Can U.S. Farmers Still Hit a Record Corn Yield?

The week started out in a downward trend but ended on a high note.

July corn prices were down 4¢, and December corn prices were up 27¢ for the week ending May 13. July

soybean prices were up 24¢, and November soybean prices were up 27¢. All classes of wheat were up from 70¢ to more than $1.

USDA’s May 12 World Agricultural Supply and Demand Estimates (WASDE) report were a big market force this week, says Jamie Wasemiller, market analyst for Gulke Group and crop insurance agent with Silveus Insurance Group.

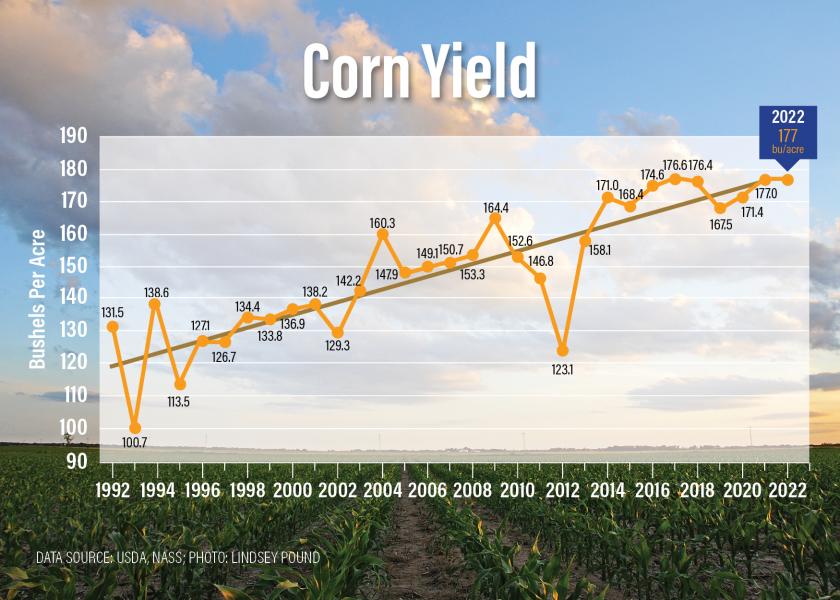

For 2022, USDA is projecting a national average corn yield of 177 bu. per acre. That is 4 bu. below the weather-adjusted trend presented at USDA’s Agricultural Outlook Forum in February.

“Remember that 177 bu. per acre equals last year and is still a record,” he says. “That yield will still be hard to attain.”

USDA’s forecast includes total U.S. corn use in 2022/23 to fall 2.5% on declines in domestic use and exports. Corn used for ethanol is unchanged relative to a year ago on expectations of flat U.S. motor gasoline consumption. Additionally, U.S. corn exports are forecast to decline 4% in 2022/23 as lower supplies and robust domestic demand limit prospects.

“On the corn side, that gave prices a little bit of support,” he says.

USDA’s soybean outlook calls for higher supplies, crush, exports and ending stocks compared with 2021/22. The soybean crop is projected at 4.64 billion bushels, up 5% from last year’s crop mainly on higher harvested area. Overall, USDA didn’t make many changes to the soybean numbers.

The bigger news was in the wheat market, Wasemiller says.

Winter wheat production is forecast at 1.17 billion bushels, down 8% from 2021. All wheat production for 2022/23 is projected at 1,729 million bushels, up 83 million from last year, as higher yields more than offset a slight decrease in harvested area.

Total 2022/23 domestic use is projected down 1% on lower feed and residual use more than offsetting higher food use. Exports are projected at 775 million bushels, down from revised 2021/22 exports and would be the lowest since 1971/72.

“That's certainly caught the market's attention,” he says. “Hopefully with what's going on in Ukraine, maybe we’ll see increases on that export side.”

Globally, Wasmiller says, USDA showed weaker demand for corn and wheat.

“That's certainly something that we want to keep an eye on,” he says.

Wasemiller is planting corn in Illinois. While progress is moving along well there, it is basically non-existent in his home state of North Dakota. His friends and relatives there have faced heavy precipitation this spring.

“They really have not turned a wheel there,” he says. “Something we need to keep an eye on in North Dakota and Minnesota is the changes that 2 million to 3 million acres of corn and/or spring wheat that we could see get changed to soybeans. With prices what they are this year, uh, planting these crops definitely looks better than claiming prevent plant on your insurance.”

Listen in as Wasemiller discusses CONAB production numbers for Brazil, crop insurance proposals and more:

Corn Yield Shocker: USDA Drops National Yield to 177

Check the latest market prices in AgWeb's Commodity Markets Center.

Get in Touch with Jamie

Do you have questions for Jamie? Contact him at info@gulkegroup.com or 312-896-2090 or GulkeGroup.com

Disclaimer: There is substantial risk of loss in trading futures or options, and each investor and trader must consider whether this is a suitable investment. There is no guarantee the advice we give will result in profitable trades. Past performance is not indicative of future results.