USDA Confirms Farmers’ Fears: Net Farm and Net Cash Farm Income Expected to Fall This Year

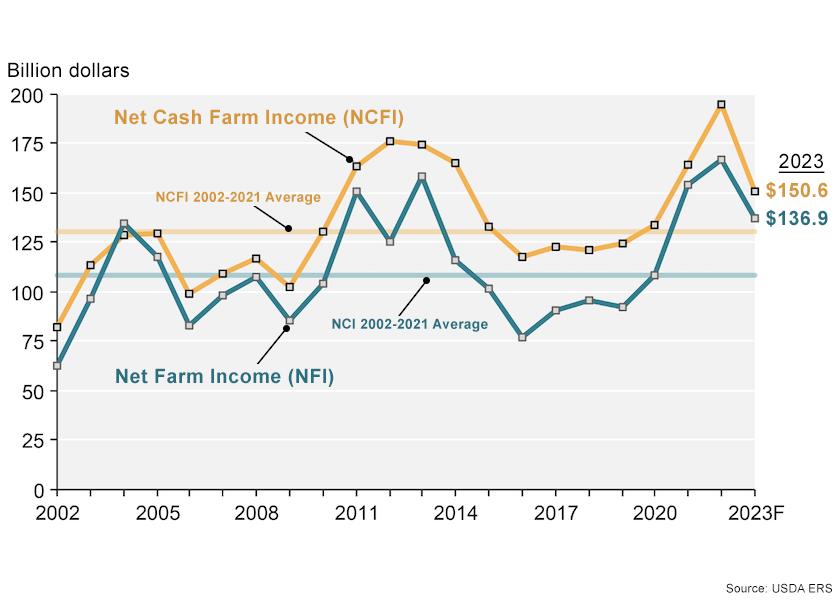

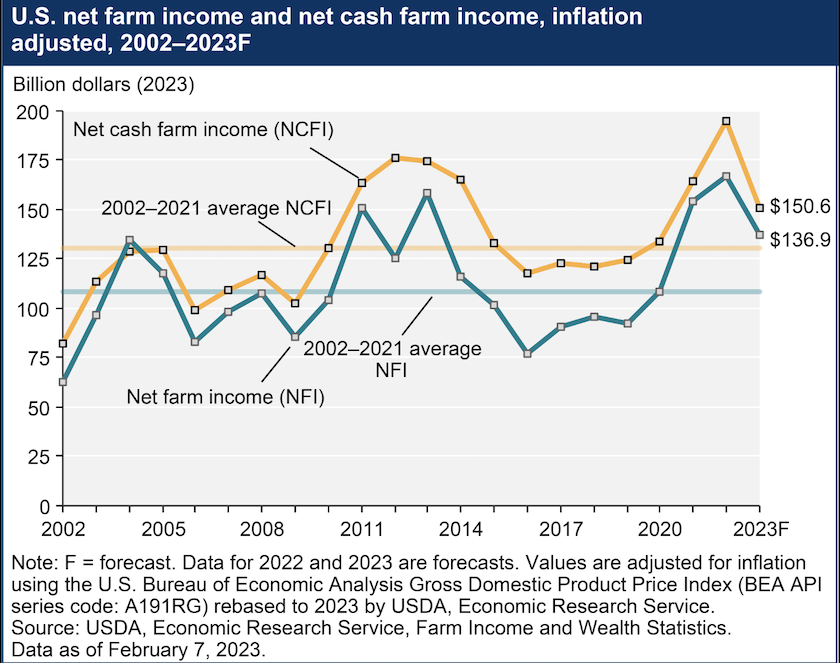

Even with the rise in fertilizer and fuel prices, net farm income hit a record in 2022. Now, USDA ERS says 2023 could be a different story, forecasting net farm income to fall nearly 16% this year.

USDA’s first official net farm income forecast of the year shows higher costs will drive down 2023 net farm income, but the bigger factor is the forecast for a decline in commodity prices. If commodity prices can at least hold where prices sit today, the picture won’t turn bleak, at least for this year, but it’s still a changing scenario from 2023.

Initial Forecast Points to Expected Drop in Cash Receipts, Government Payments

Farm Journal Washington correspondent Jim Wiesemeyer says his biggest takeaway form the initial net farm income forecast is both net cash and net farm income forecasts are lower for this year, with an expected drop in cash receipts, government payments, but an increase in expenses.

“Working capital is also falling as farmers have eaten into their cash reserves, much like consumers have burned through their savings, but to a lesser degree in agriculture,” says Wiesemeyer. “But working capital at $118.45 billion is still nearly double the recent low of $65 billion in 2016. Financial health remains solid even as debt-to-asset and debt-to-equity ratios are both expected to rise in 2023 versus 2022.”

ERS forecasts cash receipts from the sale of agricultural commodities to drop $23.6 billion, or 4.3%. That’s after a record high forecast for last year of $543.4 billion. USDA says those specializing in dairy and hogs are expected to see the largest decline relative to 2022.

The breakdown of cash receipts broken down by commodity includes:

• Total crop receipts are expected to decrease by $8.9 billion (3.1 percent) from the forecast 2022 level

• The drop is led by lower receipts for soybeans and corn

• Total animal/animal product receipts are expected to decrease by $14.7 billion (5.7 percent)

• The decline in livestock is driven by lower receipts for milk, eggs, broilers and hogs.

“The impact of lower receipts is actually greater than that of higher costs,” points out Pat Westhoff, director of the Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri. “On the cost side, the overall increase in expenses is 4.1%, after a 18.5% increase in 2022. Purchased livestock costs (think feeder steer) are projected to increase quite a bit; most other increases are fairly modest, and some categories (e.g. fuel) actually show a decline relative to 2022.”

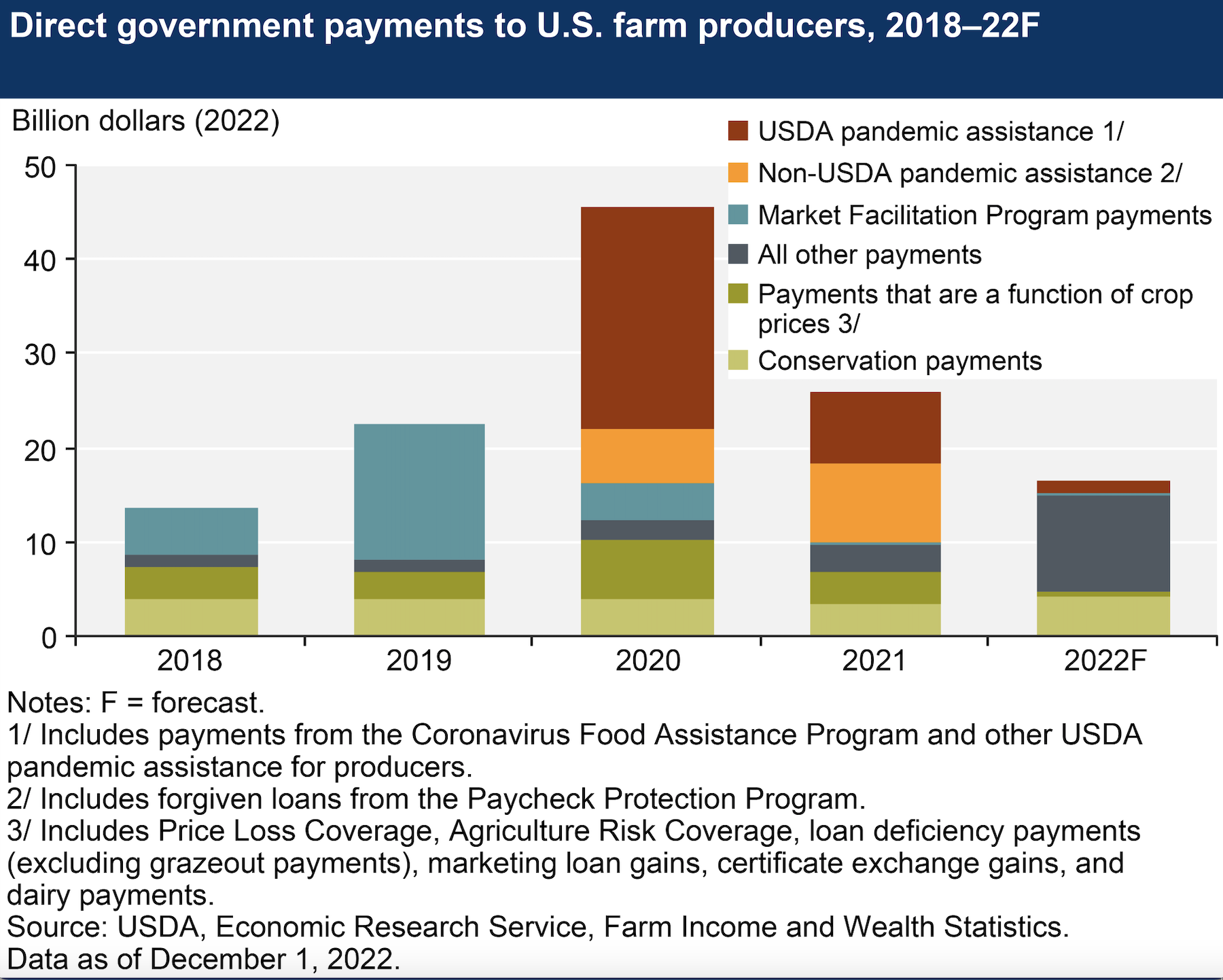

Expectation for Fewer Government Payments

Another factor at play is the forecast for lower government payments. USDA’s forecasting:

• Direct government payments to fall by $5.4 billion (34.4 percent) from 2022

• Direct government payments are expected to reach $10.2 billion in 2023

• The decrease is largely due to expectation of lower supplemental and ad hoc disaster assistance in 2023 compared to the previous years

“USDA shows more than a $5 billion drop in payments this year,” says Westhoff. “That’s reasonable given current policies and projected prices, but Congress or the Administration could always provide new programs not included here.”

A Lot Can Still Change for Net Farm Income

While the initial forecast shows a drop in net farm income, Westhoff points out much can change in a year’s time.

“Weather always matters, as does the health of the general economy,” says Westhoff. “And, as we’ve learned the last few years, there will be wildcards, think China trade war, COVID and the Russian invasion of Ukraine.”

Farmer Sentiments Inch Higher in January

Despite the waning outlook for net farm income, farmer sentiment seems to be improving. The latest CME Group/Purdue Ag Economy Barometer, which was also released on Tuesday, shows farm sentiments improved 4 points from December to January.

“An improvement in future expectations was the driver behind the modest rise in sentiment, as the Future Expectations Index rose 5 points in January,” authors of the barometer stated.

The also pointed out that while sentiments did edge higher, the majority of farmers report they expect tighter margins in 2023 than in 2022.

“Just over one out of five producers expect to have a larger operating loan in 2023 than in 2022, with higher operating expenses being the most commonly cited reason,” the January Ag Economy Barometer stated.

USDA expects total operator dwelling expenses to increase 4.1% to $459.5 billion in 2023. Of that, interest expenses and livestock/poultry purchases make up the largest dollar increases year-over-year.

Read the full USDA forecast and report here.

Related Story:

USDA Forecasts Farm Sector Profits to Remain Above Average in 2022