Spring Crop Insurance Price Looks to Smash Records for Soybeans

The ongoing Ukraine-Russia crisis is now hindering trade out of the major grain production area. And as a result, the uncertainty added fuel to volatile price action on Monday, which marked the final day for setting spring crop insurance prices this year.

“The uncertainty is causing this massive volatility,” says Chip Nellinger of Blue Reef Agri-Marketing. “The scary thing is even with corn limit up here and wheat sharply higher, as well, we're just essentially back into the middle of the range from the overnight high Thursday to the low on Friday. So that range was massive in itself.”

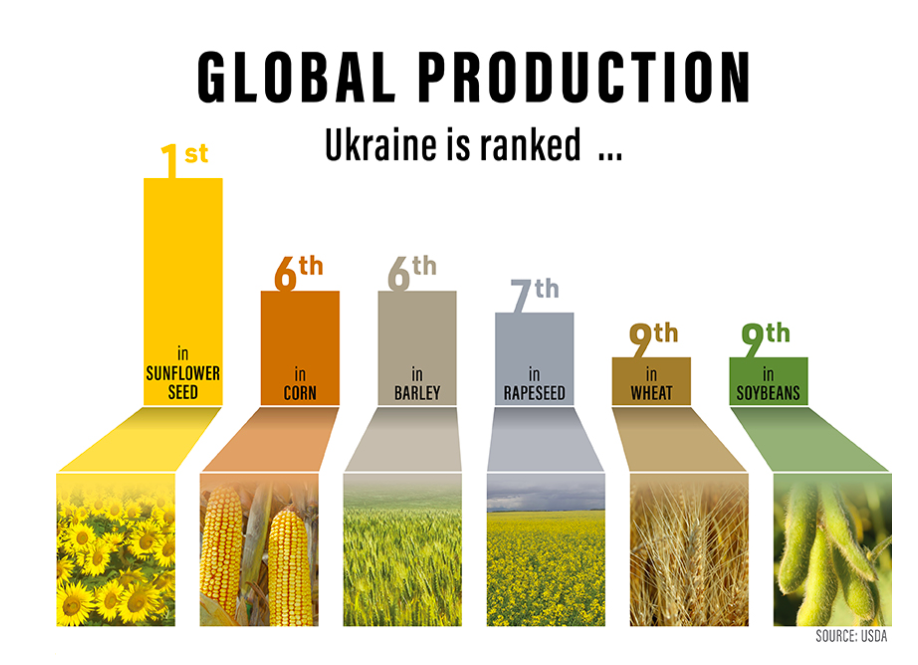

As commodities traded to the halfway point of last week’s highs, the impact of the war in Ukraine could be massive. According to AgWeb, Ukraine ranks in the top 10 in the world for six different commodities, including:

- 1st in global sunflower production (For 2021/22 Ukraine sunflower seed production is estimated at a record 17.5 MMT)

- 6th in global corn production. (For 2021/22 Ukraine corn production is estimated at a record 42 MMT)

- 6th in global barley production

- 7th in global rapeseed production

- 9th in global soybean production

- 9th in global wheat production

“The market is as uncertain as everyone else on what the effects of this Russia-Ukraine war is going to have on the Black Sea trade ongoing, whether it's going to affect spring planning for Ukrainian farmers, what the effects of the financial sanctions that we're putting on Russia will be,” adds Nellinger. “All of that is just massive uncertainty. And at least for the time being, the Black Sea is closed indefinitely. Now, there's no trade out of there. A lot of those ports have been mined by the Ukrainians to keep Russia's amphibious assault out of those ports. And so obviously, what that means to us in the big picture is, as one of the only games in town right now for corn for sure."

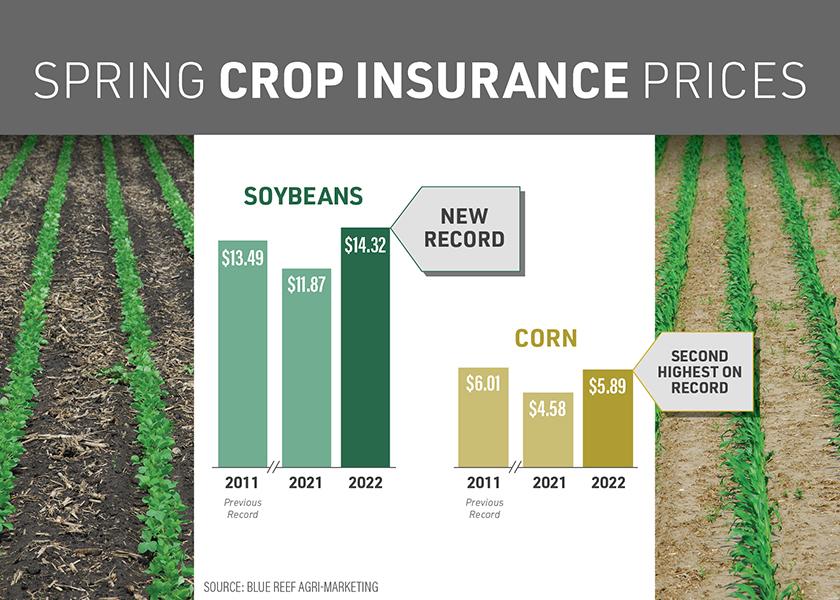

Record Spring Crop Insurance Prices

The final day of February’s volatile price action in commodities also added to the spring crop insurance revenue price guarantee. USDA’s Risk Management Agency (RMA) will release the final price, which is calculated from the average of the price range producers saw in February. But an early look at levels shows soybeans could smash the previous record set in 2011.

“Beans are sitting right at about $14.32 [per bushel] right now,” Nellinger says based on prices mid-day Monday. “Obviously, we have to still average in today, but it's going to be hard to move the needle a whole lot. So, soybeans are sharply higher, and the highest spring price crop insurance level we've ever had in beans, by about 80 cents. The previous high was in 2011, and that was $13.49."

Nellinger says while the spring crop insurance price doesn’t look to be a record in corn, it may average out to be the second-highest on record.

“Right now trading is about $5.89 [per bushel], the previous high again in 2011 at $6.01,” he adds. “The good part about this is with the trend adjustment yields that the RMA put in a few years ago, and in general, farmers' yields have been trending higher so that we're going to undoubtedly have the highest revenue guarantee that we've had, most likely, in history. So that's a good starting point. As we face all this uncertainty that's happening in the world right now.”

For reference, 2021's spring crop insurance prices were set at $4.58 per bushel for corn and $11.87 per bushel in soybeans.

Nellinger says even with the acreage debate ongoing, he’s in the camp that farmers will shift to more soybeans in 2022. He thinks the U.S. could see a “sizable shift” just based on conversations he’s having with producers across the country.

Kristy Van Ahn-Kjeseth of Van Ahn and Company said on U.S. Farm Report this past weekend she’s not in the camp that farmers will make last-minute acreage adjustments based on availability of inputs. Instead, she points out spring crop insurance prices are providing a strong risk management tool this year.

“Right now, I think people are set on what they want,” she says. “And I think they kind of have that game plan going on crop insurance prices extremely strong right now. So, you're generating those spring crop insurance prices, to give you a little bit more comfort to say, ‘hey, let's just stick with the plan.’ We know the 2023 crop could be a much different situation. But this one is penciling to give you some comfort to start it off.”

Related Stories:

Ukraine-Russia Tensions: What it Could Mean for Agriculture

BREAKING: Putin Wants to Talk to Ukraine; Grain Markets Move Back Down

Here's Why the Russia-Ukraine Crisis Creates a Realignment of World Trade

BREAKING: Russia Launches Invasion Into Ukraine

Russia-Ukraine Crisis Shakes U.S. Markets, Gas and Oil Prices Surge

Russian Invasion is Bad News for U.S. Meat Consumers, Steiner Says