South American Drought Impacts 50% of World’s Soybean Supply

The global soybean crop keeps shrinking, led by a massive decrease in South America. Last summer, USDA was expecting the combined 2021/22 soybean crop in Brazil, Argentina, and Paraguay to be a record.

Now the forecast calls for the smallest crop since 2018/19. Since December 2021, USDA has lowered soybean production in the three countries by more than 18 million tons:

- Brazil: down 7% from 2021

- Argentina: down 9% from 2021

- Paraguay: down 37% from 2021

Brazil, Argentina and Paraguay account for more than 50% of the world’s soybean supply. If these production shortfalls are realized, USDA says global soybean trade could be significantly constricted.

Joana Colussi and Gary Schnitkey at the University of Illinois provide a deep dive into this issue in their farmdoc daily piece, “Soybean Prices Rise as Drought in South America Reduces Harvest.”

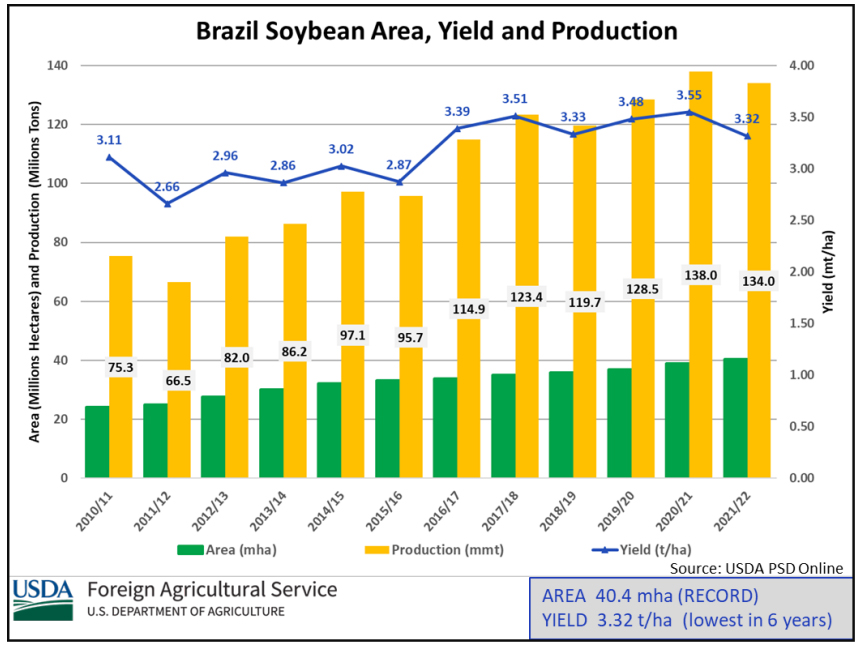

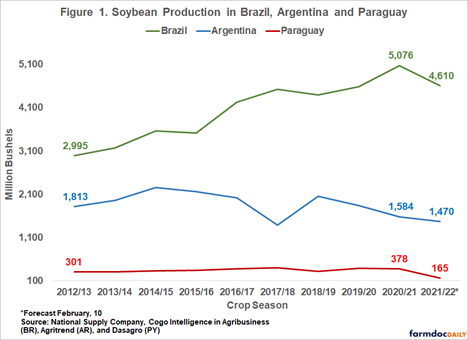

In a monthly crop report in February, the National Supply Company (Conab) pegged Brazil’s soybean crop at 4,610 million bushels, down from the January projection of 5,162 million bushels. Compared with the last harvest (5,076 million bushels), the current projection would be a reduction of 9%.

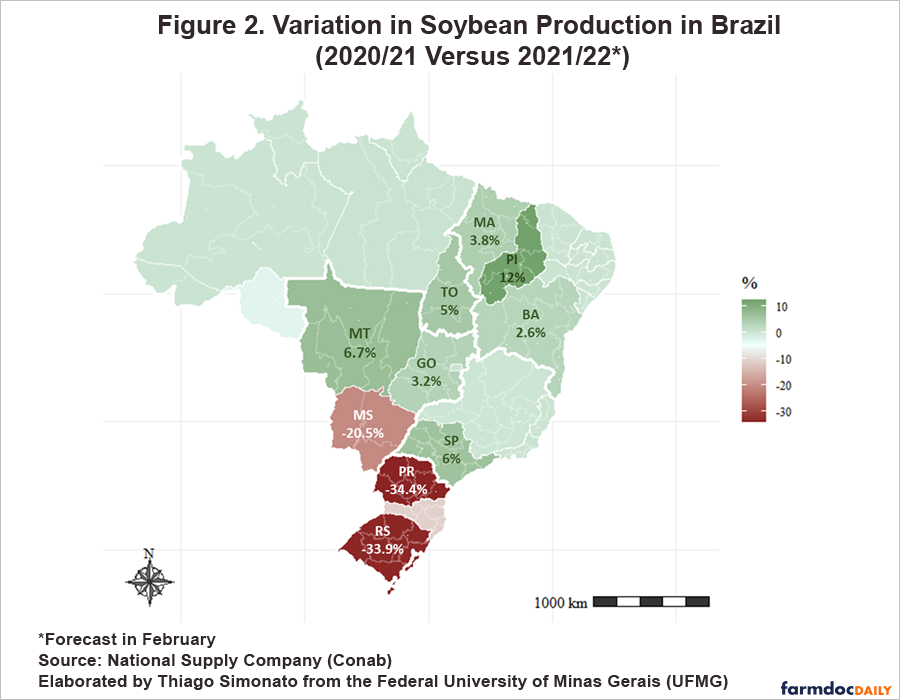

If the forecast is correct, the crop still would be the second largest in history (see Figure 1). The losses in Brazil, the world’s largest soybean producer and exporter, are concentrated mainly in the southern states, such as Rio Grande do Sul, Paraná and Mato Grosso do Sul — where La Niña caused drought during the summer.

Argentina is the world’s top soybean oil and meal exporter. Nearly the entire country has been suffering from a drought since November, again as a result of La Niña.

The most recent forecast from Agritrend, a private consulting firm in Argentina, indicates that Argentina will harvest 1,470 million bushels this season, according to Colussi and Schnitkey. That represents a 7% reduction from last year’s crop (see Figure 1).

In Paraguay, the world’s fourth-largest soybean exporter, the situation is even more dramatic. Paraguay’s soybean harvest could fall by as much as 50%, to some 165 million bushels in what would be the lowest level in the last decade.

La Niña events favor increased rain across northern Brazil and decreased rain in southern Brazil. Such has been the case this year, as the map below depicts:

If the troublesome weather brought about by the La Niña phenomenon continues to worsen it is possible soybean production could be lower than the current projection, according to Colussi and Schnitkey.

As a result of the shrinking soybean crop, soybean prices reached a nine-year high in February. (That combined with Russia’s invasion of Ukraine.)

The changing soybean market dynamics in South America may have bullish implications on exports of the upcoming U.S. soybean crop, USDA reports. In response to climbing soybean prices in South America, U.S. soybean export prices are up 25% since the December World Agricultural Supply and Demand Estimates (WASDE).

Additionally, tight South America stocks at the start of the U.S. harvest and peak soybean export season in October 2022 have the potential to boost U.S. exports. Assuming import demand in China and other key markets remains little changed this year, 2022/23 U.S. soybean exports seem poised to benefit from both tight South American exportable supplies and high prices.

Read More

Brazil: The Soybean Powerhouse

Jerry Gulke: Global Events Rattle Grain Markets

Jerry Gulke: 10 Thoughts on the Paradigm Shift in Global Agriculture