Santa Claus Rally

Market Watch with Alan Brugler and the Brugler Team

December 23, 2021

Santa Claus Rally

Santa Claus, a tale as old as time. “You better watch out, You better not cry!” As 2021 gets closer to coming to an end, it is apparent that the ags were on the nice list this year for the most part! That was evident in Thursday’s and this week’s trade, as a majority of the complex saw gains to round out the holiday week! That is what we like to call a Santa Claus rally. With next week rounding out the year the tides will turn to 2022 and the big question on everyone’s mind is what will the new year bring? As we get set to begin celebrating the Christmas holiday, we hope everyone has a safe and happy holiday season!

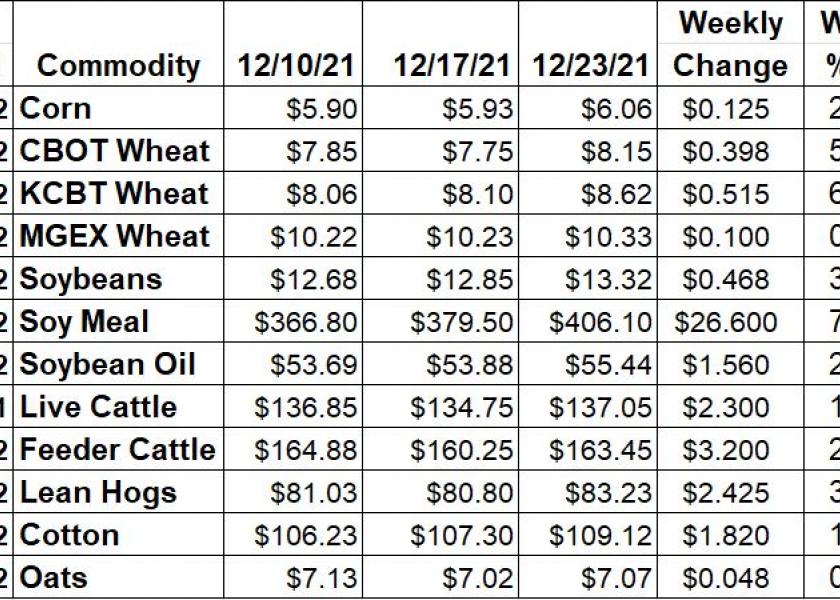

Corn futures were up 12 ½ cents per bushel this week, getting to the highest price for the front month futures since July 1st ahead of that Independence Day break. Weekly EIA data showed a 36,000 bpd drop in ethanol production for the week ending 12/17 to 1.051 million bpd. They also saw a cutback in stocks by 178,000 barrels to 20.705 million. USDA tallied corn export sales at a 5-week low 982,870 MT for the week of 12/16. Marketing year export commitments (shipped plus outstanding sales) are 39.494 MMT, about 6.5% smaller than last year at this time. That is 62% of the full year WASDE forecast, and on average we would be only at 55% by early December. While accumulated exports are 20% of the USDA projection, 3% behind normal.

Wheat futures were higher for the week, with a 6.36% gain in the KC market. Chicago was also up a net 5.13% from last Friday, but spring wheat was just a dime or 0.98% higher Friday to Thursday. As a way to curb increasing domestic prices and keep secure supplies, Russia is planning on a 8 MMT wheat export quota for February 15 through June 30. That is 1 MMT below where they had previously planned. Weekly Export Sales data showed bookings in the week ending 12/16 dropping from the MY in the week prior to 425,397 MT. That was still the 7th largest sale this MY. That sale total took export commitments to 69% of USDA’s full year forecast. They would typically be 77% by now, with export shipments 46% of the USDA number vs the 53% average.

Soybeans rose 3.6% for the week, though the complex was mostly led by meal. Soybean meal was another sharp 7% higher back to the levels not seen since mid May. Soy oil waited until Tuesday before joining the rally, and ultimately recovered 2.9% on the week. Thursday’s Export Sales report indicated exporters sold at MY low 811,502 MT of soybeans during the week ending December 16. A majority of the sales net sales were switched from unknown (571,800 MT). Total US export commitments are now 40.925 MMT, 24% smaller than year ago. On the plus side, US Exporters have now booked 73% of the USDA full year estimate vs. the average 74% pace for this date. Shipments on their way out are 49% of the USDA forecast, 2% above the normal pace. Meal sales were back up from last week’s marketing year low to 300,000 MT, while soy oil bookings exploded to 109,500 MT helped by 2 large previously announced sales to India.

Live cattle futures were back up by 1.7% on the week, though most of it was on Thursday ahead of the NASS data and the extended holiday weekend. Basis flipped this week, with cash cattle sales mostly $135 (down $3 from last week) while futures jumped to 137.05. Feeder cattle futures also bounced back, recovering $3.20 (2%) this week. The CME Feeder Cattle Index, at least through 12/20, was down by $1.15 for the week, again reflecting the basis turning negative, to $160.25. Wholesale beef prices were mixed which tightened the Chc/Sel spread $4.74 to $9.99. Choice boxes were a net 7 cents weaker through the week, while Select was $4.67 cwt. higher (1.9%). Weekly Export Sales data showed combined 2021 and 2022 sales of 20,072 metric tonnes, down from 22,849 MT the previous week. Cold Storage data released on Wednesday showed beef stocks at the end of November at 493.32 million lbs, down 3.54% from last year.

Lean hog futures stalled their rally on Thursday ahead of the NASS data, but prices were still up a strong 3% for the short week. The CME Lean Hog index was an 8 cents weaker for the week at $72.33, though the basis level was $1.51 weaker. The pork carcass cutout value was $5.65 (6.6%) higher for the week, though most of that was on Thursday. Hams carried the composite with an 18.3% increase. Weekly pork export sales for the week ending 12/16 were 35,802 MT for combined 2021 and 2022 sales. They were only 36,913 MT the previous week. Pork in cold storage on November 30 was tallied at 406.72 million lbs, a 24 year for the month and the lowest total since August 2010.

Cotton futures rose 1.7% this week. USDA showed upland cotton export sales backing off for another week to 243,913 running bales as of 12/16. Exporters have now sold 70% of the USDA projected total for the year, vs. the average pace of 71% for this date. Exports during that week kept at their current clow pace of 131,114 RB, bringing the YTD total to 44% behind last year. Those accumulated shipments are just 19 % of the USDA number 6% behind the normal pace. The week’s new AWP for cotton, at 96.27, was another 146 points higher than the previous week. Cotton Ginnings data out of NASS on Wednesday showed 2.649 million RB ginned in the first couple weeks of December. That took the YTD total to 12.469 million RB, now 8.07% above last year. Cotton Classings data from USDA suggests at least 11.56m bales have been classed, though the weekly summary will be delayed through Monday.

Market Watch

Coming out of the holiday break, the market will open at the normal Sunday evening hours for the Monday session. Export Inspections data will be released on Monday morning, per usual. Fast forward to Wednesday and we will see the EIA report on weekly ethanol production and stocks. USDA’s Export Sales report will be out on the typical Thursday morning release slot. New Year’s Eve on Friday will be first notice day for January Soybean, Soybean Meal, and Soybean Oil futures, as well as the last trade day for December Live Cattle futures.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2021 Brugler Marketing & Management, LLC. All rights reserved.