Ag Economy Barometer Shows Farmer Optimism Climbed to Levels Not Seen Since October

March Ag Economy Barometer 040721

As the 2021 agricultural bull market continues, it’s leading to a growing level of optimism from farmers and ranchers.

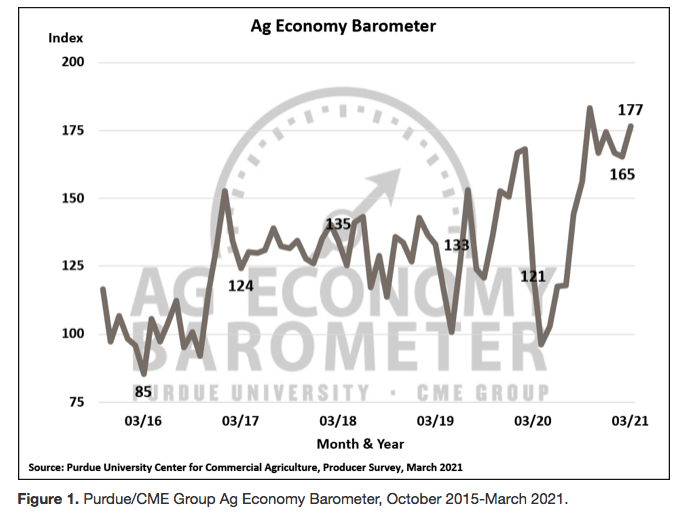

The latest Ag Economy Barometer from Purdue University and CME group shows farmer sentiments rose to a reading of 177 this month. That’s the highest reading since the record high hit in October of 2020. The main driver was the continued strength in commodity prices, which also lead to an improved farm financial outlook.

The March results – released April 6 – shows the gauge of producer sentiment’s rose 12 points in one month. Authors of the survey say it was driven by producers showing a more optimistic outlook toward the future.

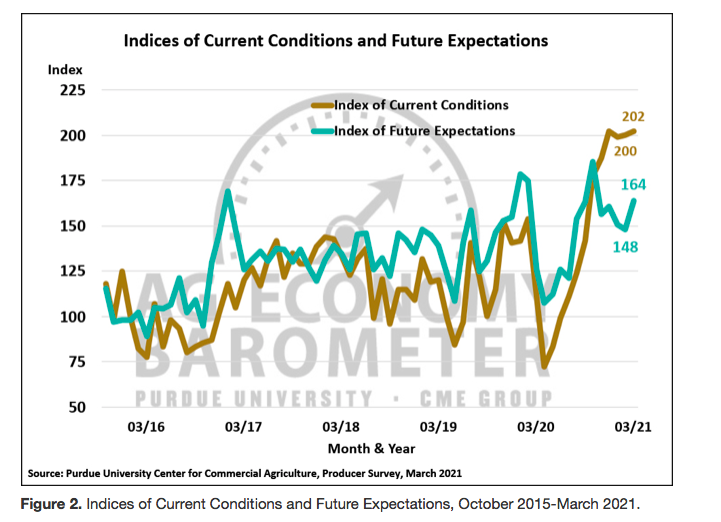

"That index rose 16 points to a reading of 164 this month and that's the highest reading we've seen on that index since last fall,” says Jim Mintert, Director, Center for Commercial Agriculture, Purdue University. “The index of current conditions rose slightly to a reading of 202 versus 200, so the real driver in the improvement of the barometer was really from the index of future expectations."

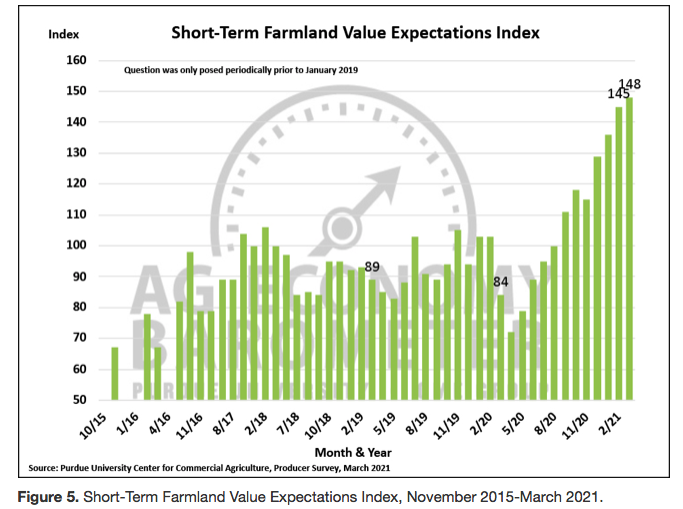

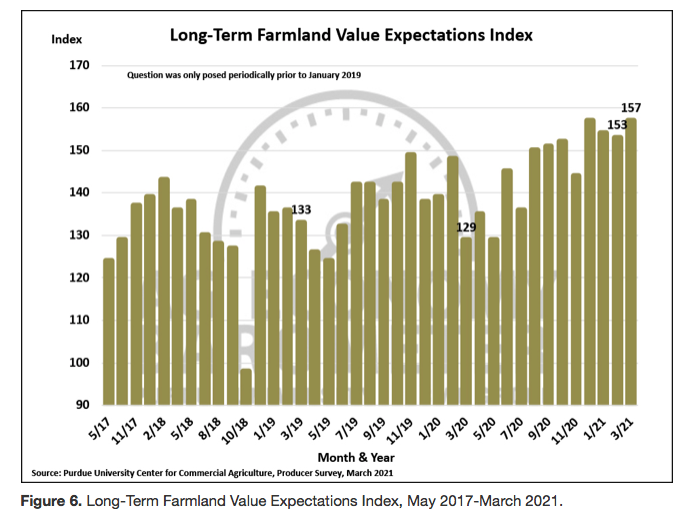

Farmers are also indicating farmland values are showing strength. Both the short-term and long-term value expectations index on the Ag Economy Barometer saw a slight increase.

“The short-term farmland value index rose to a record reading of 148 versus 145 a month earlier, and all the way up from 84 this time last year,” adds Mintert. “The long-term farmland value expectations index also rose to a reading of 157. That was a four-point improvement compared to a month earlier. And again, when you compare it to last year that reading was just 129.”

The Ag Economy Barometer is a gauge of farmer sentiments based on a monthly survey of 400 U.S. agricultural producers.