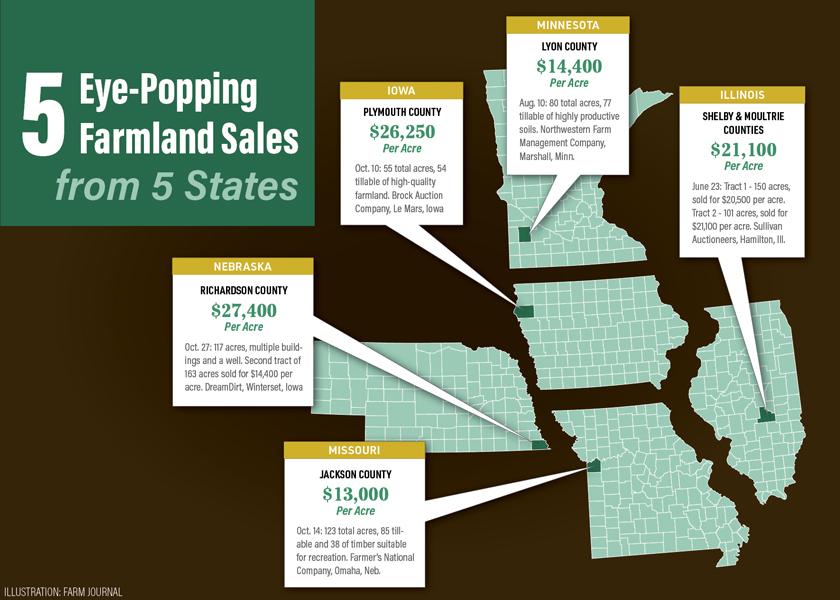

5 Eye-Popping Farmland Sales from 5 States

For 2022, USDA reports the value of the nation’s cropland is $5,050. That’s up $630, or 14%, from 2021. This year’s figure marks back-to-back record highs in cropland values. See the full USDA report.

Since 2014 the value of U.S. cropland had hovered around $4,000 per acre, that was up until 2021 when things changed.

Here are just a few noteworthy farmland sales from this year:

RICHARDSON COUNTY, NEBRASKA

$27,400 Per Acre

Oct. 27: 117 acres, multiple buildings and a well. Second tract of 163 acres sold for $14,400 per acre. DreamDirt, Winterset, Iowa

JACKSON COUNTY, MISSOURI

$13,000 Per Acre

Oct. 14: 123 total acres, 85 tillable and 38 of timber suitable for recreation. Farmer’s National Company, Omaha, Neb.

PLYMOUTH COUNTY, IOWA

$26,250 Per Acre

Oct. 10: 55 total acres, 54 tillable of high-quality farmland. Brock Auction Company, Le Mars, Iowa

LYON COUNTY, MINNESOTA

$14,400 Per Acre

Aug. 10: 80 total acres, 77 tillable of highly productive soils. Northwestern Farm Management Company, Marshall, Minn.

SHELBY & MOULTRIE COUNTIES, ILLINOIS

$21,100 Per Acre

June 23: Tract 1 - 150 acres, sold for $20,500 per acre. Tract 2 - 101 acres, sold for $21,100 per acre. Sullivan Auctioneers, Hamilton, Ill.

Read about more mind-boggling farmland sales:

$30,000 Per Acre? Yep, The Details on the Latest Record-Breaking Farmland Sale

Farmland Price Record: $27,400 Per Acre in Southeast Nebraska

New Record: Iowa Farm Joins the $26,000 Per Acre Club