Fed Banks Report Sharp Gains in Farmland Values

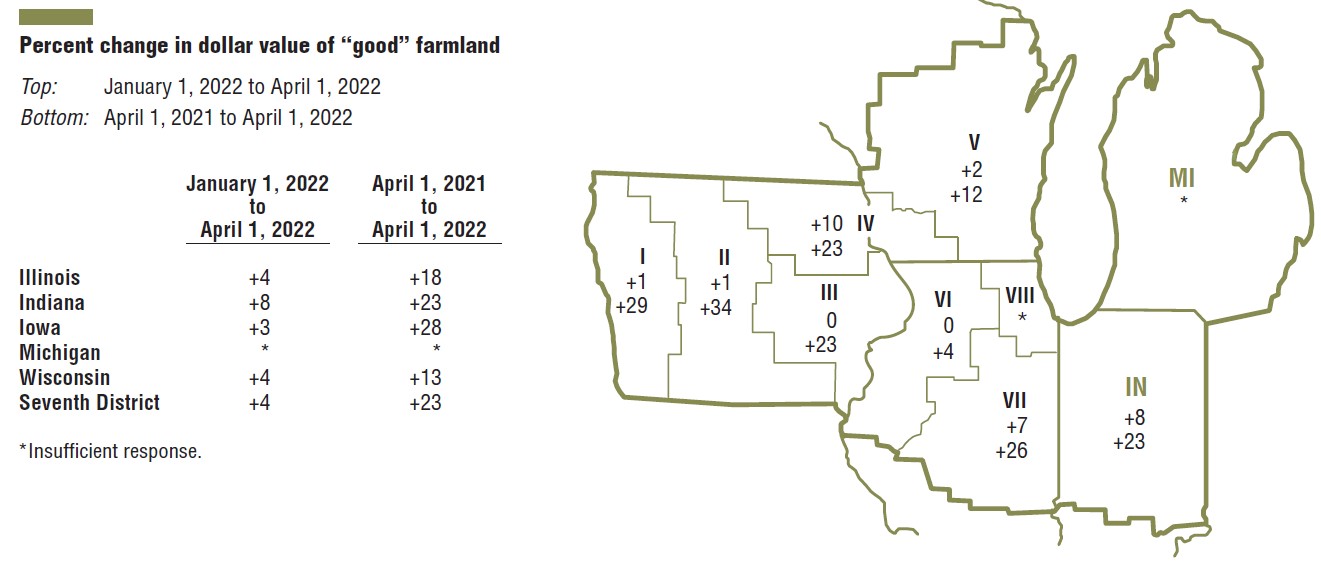

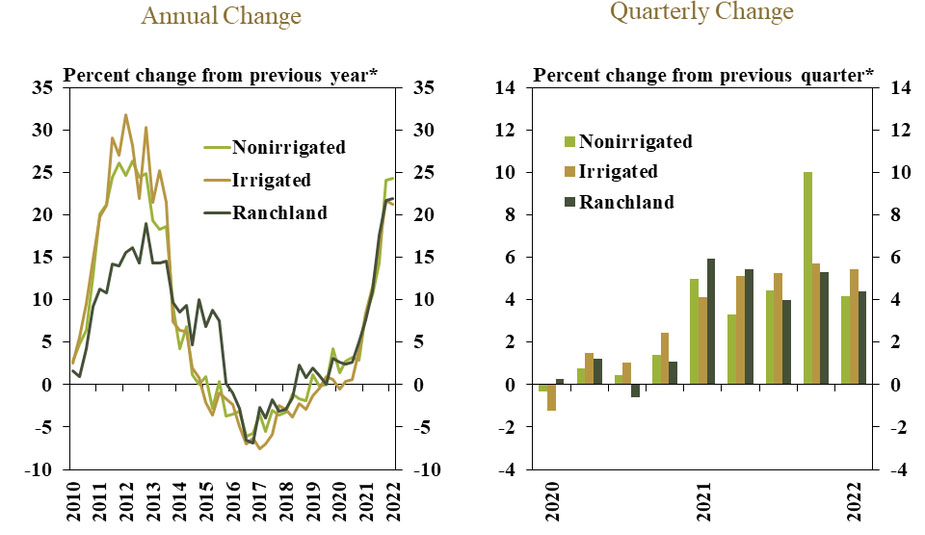

Sharp gains in Midwestern and Plains land values continued through the first quarter of 2022, report the Federal Reserve Banks of Chicago and Kansas City. The banks’ quarterly surveys of ag bankers in their service areas found Central Corn Belt farmland jumped 23% through March 31 and the value of Central Plains farmland rose more than 20%.

In addition, the value of “good” agriculture land across Indiana, Illinois and Iowa rose 4% in the first quarter compared to the fourth quarter of 2021. In Nebraska, Kansas, Oklahoma, western Missouri and the mountain states of Colorado, northern New Mexico and Wyoming the value of dryland cropland, irrigated cropland and ranchland increased 5% in the first quarter compared to the end of 2021.

Driving the gains in farmland values are very favorable net farm income, low interest rates and relatively tight supply of farms available for purchase, the banks report.

On a state-by-state basis:

- the price of Illinois farmland rose 18%

- Indiana land surged 23%

- Iowa farmland exploded 28%

- southeast Wisconsin farmland increased 13%.

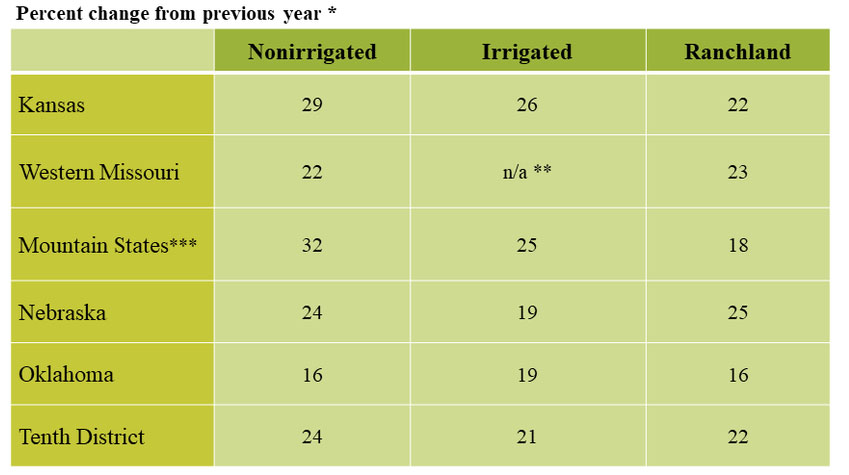

The Kansas City Fed bank reports :

- the value of dryland cropland in Kansas boomed 29%

- western Missouri saw a 22% surge

- the mountain states rocketed 32%,

- Nebraska jumped 24%

- Oklahoma rose 16%

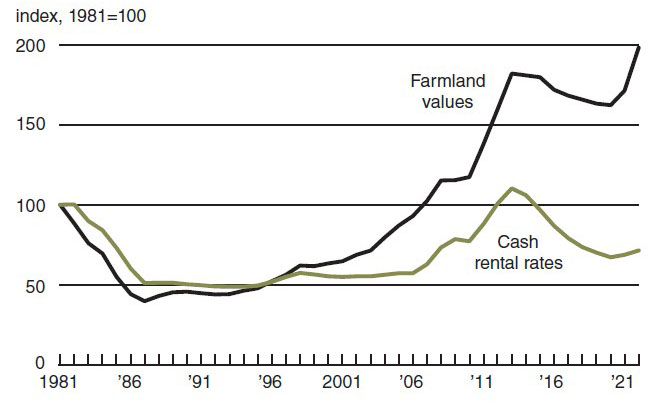

Looking at cash rents, the Chicago Fed banks report cash rents for the district increased 11% from 2021 to 2022. For 2022, average annual cash rents for farmland were up 10% in Illinois, 11% in Indiana, 12% in Iowa and 8% in Wisconsin. The Kansas City Fed bank states cash rents for all types of land in its district increased about 15% than a year ago, the fastest increase since 2013.

Central Corn Belt Farmland Values Adjusted for Inflation

Central, Southern Plains Farmland Values Explode

Annual Change by Farmland Type