Soaring Input Costs Cause Farmer Sentiments to Drop to Lowest Reading Since Corn Was $3

Ag Economy Barometer 040622

Input prices and growing concerns about how the war in Ukraine could hamper the flow of agricultural inputs are weighing heavily on the minds of farmers. The monthly CME/Purdue Ag Economy Barometer experienced a large drop, as the survey found the biggest concern among producers continues to be “higher input costs.”

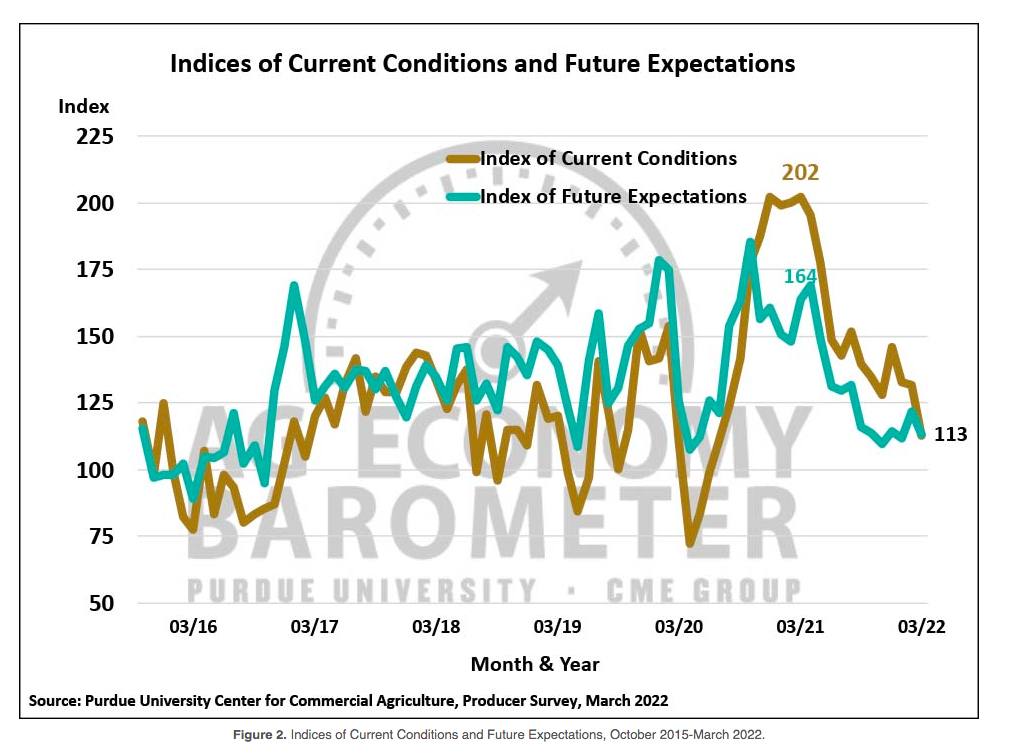

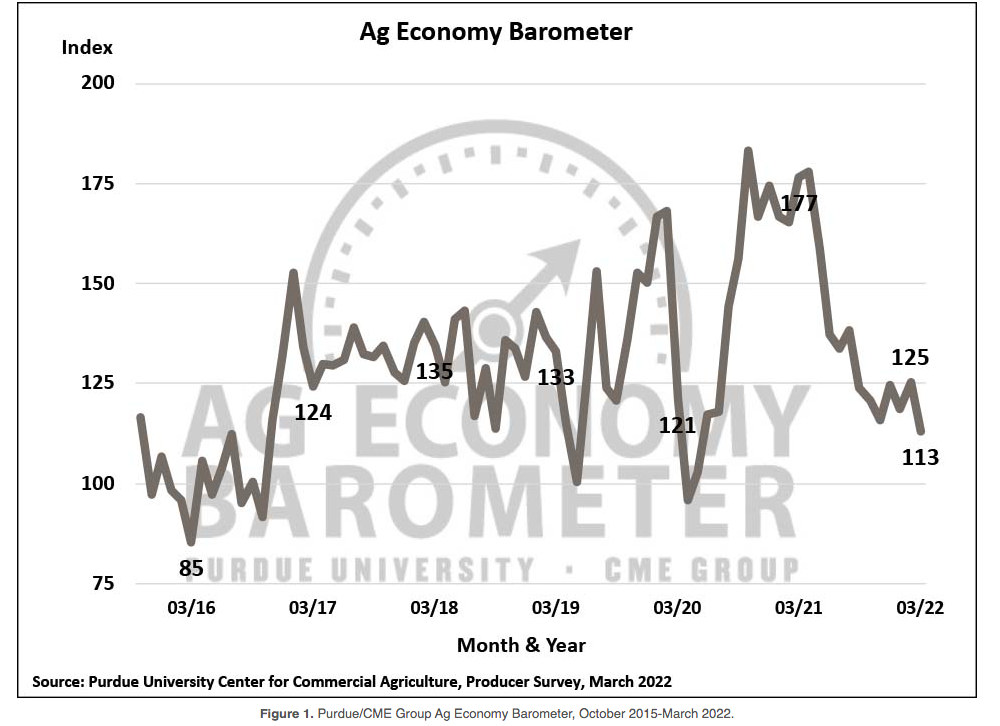

The March Ag Economy Barometer posted the weakest farmer sentiment reading since May 2020, when corn prices were sitting at $3 per bushel. With a reading of 113 in March 2022, sentiments showed a 12-point drop in just a month, and 36% lower than the reading a year ago.

“The March barometer survey provided the first opportunity to ask farmers what they expect to be the biggest impact as a result of the war in Ukraine,” says survey co-author Jim Mintert, who's with the Purdue Center for Commercial Agriculture. “63% of producers in this month's survey said input prices would see the biggest impact, followed by crop prices at 33%.”

The monthly survey compiles responses of 400 U.S. agricultural producers who answer the questions in a telephone survey. The latest barometer shows producers continue to say that they expect their farm’s financial performance to decline in 2022 compared to 2021.

“On the March barometer survey, we asked producers what their biggest concerns are for their farming operation in the upcoming year,” says Mintert. “The No. 1 choice among producers was higher input costs at 41%. That was followed by producers concerned about availability of inputs at 19%, as well as lower crop or livestock prices also at 19%.”

The Ag Economy Barometer also asked farmers about their expectations for farm inputs in 2022. The survey found:

- 57% of producers said they expect farm input prices to rise by 20% or more.

- 36% said they think input prices will rise by 30% or more.

- 27% of producers said they’ve had difficulty purchasing crop inputs for the 2022 crop season.

Farmers also communicated concerns about supply chain issues. Survey respondents said the issues are far-reaching and range from trouble with herbicides and fertilizer availability to issues sourcing needed farm machinery parts.

“For example, 42% of producers this month said their machinery purchase plans were impacted by low farm machinery inventories, consistent with industry reports that major machinery manufacturers are experiencing order backlogs,” says Mintert.