Food Inflation Makes Your Super Bowl Party Cost More

The economists at Wells Fargo, led by Dr. Michael Swanson, have some insights on how this year’s snacks for the Super Bowl are reflecting the trend of food inflation.

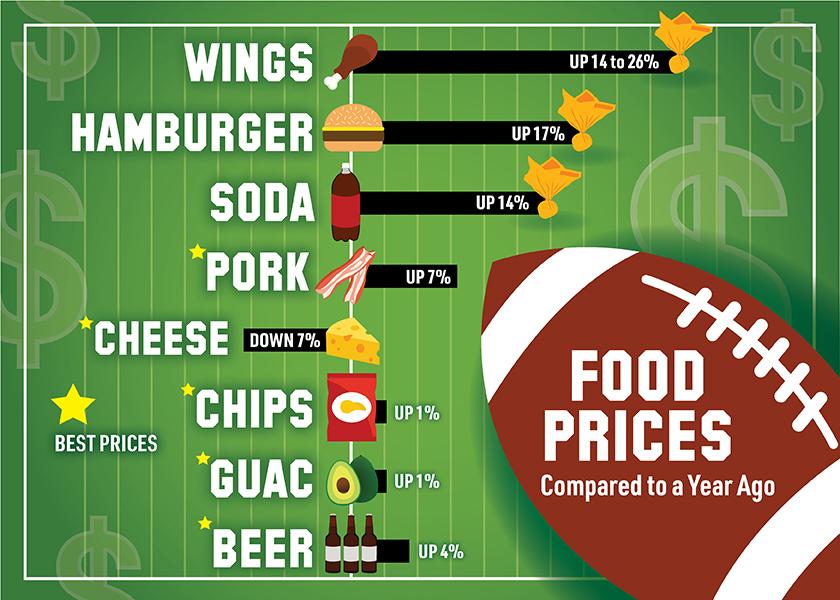

“Food inflation is a hot topic,” Swanson says noting that overall prices in the category are running at 6% higher than a year ago, whereas typically year-to-year food inflation is 1%.

The economists pulled data from USDA, Bureau of Labor Statistics, Nielsen data at the supermarkets, and insights from the bigger team at Wells Fargo.

Broadly, the categories more dependent on packaging and general logistical resources show the highest increases comparing at-store prices this year to last year.

By category here are some key takeaways from their findings:

Chips are only up 1%.

Chips are only up 1%.

“We’re a great potato growing country, and so we have a good supply of potatoes this year. The chip manufacturers are very efficient at turning them into potato chips. And so even though they've had challenges with their packaging and their labor and their freight, they've kind of kept a lid on the potato chip and chip prices,” Swanson says.

Two popular dips, two different stories.

Two popular dips, two different stories.

Guacamole is only up 1%.

“Avocados and guacamole have become really popular. Most people should know but maybe they don't that most of our avocado is coming from Mexico and Peru. And we've seen a lot of expansion down there. They've found it profitable to grow avocados and turn them into guacamole,” he says. Salsa is up 6%.

“It wasn't so much in the tomato and chilies, but it’s the packaging and labor and transportation that caught up with salsa prices,” Swanson says.

Go for bulk packaged vegetables

Swanson shares as a category you can evaluate vegetables as either bulk goods or the pre-package convenience options. He shares to save a bit on the inflationary costs, go with bulk carrots and celery and wash and chop them yourself so you are only exposed to 2 to 3% higher prices. He says the packaged salads and other such products are seeing higher cost increases.

Proteins are more expensive—some showing double digit higher prices

Proteins are more expensive—some showing double digit higher prices

“We've seen almost every protein jump up,” Swanson says. “This is where we're starting to see some double digit, you know, between 15 and 25% type increases depending on what protein and cut you're talking about. So far pork has really been the bargain, in terms of increases. You can still find some really good values in the pork category,” he says.

And popularity has propelled one poultry product very high.

Wells Fargo economists quote USDA data showing prepared chicken wings are up 14% to 26% (bone-in and boneless respectively). The IQF (individually quick frozen) chickens are up 26%. So IQF wings are $3.57 per pound, and $7.24 per pound is the average for prepared wings.

Double dip on cheese, perhaps

“The American dairy complex and American dairy producers have really stepped up,” Swanson says. “We're actually seeing about a 7% decline as a cheddar cheese from a year ago. Dairy is a category where it’s actually helping control the budget, without any runaway inflation.”

Some beverage categories quench your thirst with less inflation

Swanson’s team evaluated the costs of soft drinks, beer and wine. The report shows how packaging and logistics have swelled soft drink prices by 14%. However, market dynamics have kept beer and wine inflation more in check. He says beer prices have only increased 4%--mostly due to diversification in the market with more craft breweries in production. Wine prices are up only 3% thanks to a global market supply of products from Australia, Chile, South Africa and Europe.

Swanson’s team evaluated the costs of soft drinks, beer and wine. The report shows how packaging and logistics have swelled soft drink prices by 14%. However, market dynamics have kept beer and wine inflation more in check. He says beer prices have only increased 4%--mostly due to diversification in the market with more craft breweries in production. Wine prices are up only 3% thanks to a global market supply of products from Australia, Chile, South Africa and Europe.