The Future of Phosphate Imports And 5 Things For Ag Retailers To Know

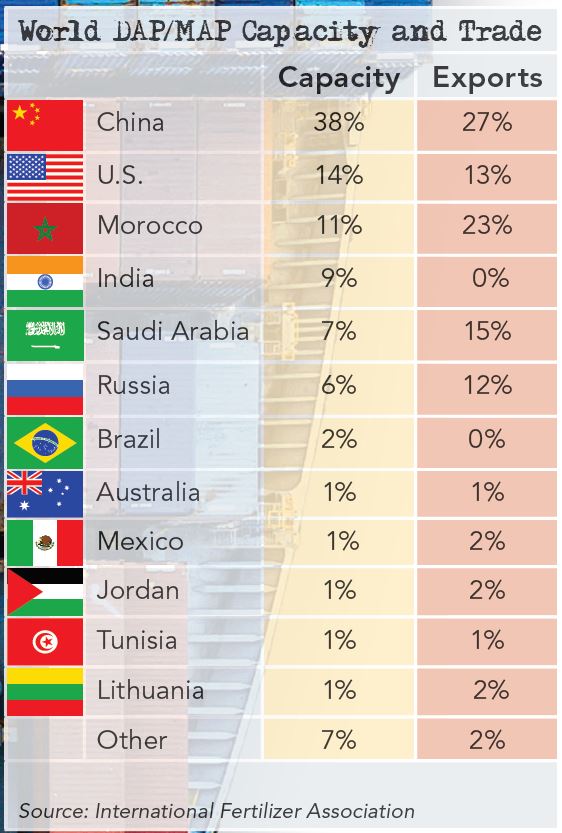

In early March, The U.S. Department of Commerce issued countervailing duty orders on phosphate fertilizers with cash deposit rates that will be approximately 20% for Moroccan producer OCP, 9% for Russian producer PhosAgro, 47% Russian producer EuroChem, and 17% for all other Russian producers. These countervailing duties will be in place for at least the next five years.

This decision was after an eight-month investigation started after Mosaic filed a case against imports of phosphates from Morocco and Russia. The price tag in the complaint showed $729.4 million for Morocco and $299.4 million for Russia in 2019 alone.

So, what does the outcome of this case mean for prices? Phosphate prices were already at the highest level since 2012, and Josh Linville of StoneX Group thinks the outcome of this case could push phosphate prices even higher.

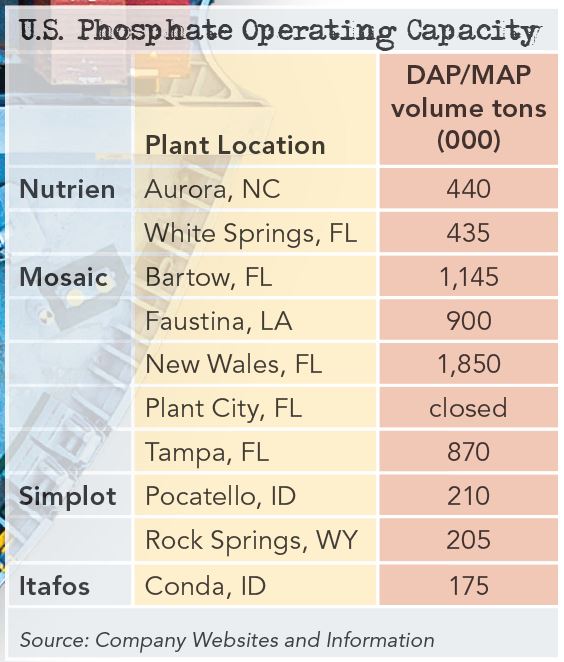

He says not only does this set up the U.S. as a premium market going forward, it also means Mosaic now controls 88% of the market from a U.S. point of view, which accounts for ownership, duties or lack of exports by that country.

“We will still ebb and flow with world price trends, but rather than being at parity to a discount to the world, we will now operate at a premium,” explains Linville. “This shuts down efficient trade routes to the U.S., with Morocco being the best example, and forces us to buy from places like Australia.”

Mosaic says decision won’t further impact prices. Ben Pratt, senior vice president of government and public affairs at The Mosaic Company, says this case should emphasize that American farmers can be supplied with reliable phosphate supplies by American producers in the long-term.

“We are confident there will be enough phosphate fertilizer to go around for U.S. farmers and farmers around the world—both this spring and into the future,” he says and adds that Mosaic has about half of the marketshare for U.S. applied phosphate fertilizers. “Ag retailers are our customers directly, and we have been in communication with all of them through this to help them understand why we took this action. Our customers by and large supported our efforts for long-term competitive American phosphates. Mosaic is going to be here for the long term to provide reliable supply of phosphates.”

“The individual suppliers that have come into the market by themselves don’t have same capacity as Morocco and Russia, but if you aggregate the new imports, the amount of phosphate fertilizer coming into the US is about the same as when Russia and Morocco were importing,” Pratt says. “We welcome vigorous competition, and we believe in a fair and level playing field.”

Regarding the impact of the decision on prices, Pratt says the global market is operating at a premium right now.

“When we filed the petition, Morocco and Russia stopped imports. And prices moved from discount, which were the result of unfair trade from Russia and Morocco, to being a premium. Now, that premium has largely gone away and the market is balanced and prices are balanced with other key geographies such as Brazil. The farmers in U.S. are currently paying the same rate for phosphate fertilizers as their counterparts in Brazil,” Pratt says.

OCP Group in Morocco responds. OCP Group, a company that mines phosphates in Morocco, said it knew the decision was coming despite the strong arguments by the OCP Group. Kevin Kimm, VP of commercial for OCP, says there is no basis for such duties. The group also says despite the decision, OCP recognizes the supply challenges that American farmers face and is determined to serve them in the future, and will explore the most appropriate options to do so.

"What the case filing has meant to the market is uncertainty," said Kimm. "Imports are needed to have reliable, viable supply to the farmer and to allow them to be competitive globally."

Kimm pointed out the tightening of the market occurred due to not enough supplies, which included monoammonium phosphate (MAP). It resulted in a 36% increase in prices to retailers and 25% increase to farmers at the farm gate.

"OCP is a global reputable company looking to serve the U.S. farmer," said Kimm. "What we care about is providing the US farmer viable products for a longer time to come. The phosphate business is a global market, and imports are needed."

Josh Linville of StoneX Group gives these 5 takeaways for ag retailers:

1. U.S. phosphate values will continue to ebb and flow with world price movements – just because the counter vailing duty was approved does not completely disconnect the U.S. market from the world. Our values will continue to move lower/higher as the world does.

2. The U.S. phosphate market will likely trade at a premium to the world going forward – placing duties against Morocco/Russia made it very difficult to continue a couple of the most efficient global trade flows going forward. This duty will likely force Morocco/Russia to find new homes around the world which will force inefficient origins to come here

3. The CVD does NOT mean that Morocco/Russia cannot come here – it only means that it will cost them more to ship product to the U.S. as they have to pay the rate. If they are comfortable paying that duty rate, they are still allowed to come

4. U.S. phosphate exports “should” be lower going forward – is it guaranteed to drop? No. However, with the U.S. a premium market going forward, it will make more sense to keep tons “home” rather than exporting.

5. Need to keep a rational approach to phosphate needs/applications – we have heard from a lot in the industry regarding cutting their phosphate application rates partially or completely out of anger. That anger is understood but also remember that if the application rate is reduced, there is a chance that the overall top end yield could be in danger of dropping. Everything else is high priced (nitrogen/potash/chemical/seed/equipment/etc) and requires max yields.