Drought's Impact

Cattle producers in the U.S. are once again staring at a historic drought, one that comes as some states have yet to fully recover from the previous drought years which climaxed from 2011 to 2013.

By June 15, over 26% of the western U.S. was experiencing exceptional drought, the most intense level reported by the U.S. Drought Monitor. Nearly 98% of the West was experiencing some level of drought. Those numbers are startling considering prior to this cycle of dryness, the biggest proportion of the West dealing with drought at any one time during the past 20 years was a mere 12%.

California has fallen under a drought of biblical proportions. Nearly 95% of the state was in severe drought before the calendar turned to summer, and 85% of the state was listed in the extreme category. California is now in what experts call a megadrought, defined as a prolonged drought lasting two decades or longer.

States in the northern Central Plains are just as dry. North Dakota, for instance, saw 93% of the state under severe drought by mid-June, a disaster for the state’s farmers and ranchers.

“We’re getting late along in the growing season,” says Allen Schlag, National Weather Service hydrologist in Bismarck, in mid-June. “We’ve missed out on a good portion of grass production and there’s no making it up. A lot of grasses have headed-out and, once that happens, it doesn’t get any taller. From that standpoint, it does not matter one bit how wet we are between now and July 4.”

Overall U.S. Pasture and Rangeland Conditions since May 1 show the worst ratings in the dataset going back to 1995, with states in the north and west heavy contributors to the U.S. average. Conditions were expected to worsen and spread during the following 60 days in June and July.

Drought forces cattle producers to cull their herds, and the

evidence is mounting this drought-induced cycle could rival the historic drought of a decade ago. That drought began in the southwest and saw Texas ranchers reduce their beef cowherd by 13% from 2011 to 2012. Oklahoma lost 14% of its cows during the same period.

Between 2010 and 2014, U.S. beef cow numbers declined 6.3% from 31.37 million to 29.08 million, the lowest total beef cow number since 1952.

Texas, the No. 1 beef cow state, has not fully recovered its herd numbers. Home to 5.03 million beef cows in 2011, Texas’ numbers fell to 4.37 million in 2012. USDA’s annual cattle inventory report counted 4.69 million cows in Texas on Jan. 1, 2021, or still about 7% fewer than in 2011.

Accelerated cow slaughter

Beef cow slaughter numbers began a noticeable increase early this year, and are now outpacing heifer retention rates.

“We saw beef cow slaughter increase significantly with last winter’s storms,” says John Nalivka, president of Sterling Marketing. “Since then, we’ve seen a significant increase in beef cow slaughter to where the year-to-date total through the first week of June was 1.4 million, or 11% higher than 2020. That’s the highest year-to-date cow slaughter number since 2011.”

In fact, Nalivka says 2021 cow slaughter data compare nearly identically to 2011.

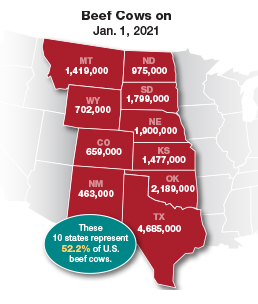

While this year’s drought is already extensive, expansion from north to south in the Central Plains could produce an impact similar to what was seen in the drought a decade ago. Ten states in the Central Plains are where 52% of the nation’s beef cows were found on Jan. 1 of this year. Those 10 states — Colorado, Kansas, Montana, Nebraska, New Mexico, North Dakota, Oklahoma, South Dakota, Texas and Wyoming — held 16.27 million beef cows.

In 2011 those 10 states had 16.17 million beef cows and saw a decline of 5.8% (936,000 head) by 2012 due to drought.

Nalivka’s early projection for the 2022 beef cow number is 30.35 million head, about 2.6% fewer than 2021 and would represent the third consecutive year of decline. That would translate into a calf crop total of 34.4 million head, a 1.2% decline.

Price Comparisons

The drought of a decade ago led to historically low cattle numbers and eventually to historically high cattle prices in 2014. Might that happen again as this drought cycle plays out? Nalivka believes fewer cattle will ultimately produce higher prices, though not likely to the levels seen in 2014.

“There are several factors at play that we didn’t have in 2014,” Nalivka says. “First, I don’t think we’re going to take the total cattle inventory down to that 88 million head level like we saw in 2014. Additionally, we have a larger total meat supply — more chicken and pork production — than in 2014.”

Finally, beef — and all livestock proteins — have a new competitor. Plant-based proteins were not as commercially available in 2014, but they now hold a small percentage of market share. That share is 1% to 2% in the U.S., and could increase if retail beef prices continue to rise.