It’s Time to Talk About Soybeans

Corn has been stealing the spotlight for months. Acres jumped per USDA’s June Acreage report, and prices have rallied between 50¢ and 75¢ since March, making them likely more profitable to grow that soybeans.

But farmers need to keep their eyes on soybeans, says Scott Irwin, University of Illinois agricultural economist.

“We are really in an incredible situation,” he says.

Why? Let’s set the stage.

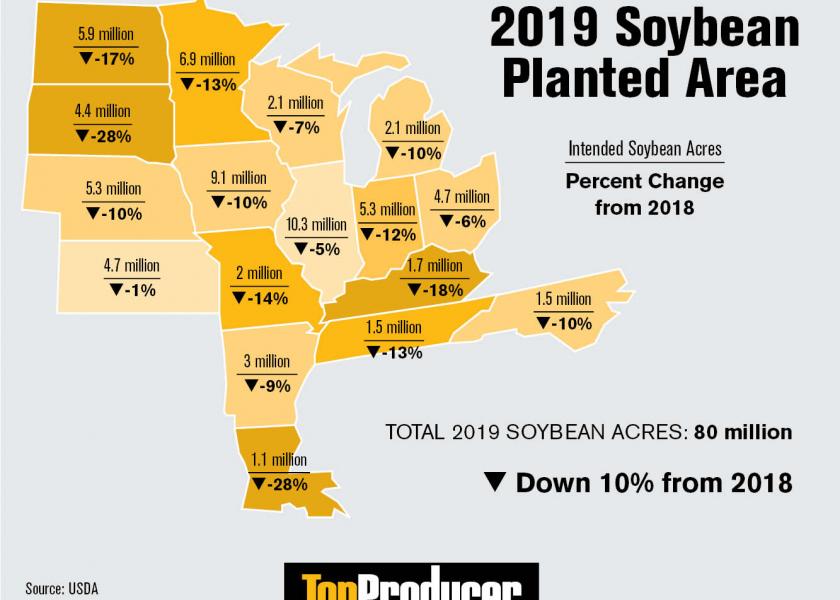

- Soybean acres for 2019 are estimated at 80 million acres, which is down 10% (and 9.2 million acres) from 2018. This represents the lowest soybean planted acreage in the United States since 2013. Ahead of last week’s Acreage report, the average trade estimate was for 84.4 million soybean acres.

- Of those 80 million acres, 33 million were not planted by mid-June, according to the Acreage report. That represents around 40% of the entire soybean crop.

- Condition of the soybean crop remains a huge wildcard. As of June 30, USDA estimates only 7% of the soybean crop is in excellent condition. That leaves 47% of the crop in good condition, 35% in fair condition, 9% in poor condition and 2% in very poor condition.

- Soybean stocks remain at record levels. Soybeans stored in all positions on June 1, 2019 totaled 1.79 billion bushels, up 47% from June 1, 2018. On-farm stocks totaled 730 million bushels, up 94% from a year ago. Off-farm stocks, at 1.06 billion bushels, are up 26% from a year ago.

All of these factors bring off-the-charts uncertainty, Irwin says. As a result, USDA said it will resurvey the entire Corn Belt for updated corn and soybean production data.

In a farmdoc webinar last week, Irwin and Todd Hubbs, University of Illinois agricultural economist, looked at the supply-and-demand situation for soybeans. (Read: June Acreage Report Heightens Uncertainty by Hubbs.)

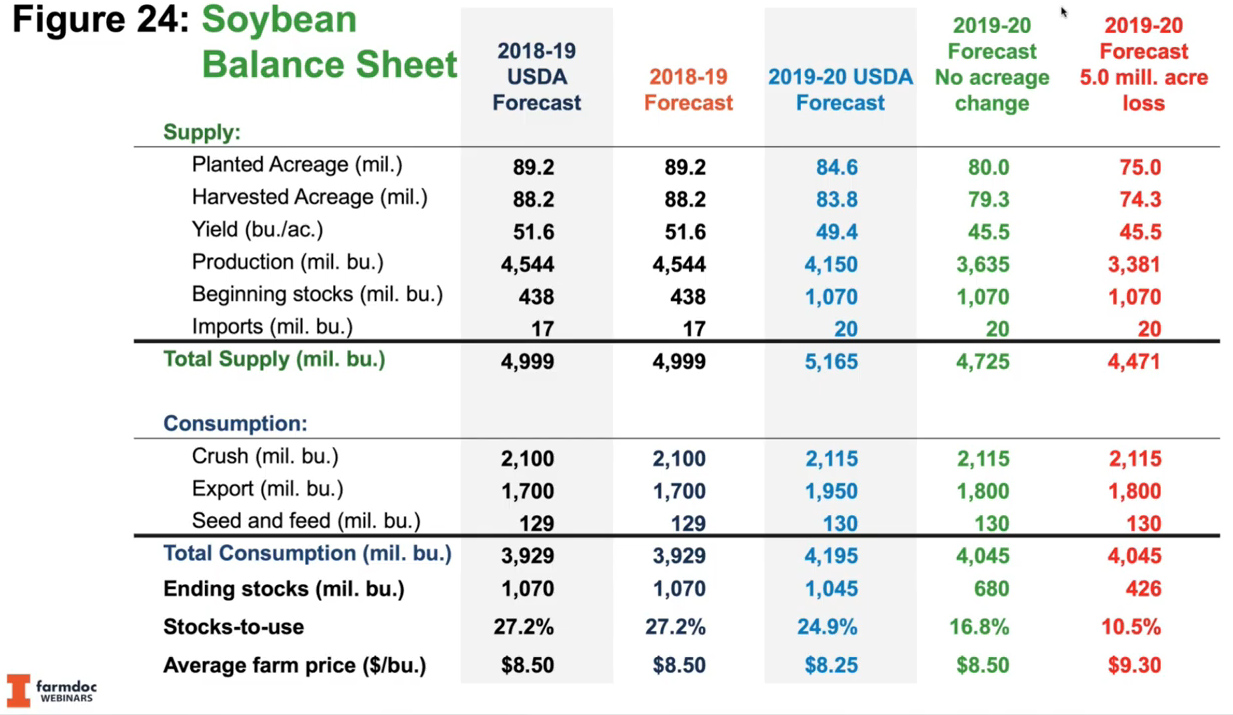

In the chart below from Hubbs, pay special attention to the last two columns (click to enlarge).

The only difference is taking planted acres down by 5 million, which adjusts the total supply and so forth. “I don’t think losing 5 million acres of soybeans to prevent plant is unreasonable,” Hubbs says.

With the same consumption expectations, Hubbs says, ending stocks would be around 426 million bu. “That’s something we’re more used to,” he says. “In my opinion, that’s a $9.30 average cash price for beans.”

If the acreage does drop, it creates a bullish picture for soybeans, Hubbs says.

“What I think most remarkable in looking at these balance sheet projections is the combination of the stampede out the door away from soybean acres, which reduced the total base of intended soybeans, plus what Mother Nature appears to be doing on both the acreage and likely yields,” Irwin says. “That means in one year it’s not unreasonable to project that we’re going to have gotten out of an extreme surplus situation in soybeans that I thought would take us many years to overcome.”

While the focus now is on soybean acreage, yields will also be a big question mark.

“From the first two weeks of June, there were 33 million acres of intended soybeans yet to plant,” Irwin adds. “Some of that is double crop, but that is a huge chunk of soybeans. If it does go in, at best, you’re looking at double-crop yields. In Illinois, our data says it should be at least a 25% hit on yields.”

Watch the webinar featuring Hubbs and Irwin:

Read More

Jerry Gulke: USDA Reports Provide More Questions than Answers