Is the Fed Behind the Curve in Battling Inflation?

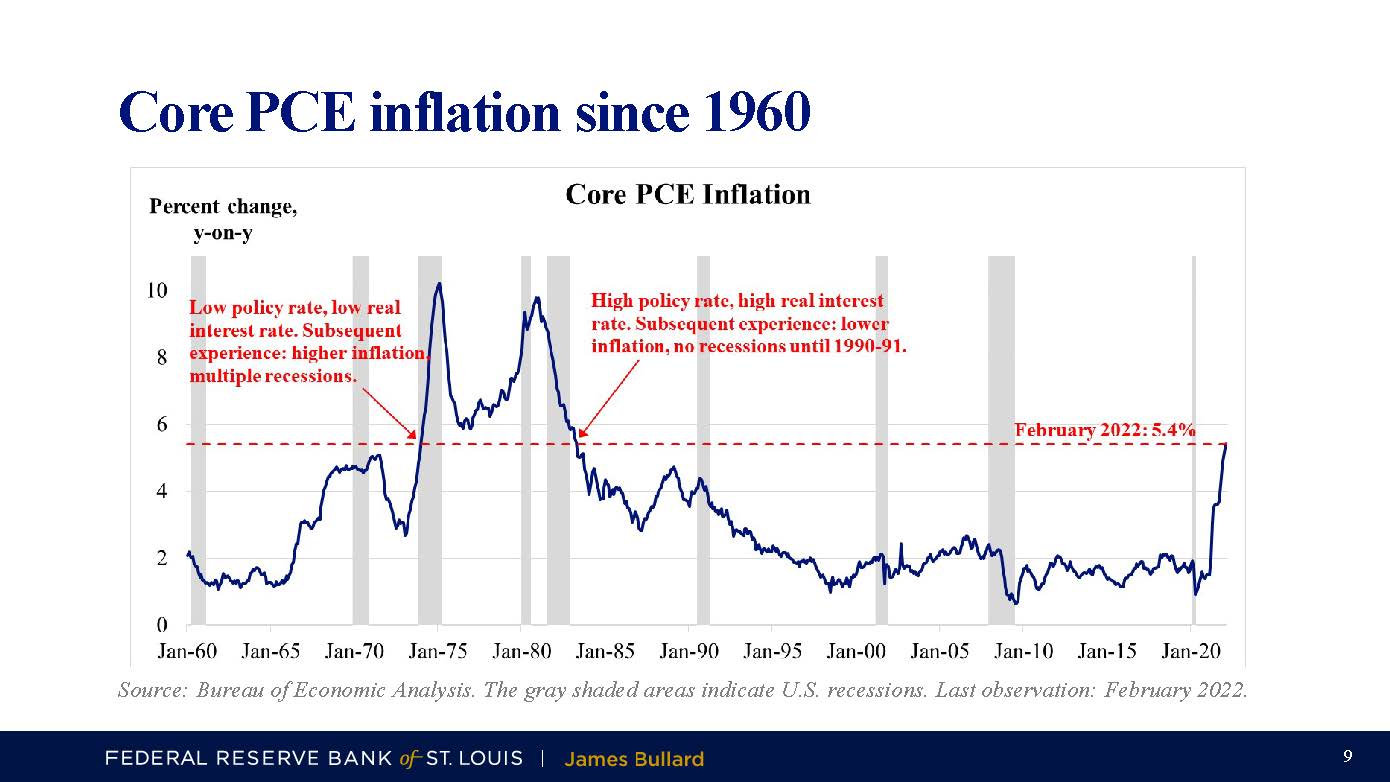

How do you keep inflation from spiraling out of control? Tamp it down with higher interest rates. But is it too late for the Federal Reserve to combat inflation levels not seen in 40 years?

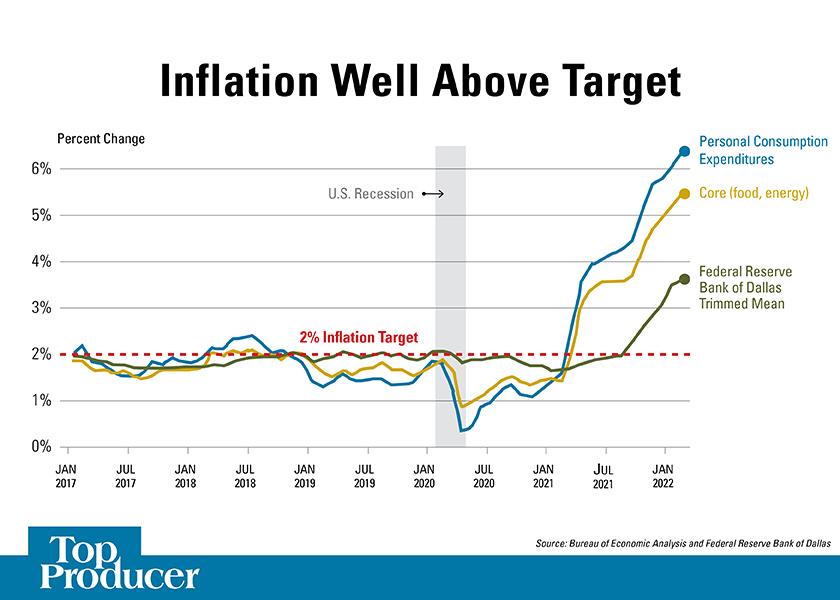

The Federal Open Market Committee’s (FOMC) inflation target is 2%. Yet in February the rate, which is the measure of general price trends throughout the economy, was 6.4%.

James Bullard, president and CEO of the Federal Reserve Bank of St. Louis says the U.S. is “behind the curve” on raising interest rates to keep inflation in check but is making progress. He considers the present moment a critical juncture for U.S. and global monetary policy.

“We have a lot more inflation than we are used to, and we are having to re-educate ourselves, the financial community and the public about what inflation means and what we have to do to keep it under control,” Bullard said on April 7 during a presentation at the University of Missouri.

Standard Taylor-type monetary policy rules, even if based on a minimum interpretation of the persistent component of inflation, still recommend substantial increases in the policy rate, Bullard says.

“However, all is not lost. Modern central banks are more credible than their 1970s counterparts and use forward guidance,” he says. “Credible forward guidance means market interest rates have increased substantially in advance of tangible Fed action. This provides another definition of ‘behind the curve,’ and the Fed is not as far behind based on this definition.”

The Fed uses forward guidance, which provides clues to the market about where policy is going.

“You don’t do anything, but markets think you will, so you get response before action,” Bullard says.

The presidents of the Federal Reserve Bank and members of the FOMC will continue to provide clues and warnings to their upcoming decisions, says Ernie Goss, Creighton University economist.

“They do not want to surprise anyone; they want to deliver what the markets expect,” he says. “But they also want the markets to expect what they deliver. It is a dance they want to get right. At one point in time the Federal Reserve did not want to let the market know their moves in advance. That’s no longer the idea.”

A Booming U.S. Economy

2021 was a banner year in terms of the U.S. economy, Bullard says. U.S. real GDP grew at a 5.5% rate in 2021, and the most recent forecasts in the FOMC Summary of Economic Projections suggest real GDP will continue to grow at “a slower but still robust 2.8% pace in 2022,” despite an anticipated relatively weak first-quarter reading due to omicron and the Russia-Ukraine war.

Additionally, Bullard notes, this economic expansion is new and growing.

“This expansion is not old,” he says. “It’s just been happening since we’ve busted out of the pandemic. We could have a run for many years.”

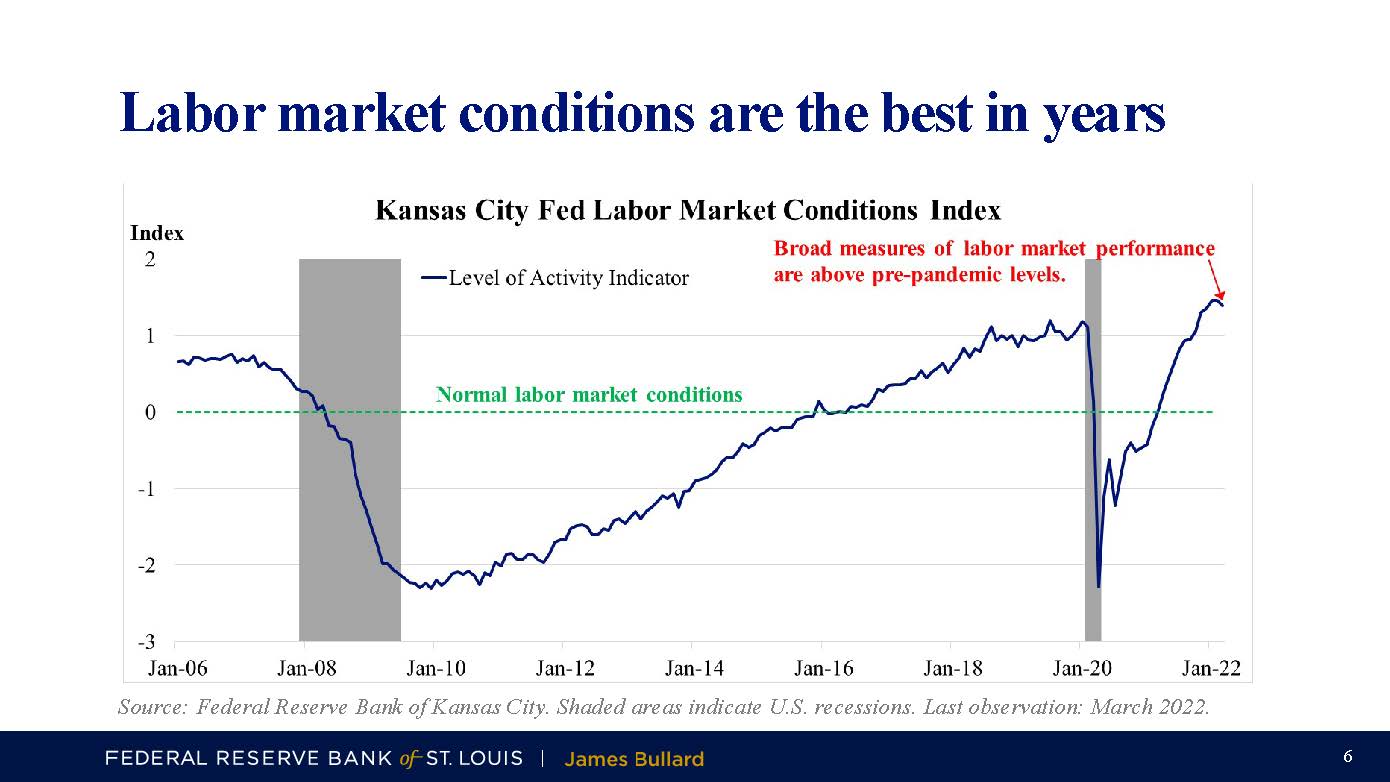

The labor markets are also a bright spot. The U.S. unemployment rate has fallen to 3.6% and will likely fall below 3% later this year, which has not occurred since the 1950s, Bullard says: “This would make the U.S. labor market one of the best in the entire post-World-War-II era.”

Read More

How to Anchor Your Farm's Profits From Inflation’s Pull

Listen to Nathan Kauffman, vice president and Omaha Branch executive for the Kansas City Federal Reserve Bank, on the Farm CPA Podcast: