Should You Buy That Farm? A Tool to Help You Do the Math

Land prices are higher than they’ve ever been, and farmers continue to pay top dollar for quality land. In that mix are land developers and investors that can make land sales more complicated. You might be asking yourself, ‘Is it really worth the cost?’

First, consider these challenges of purchasing land in 2021:

- A strong stock market creates incentive for investing dollars in other areas of higher return.

- Land is a long-term investment and usually takes many years to provide high return.

- Larger acreage purchases are very capital intensive.

- Tremendous amount of debt liability exposure in a volatile commodity market.

- Additional maintenance and conservation of the land.

- High commodities tend to lead to higher input costs and land price increases soon after.

- High value, low direct capital return.

Now, consider these reasons why purchasing land now is a great opportunity:

- Land purchases have historically created phenomenal opportunities and sustainability for the next generation of farmers.

- Land is a disappearing asset; we’ve all heard someone say ‘they’re not making any more of it!’

- Low supply and high demand means values most likely will continue to increase.

- Stable and increasing values have allowed for a tremendous amount of land to be fully owned (more than 70% of tillable land is owned debt free in some states.)

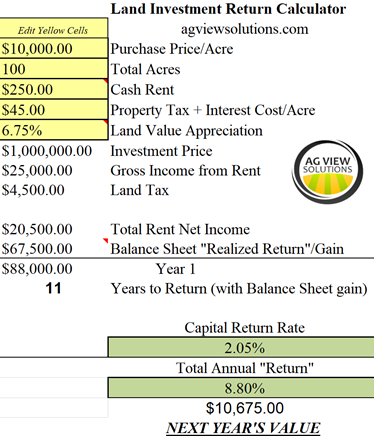

- The overall gain and capital return often exceeds 8% to 10% annually, as you see in the calculator.

So, is buying farmland really worth the cost? There’s no right answer. Variables for consideration are your working capital position, balance sheet strength, career timeline and base acres of the operation. Reducing machinery cost/acre by increasing efficiency and productivity can be a great additional benefit of land acquisition.

Email shay@agviewsolutions.com for a copy of this tool to use your own numbers when making land purchase decisions!

A key point when evaluating the long-term value of land is looking at historical prices. Over the last 30 years land values have increased on average 6.75%. This is a return to the operational balance sheet that is hard to match, even though those are not short-term assets for cash flowing the operation.

Another consideration is capital return rate. Many land investors and farm management companies have benchmarked capital return rates between 2.5% and 3.5% or higher. This is where some of the really high cash rent numbers you hear about are coming from. As the farmer or land investor, are you better off purchasing the land yourself and realizing the balance sheet growth with a lower capital return rate? These are questions for you to consider as you move through the rest of 2021 and into 2022!

We wish you good luck, and please reach out to shay@agviewsolutions.com with any questions and I will email you this Land Investment Calculator. Learn more about Ag View Solutions.

Read More

Your Path to Smart Farm Technology Investments

How Quick Is The Payback For A $150,000 Planter Expense?