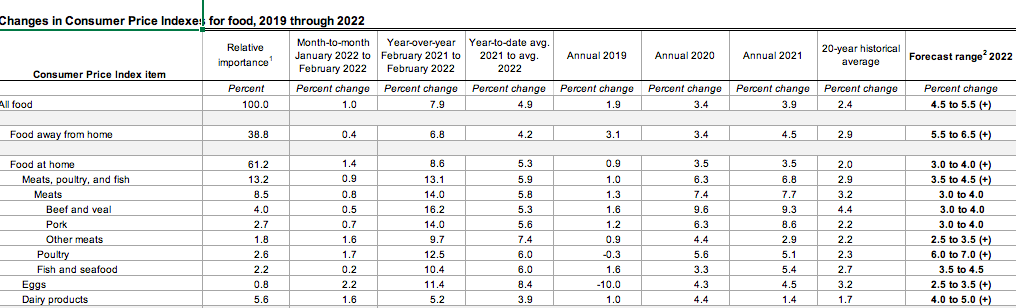

Inflation Already Costing Consumers, USDA Makes Large Upward Revisions in Food Price Forecast

USDA now expects food price inflation in 2022 to be from 4.5% to 5.5%, compared with 2021, based on the all-food Consumer Price Index (CPI). The prior outlook for food prices pegged the increase at 2.5% to 3.5%. Not a single or aggregate category is expected to decline.

Food away from home (restaurant) prices are forecasted to increase 5.5% to 6.5%, the third increase in as many months. Last month’s forecast was for a rise of 4% to 5%.

Food at home (grocery store) prices are now forecast to be up 3% to 4% in 2022, up from their previous forecast for an increase 2% to 3% from 2021 levels.

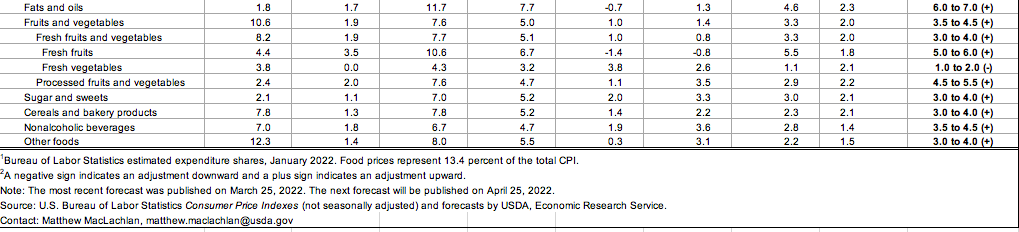

In 2021, grocery store prices increased 3.5% and restaurant prices were up 4.5%, with all food prices up 3.9% versus 2020 levels. The biggest increases in items tracked by USDA’s Economic Research Service (ERS) were the beef and veal category at 9.3% and the fresh vegetables category had the smallest rise of 1.1%.

The overall food price CPI rose 1% from January to February and was up 7.9% from February 2021. The restaurant CPI increased 0.4% in February 2022 and was 6.8% higher than February 2021. Meanwhile, grocery prices were up 1.4% from January while those prices stood 8.6% higher than they were in February 2021.

The increases versus year-ago marks were substantial for many categories, and all categories saw gains. Prices for meats, poultry, and fish were up 13.1% from February 2021 while they edged up 0.9% from January—following a more modest rise of 0.2% seen from December to January. Prices for meats were 14.0% higher than a year ago, while beef and veal prices gained 16.2% and pork prices were 14.0% higher. The CPI for meats rose 0.8% from January, with a rise of 0.5% for beef and veal while pork prices moved up 0.7%.