Livestock Round Up: Cattle Futures Consolidate

Watch us on RFD-TV, today at 12:45pm CT!

Live Cattle

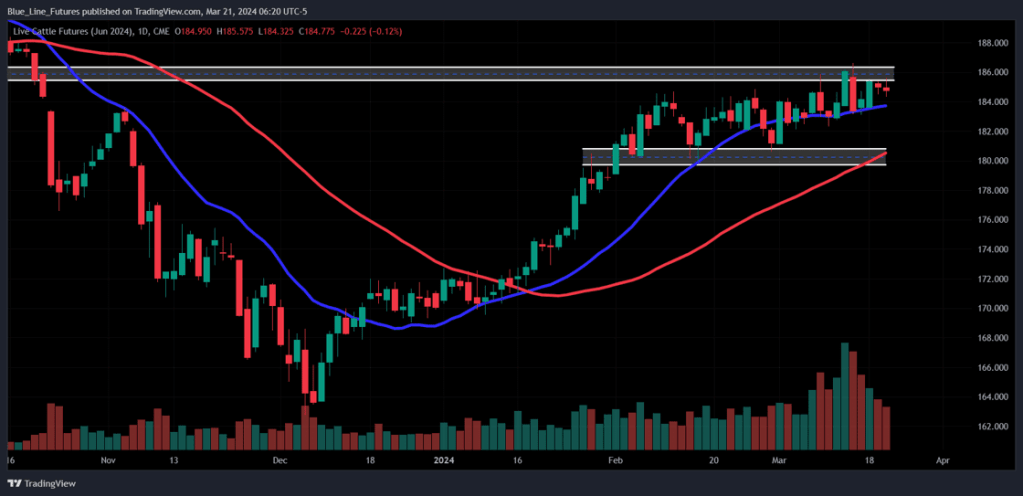

Technicals (June-M)

Not a lot of new news here for cattle as prices were little changed in yesterday's trade. With that said, after the close the outside markets did see a risk-on trade which sent many commodity markets higher into the afternoon trade which has spilled over into a similar environment in the early morning hours. This could be a tailwind for live cattle in today's trade. Tomorrow's Cattle on Feed report will also be top of mind which could play a role in price action as traders look to position in advance. The average analyst estimate for On-Feed comes in at 100.9%. Placements are estimated to be near 106.4%. And markeings near 104.1%.

Yesterday's cutout values were mixed with choice cuts 22 cents higher to 313.44 and select cuts down 47 cents to 302.71. Daily slaughter was reported at 116k head, about 11k less than the same day last year.

Resistance: 185.85-186.625*, 189.05

Pivot: 182.20

Support: 179.825-180.625**, 177.10

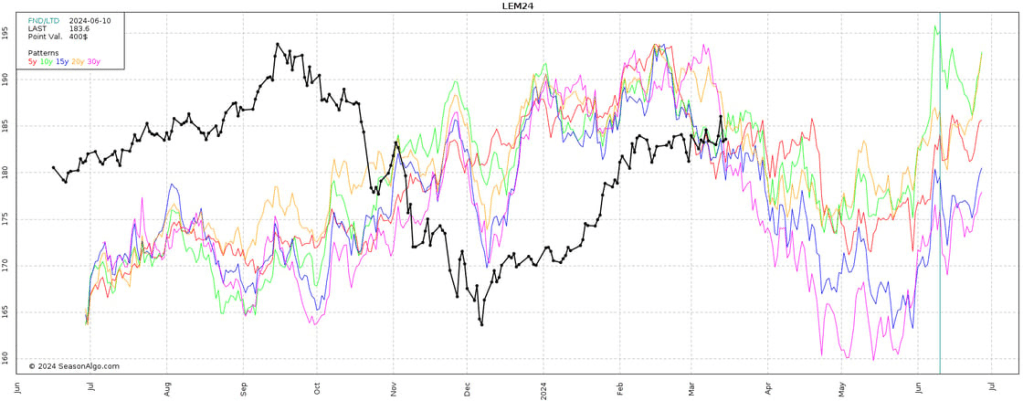

Seasonal Tendencies (June Live Cattle)

Below is a look at historical seasonality's (updated each Monday) VS today's prices (black line). Seasonally we start to see June futures soften up, but if you've been watching cattle at all over the last year you know that seasonals tendencies tend to have had a lower correlation this year.

*Past performance is not necessarily indicative of futures results.

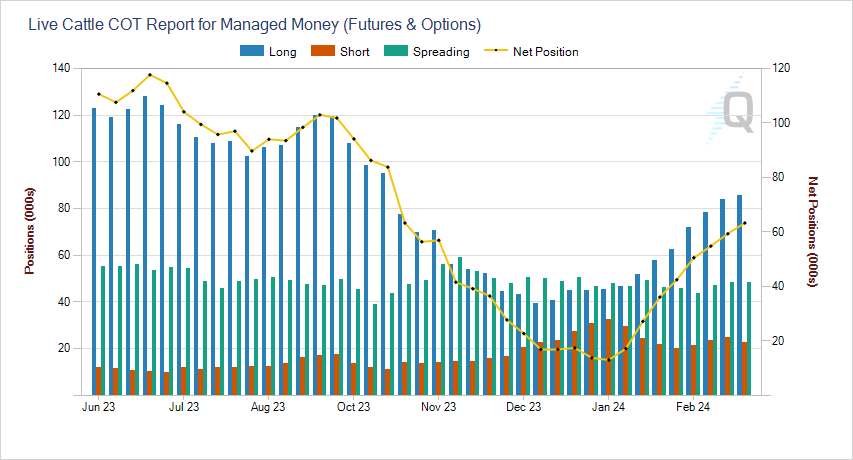

Commitment of Traders Snapshot

(updated on Mondays)

Friday's Commitment of Traders report showed Funds were net buyers of about 4k futures and options contracts, extending their net long position for the eighth consecutive week, now sitting roughly 63.3k contracts long. Typically, we would view this as a relatively Neutral/Bullish position. This is about half of the length they had when prices peaked last Fall.

Check out the full article Cattle Futures Consolidate - Blue Line Futures