Grains Gain Ground

Grain markets are attempting to recover some lost ground in the early morning trade, will the strength last through today's session?

Check out our 2:00 Minute Drill with Oliver Sloup

As he discusses why, Soybean futures had a nice start to the week but gave it all back and them some in today's trade as the market retreated back towards the lows from last summer. Is there any hope for a relief rally into springtime?

https://youtu.be/Dda15DDwrPQ?feature=shared

Corn

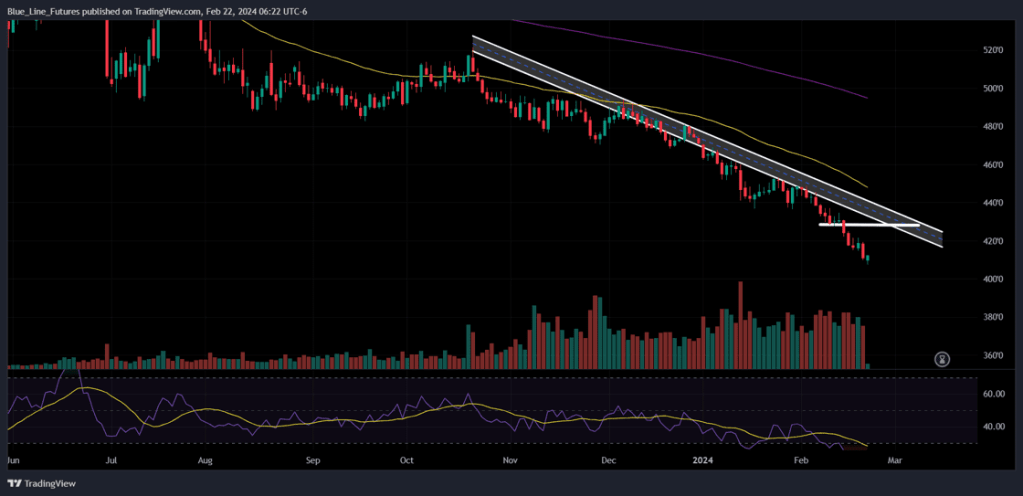

Technicals (March)

Corn futures continued to bleed lower, making new contract lows which keeps prices in uncharted territory as we inch closer to March options expiration. The RSI remains in oversold territory and near the lowest levels for this contract since last March. The first hurdle for the Bulls to overcome is 415-416, above that is 422-425. On the support side, eyes will be on the psychologically significant 400 level.

Bias: Neutral/Bullish

Resistance: 422-425** 435-436 1/2***

Pivot: 415-416

Support: 398-402**

Fundamental Notes

- Weekly export sales data is pushed back to Friday.

- March options expiration is tomorrow. If you're still in March futures, you may want to consider exiting or rolling before the weekend.

Seasonal Tendencies

(updated on Mondays)

Below is a look at historical seasonal averages for March corn futures (updated each Monday) VS today's prices (black line). *Past performance is not necessarily indicative of futures results.

Fund Positioning

(updated on Mondays)

Funds were net sellers of corn for the seventh consecutive week, expanding their net short position to a whopping 314,341 futures and options contracts. This is inching closer and closer to the record short position of 322,215 contracts, set in April of 2019.

Soybeans

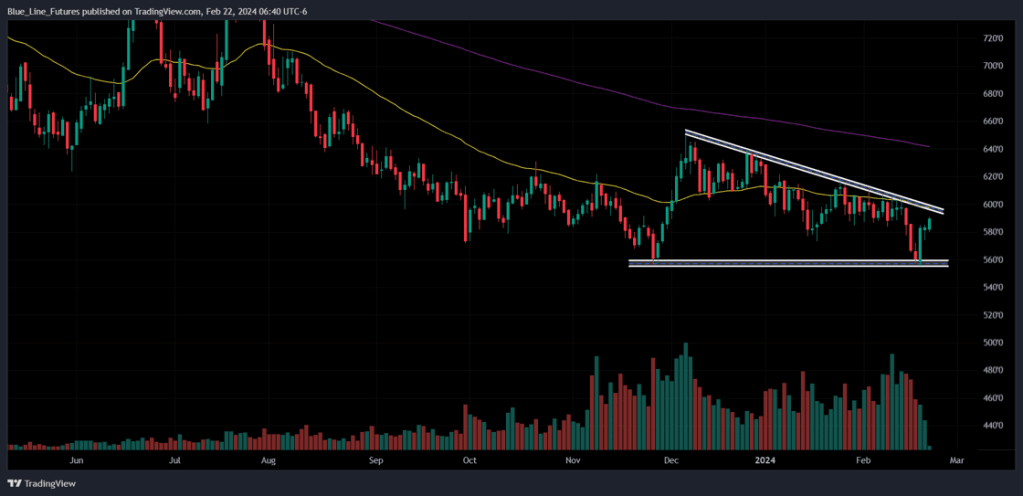

Technicals (March)

March soybean futures made new lows for the move in yesterday's trade but are attempting to regain some of that lost ground in the early morning trade. The end of June and beginning of May lows are still intact as we get closer to rounding out the week. With options expiration tomorrow the volume will continue to shift to the May contract. We did a 2-Minute Drill on May wheat yesterday afternoon, click here to check it out!

Bias: Neutral

Resistance: 1198-1205 1/2***, 1221-1223**, 1230-1235***

Pivot: 1175-1176

Support: 1145-1157****

Fundamental Notes

- Weekly export sales data is pushed back to Friday. March options expiration is tomorrow. If you're still in.

- March futures, you may want to consider exiting or rolling before the weekend.

Seasonal Tendencies

Below is a look at historical seasonal averages for March soybean futures VS this year's price (black line), updated each Monday. *Past performance is not necessarily indicative of futures results.

Commitment of Traders Snapshot

(updated on Mondays)

Friday's Commitment of Traders report showed Funds were net sellers yet again, extending the streak to 13 consecutive weeks, a new record. They are now net short 134,500 futures and options contracts, the fifth largest net short on record.

Wheat

Technicals (March)

March Chicago wheat futures are staging a nice recovery as they were able to defend 4-star support earlier this week and are now inching closer to 3-star resistance from 595 3/4-600. A breakout above this barrier could spur a bigger move to the upside, with that said, it probably won't come from the March contract, you'll want to keep an eye on May and beyond into next week's trade.

Bias: Neutral/Bullish

Resistance: 595 3/4-600***, 608 1/2-611**

Pivot: 573-578

Support: 555-558****

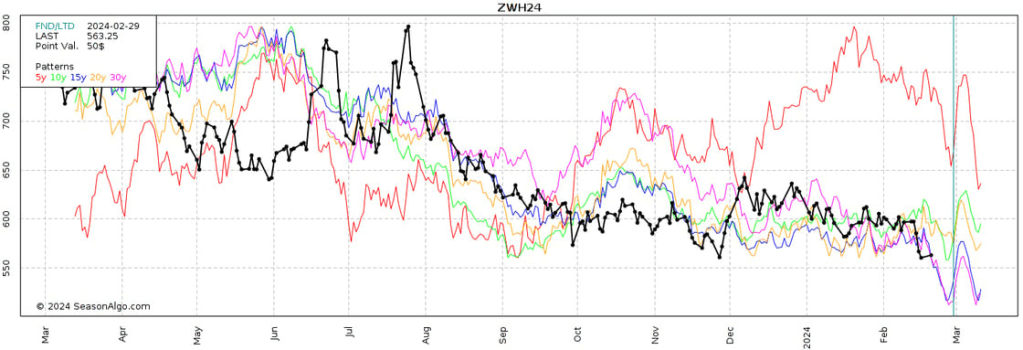

Seasonal Tendencies

Below is a look at historical seasonal averages for March Chicago wheat futures VS this year's price (black line), updated each Monday.

*Past performance is not necessarily indicative of futures results.

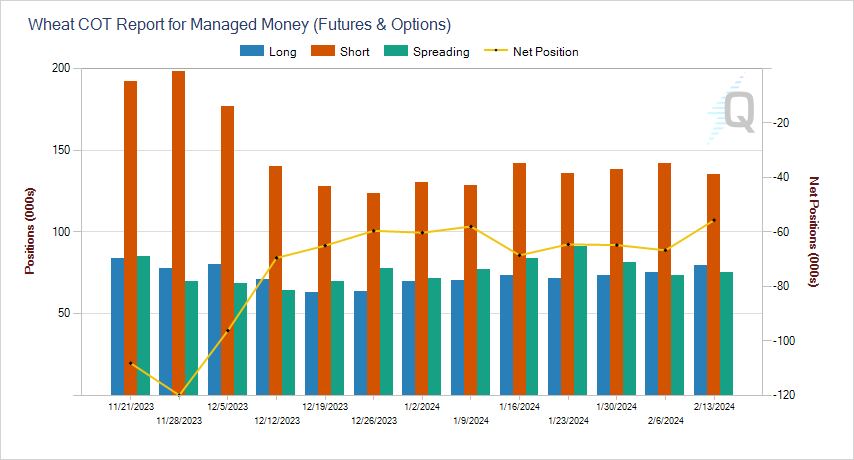

Commitment of Traders Snapshot

(updated on Mondays)

Managed Money continue to seem fairly comfortable with their position in wheat as there is yet again little change from the previous week. Funds are net short about 56k contracts, which as you can see from the chart below is fairly steady with where they've been for the better part of the last two months.

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500