A Long Month

Market Watch with Austin Schroeder

February 23, 2024

A Long Month

Is February over with yet? From getting materials ready for our annual Winter Seminars, to the travel, keeping up with the daily grind, throwing some sick kids in there, and I cannot wait for the calendar to turn to March. Then you have the grain market grinding lower, and I’m sure there are several of you that can feel a similar pain. What is supposed to be the shortest month of them all has turned out to feel the longest. Of course, this year is a little longer than the 3 years prior just due to the Leap Year factor, but you get the point. For some others (the livestock and cotton bulls, namely), I’m sure it hasn’t felt like it’s long enough!

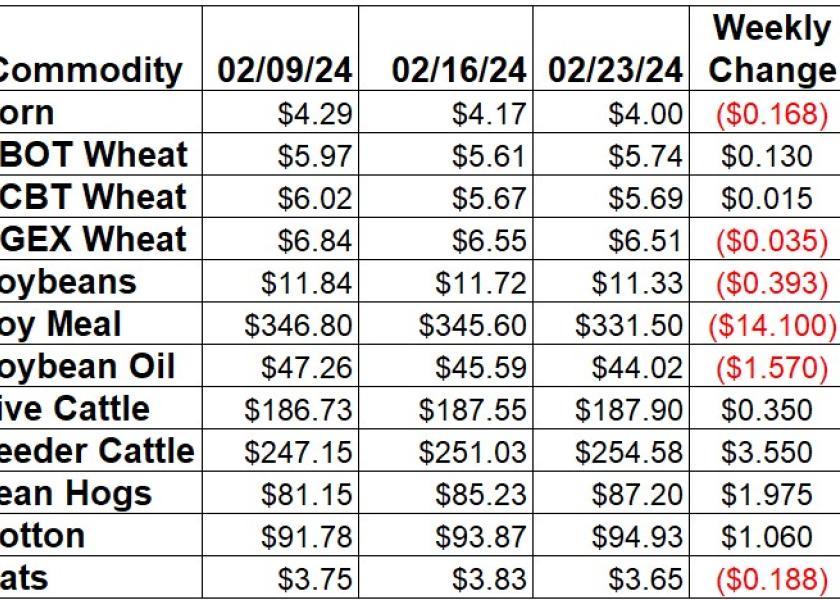

Corn collapse continued this week as March hit below $4 for the first time on the spot contract since 2020. They closed the week at $3.99 ¾, down 16 ¾ cents (-4.02%) on the week. Managed money pressure keeps coming, with their net short position as of Tuesday a record 340,732 contracts (26,391 contracts larger than the week prior). Commercials are busy hedging (in the form of feedlots and ethanol plants), as their net long is now a record 58,342 contracts, with producer selling drying up. Ethanol production is still riding at a steady pace, after the January cold spell slowed production, with 1.084 million barrels per day produced in the week of 2/16, up just 1,000 bpd on the week. Stocks saw a draw of 380,000 barrels to 25.502 million barrels. A release from the White House announced the approval of E15 gasoline sales in the Midwest but starting in 2025. They hinted at allowing waivers for the upcoming summer period. Export Sales data from Friday showed bookings slipping to a 6-week low of 820,414 MT during the week that ended on February 15. Shipped and unshipped export commitments for corn are now 69% of the USDA forecast, compared to the average pace of 77% for this time of year. Actual shipments are 36% of the USDA number, now 3% below the average pace.

The wheat market was a little better this week, with the winter wheat catching some of a break. Chicago was up 2.32%, or 13 cents in the March contract. Kansas City saw a 1 1/2 cent higher Friday/Friday trade, or 0.26% move. Minneapolis spring wheat was down 3 ½ cents since last Friday for a 0.53% loss. Pressure from the other major world exporters continues to drag on prices. Weekly Export Sales slipped to the lowest total in 6 weeks at 233,521 MT for the week that ended on 2/15. That took export commitments to 91% of the USDA full year export projection, now 2% below the 5-year average pace and 6% larger than the same point last year. Actual shipments are running a little slower, with 60% of the USDA forecast fulfilled compared to the 69% average. Friday’s Commitment of Traders report showed spec traders in CBT wheat futures and options adding back another 12,524 contracts to their net short position as of 2/20. They took that net short to 68,524 contracts. In KC wheat, they added another 5,499 contracts to their net short, at 41,907 contracts as of Tuesday.

Soybeans had another promising start to the week, but found pressure after Tuesday, with March down 39 ¼ cents or 3.35% and exploring new contract lows. Soybean meal losses mounted another $14.10 lower on the week. Soy oil headed towards fresh nearly 3-year lows and was down 3.44% on the week. Despite a solid crush pace, product value pressure and a large US premium to the South American counter parts is making the path of least resistance, lower. This week’s Export Sales report saw soybean bookings at a MY low of just 55,919 MT for the week of February 15. Brazil FOB prices are still ~$1.50+ below US offers. Export sale commitments for soybeans are now 83% of USDA’s forecast total, 4% below the 5-year average pace. Accumulated shipments are 68% of that total, below the average pace of 70%. This week’s Commitment of Traders report showed spec funds slightly increasing their net short in soybean futures and options another 2,177 contracts in the week that ended last Tuesday. That is still the 5th largest net short all time at 136,677 contracts. Commercials hold a net long of 36,394 contracts, as longs are adding to their very large outright position of 368,392 contracts.

Live cattle continued their shallow ascent this week, as April was up 35 cents despite a pullback mid-week. Cash trade mostly waited until Friday afternoon, as action picked up anywhere from $182-184 across the country, with most in the $183 range. Feeders were again the leaders this week, as are getting expensive and up $3.55 on the week (1.41%). The CME Feeder Cattle Index was up another 42 cents this week to $245.00. The monthly Cattle on Feed report showed January placements totaling 1.792 million head, a 7.44% drop compared to last year and above most trade estimates. January Marketings totaled 1.844 million head, down 0.11% from a year ago. That took the February 1 on feed inventory to 11.797 million head, a 0.37% increase over Feb 2023. Wholesale boxed beef quotes were mixed around this week widening the Chc/Sel spread to $14.30. Choice boxes were up $4.41 (1.50%) to $300.61, while Select was 35 cents lower (0.1%) to $286.31. Weekly beef production was down 3% vs. last week and 2.8% below the same week last year. Actual slaughter totals in the first several weeks of the year are down 5.4%, with production 4.3% lower. Spec funds in live cattle futures and options continue to rebuild their net long, with another 8,061 contracts added to the overall net position. They took the net long position to 50,533 contracts as of Tuesday Feb 20.

Hogs left the car in rally mode this week with April up 2.32% since last Friday, a $1.97 gain. The CME Lean Hog Index was another $3.66 higher this week at $78.78. USDA’s Pork Carcass Cutout was back up 59 cents this week (0.7%) this week to $91.16. The belly (-10.51%) was a drag on the value, as all other primals were reported higher. Weekly pork production was up 0.5% compared to last week and was 9.5% larger vs. a year ago. Slaughter for the first few weeks of the year is now up 1.3%, with a 1.3% increase in production. USDA’s weekly Export Sales report showed pork export bookings at 28,902 MT, down from last week’s revised total of 33,691 MT. Actual export shipments also backed off the previous week’s revision to 36,835 MT. CFTC data showed spec traders in lean hog futures and options adding another 14,382 contracts to the largest net long since last Jan 2023 or 48,173 contracts as of Tuesday.

Cotton futures continued their ascent as March rallied another 106 points (1.13%) on the week. US Export Sales were slower at 130,468 RB for cotton in the week of 2/15. Sales, though, are still running at a solid pace, as commitments for 23/24 are now 10.437 million RB, which is now 90% of USDA’s current cotton export forecast. That is 2% back of the 92% average pace for this point in the MY. Shipments backed off from the previous week’s MY high to 255,484 RB during that week, taking the MY total to 44% of the USDA forecast, 1% ahead of normal. The FSA raised the Average World Price for cotton by 1.68 cents on Thursday, to 75.12 cents/lb. This week’s Commitment of Traders report revealed managed money spec funds piling on another 14,520 contracts to their net long in cotton futures and options. They took that net position to 86,079 contracts as of February 20, the largest since October 2021.

Market Watch

We start next week with cattle traders reacting to Friday’s Cattle on Feed reports. The weekly Export Inspections data will be released on Monday morning, with the Cold Storage report delayed until Monday afternoon. Skip ahead to Wednesday and EIA will release weekly ethanol stocks and production data. It is Leap Year, with Thursday February 29 having the weekly Export Sales report in the morning, as well as the last trading day got February live cattle futures and first notice day for March grain futures. On Friday, we will get the monthly Grain Crushings, Fats & Oils, and Cotton Systems reports showing domestic use during January. Friday is also the last trade day for March live cattle serial options.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2024 Brugler Marketing & Management, LLC. All rights reserved.