11,968 contracts to 41,225 contracts as of last Tuesday.

Live cattle saw another back and forth week, as April was up just a quarter (0.13%) since last Friday, with June down 70 cents (-0.38%). Cash trade did hold the front month up, as it improved $2-3 on the week. Cattle exchanged hands at $188 in the south and $190-191 in the north. Feeder cattle were also mixed on choppy trade but were pressured by late week action, as March was up just 67 cents and April was down 62 cents. The CME Feeder Cattle Index was up another $2.82 this week to $251.82. Wholesale boxed beef quotes backed off some this week, thanks to a weaker Friday. Choice boxes were down $1.18 at $310.72, while Select was 93 cents lower to $301.47. Weekly beef production was back down 0.2% vs. last week and still 2.5% below vs. the same week last year. Actual slaughter totals in the first several weeks of the year are down 5.4%, with production 4.0% lower as carcass weights have picked back up recently. Cattle on Feed data from Friday showed February placements ahead of expectations at 1.89 million head, 9.69% above a year ago. Feb Marketings came in 3.4% larger than last year at 1.793 million head. March 1 fed cattle inventory was 11.838 million head, a 1.31% increase vs. a year ago. Spec funds in live cattle futures and options pulled back 920 contracts from their net long in the reporting week ending Tuesday. They held a net long of 62,391 contracts on Tuesday night.

Hogs were in pullback mode this week, as April was $2.35 lower (-2.70%), with June losing $2.77 (2.71%). The CME Lean Hog Index was another $1.35 higher this week at $83.54. USDA’s Pork Carcass Cutout was up another 90 cents this week (1%) to $94.37. The belly (+4.87.6%) was the driver to the upside, with the butt, picnic and ham primals all reported lower. Weekly pork production was up 1.7% compared to last week and was 0.5% above the same week a year ago. Slaughter for the first few weeks of the year is now up 0.8%, with a 0.5% increase in production. Weekly Export Sales data showed pork sales improving from last week at 33,829 MT. Export shipments slipped off of last week’s 3-week high to 32,133 MT. Friday’s CFTC data showed spec traders in lean hog futures and options backing off another 802 contracts from their net long as of Tuesday. That position was tallied 62,877 MT as of March 19.

Cotton continued to pull back this week, with May down 241 points since last Friday. USDA Export Sales data showed weekly cotton bookings of 92,620 RB during the week of March 14, an improvement from last week. New crop sales weren’t quite as good as the week prior, but still a solid 40,462 RB. Old crop commitments are still running at a solid pace for 23/24 at 10.708 million RB, which is now 93% of USDA’s current cotton export forecast. That is 6% back of the 99% average pace for this point in the MY. Shipments were tallied at MT high of 397,297 RB. That took the MY total to 55% of the USDA forecast, 2% ahead of the average pace. The FSA cut the Adjusted World Price for cotton by 3.6 cents on Thursday, to 72.50 cents/lb. The weekly Commitment of Traders report indicated managed money spec funds trimming another 3,638 contracts from their net long position in cotton futures and options. They took that net position to 89,522 contracts as of Tuesday March 19.

Market Watch

Next week’s shortened schedule begins with the weekly Export Inspections report on Monday morning. That afternoon, NASS will release their monthly Cold Storage report. On Wednesday, EIA will release the weekly ethanol stocks and production report. Thursday will be a busy one as we round out the week, month, and quarter beginning with the weekly Export Sales report. USDA will release their quarterly Grain Stocks and annual Planting Intentions report at 11:00 am CDT. The quarterly Hogs & Pigs report will be out that afternoon. March feeder cattle futures and options expire on Thursday as well. The markets will take a day off at the end of the week in observation of Good Friday.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2024 Brugler Marketing & Management, LLC. All rights reserved.