Will Indonesia's Ban on Palm Oil Exports Derail Renewable Diesel Growth in the U.S.?

Soybean oil prices hit nearly limit up in overnight trading after Indonesia announced it will effectively ban palm oil exports as of April 28 due to soaring domestic prices.

While no timeline was given on the announced export ban, Indonesia said the ban on palm oil exports will be until further notice. The news sent soybean oil shooting higher, with CBOT hitting a record high of 83.21 cents per pound.

The Reality of Palm Oil Supplies

While some called the ban “totally unexpected,” Indonesia made a similar move earlier this year. In January, the country restricted palm oil exports, which was then lifted in March.

S&P Global Platts is questioning the duration and motivation of Indonesia’s palm oil export ban announcement. Peter Meyer of S&P Global Platts says, “A long-term ban could severely damage Indonesia’s economy given its reliance on palm oil exports. Additionally, this is not the first time Indonesia has announced this type of action since the war started in Ukraine, only to reverse course quickly.”

Meyer added that the proposed ban, which is slated to begin on April 28th, may ultimately result in increased exports tariffs, but not a total shutdown of exports.”

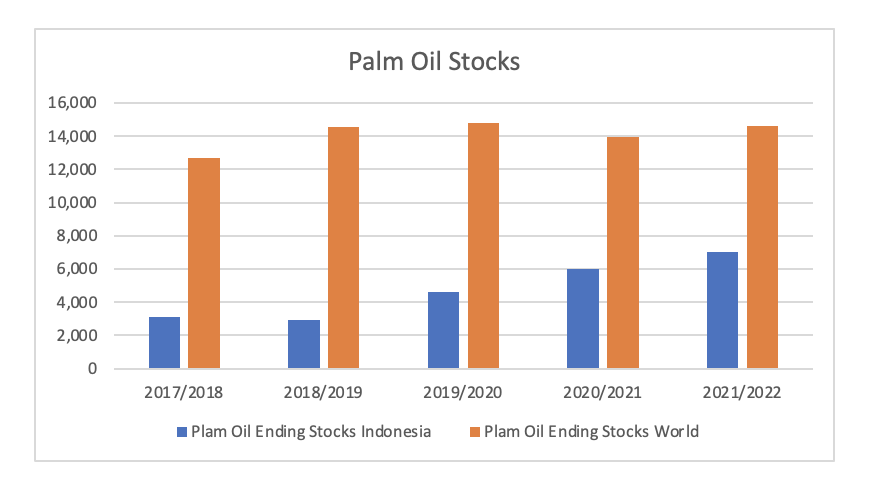

Meyer also points out there’s no shortage of palm oil supplies in Indonesia today that would spur such a ban. A chart from S&P Global Platts shows palm oil supplies for the 2021/2022 year are actually above the previous year, and considerably higher when compared to historical levels.

The bigger concern is what this would mean for world trade considering the largest supplier of sunflower oil, Ukraine, is also facing an uncertain supply situation as the war continues.

The Black Sea region accounts for 60% of the world’s sun oil output, as well as 76% of exports. Considering so much of the world’s supplies comes from an area partially under siege, the uncertainty caused global vegetable prices to hit record highs already this year.

Food and Biofuels

According to Reuters, the measure could further inflame global food inflation that soared to a record high following Russia's invasion of Ukraine, raise costs for packaged food producers and force governments to choose between using vegetable oils in food or for biofuel.

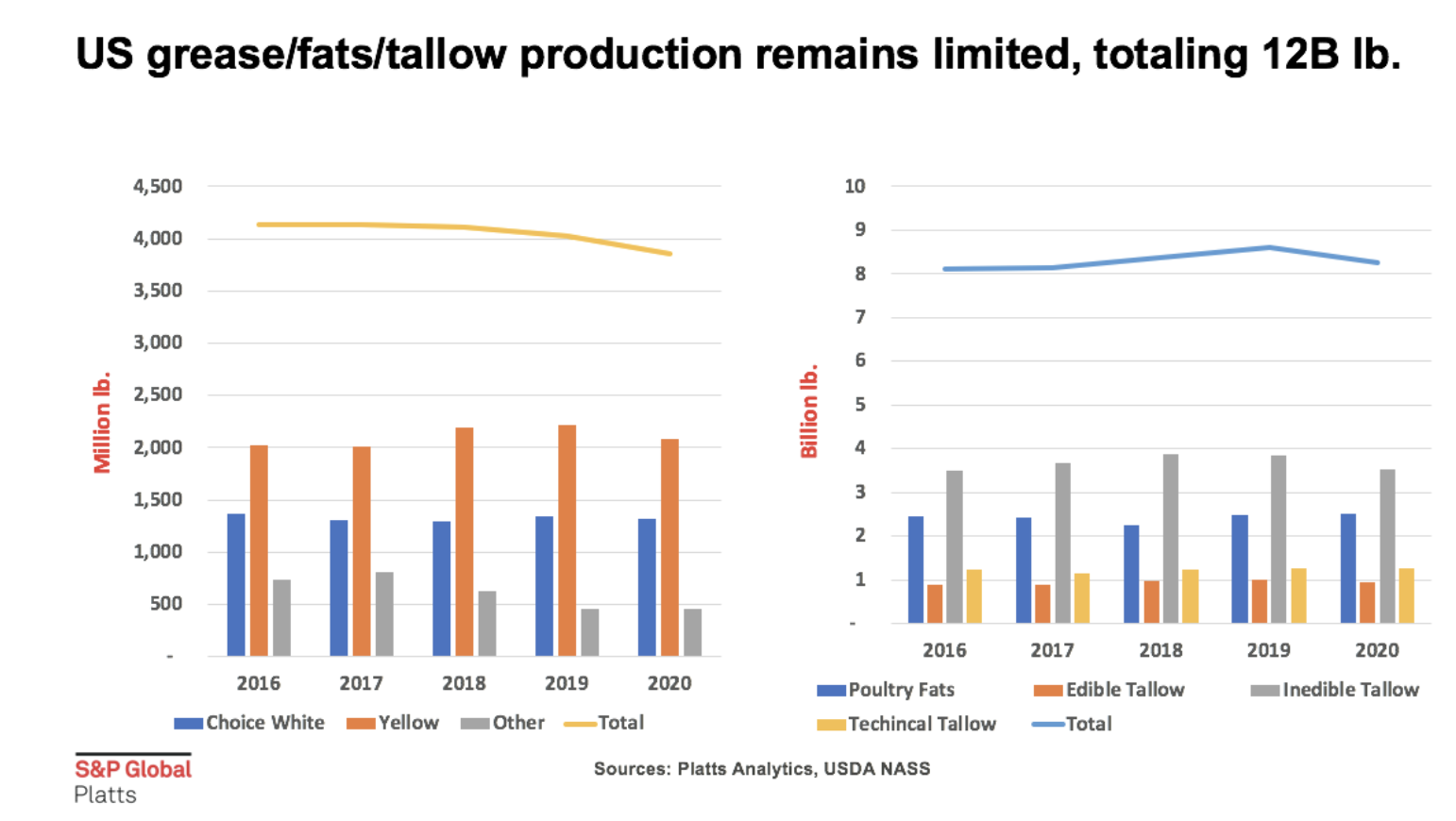

The renewable fuel conversation relies on more supplies of vegetable oils, as well as tallows and fats. Meyer says the energy transition away from fossil fuels, which seems to be accelerating in coming years, will require more renewable fuel production.

“The fact of the matter is that, in our opinion, by the year 2025 we will need 40 billion pounds of feedstock to keep the renewable energy refineries running,” says Meyer.

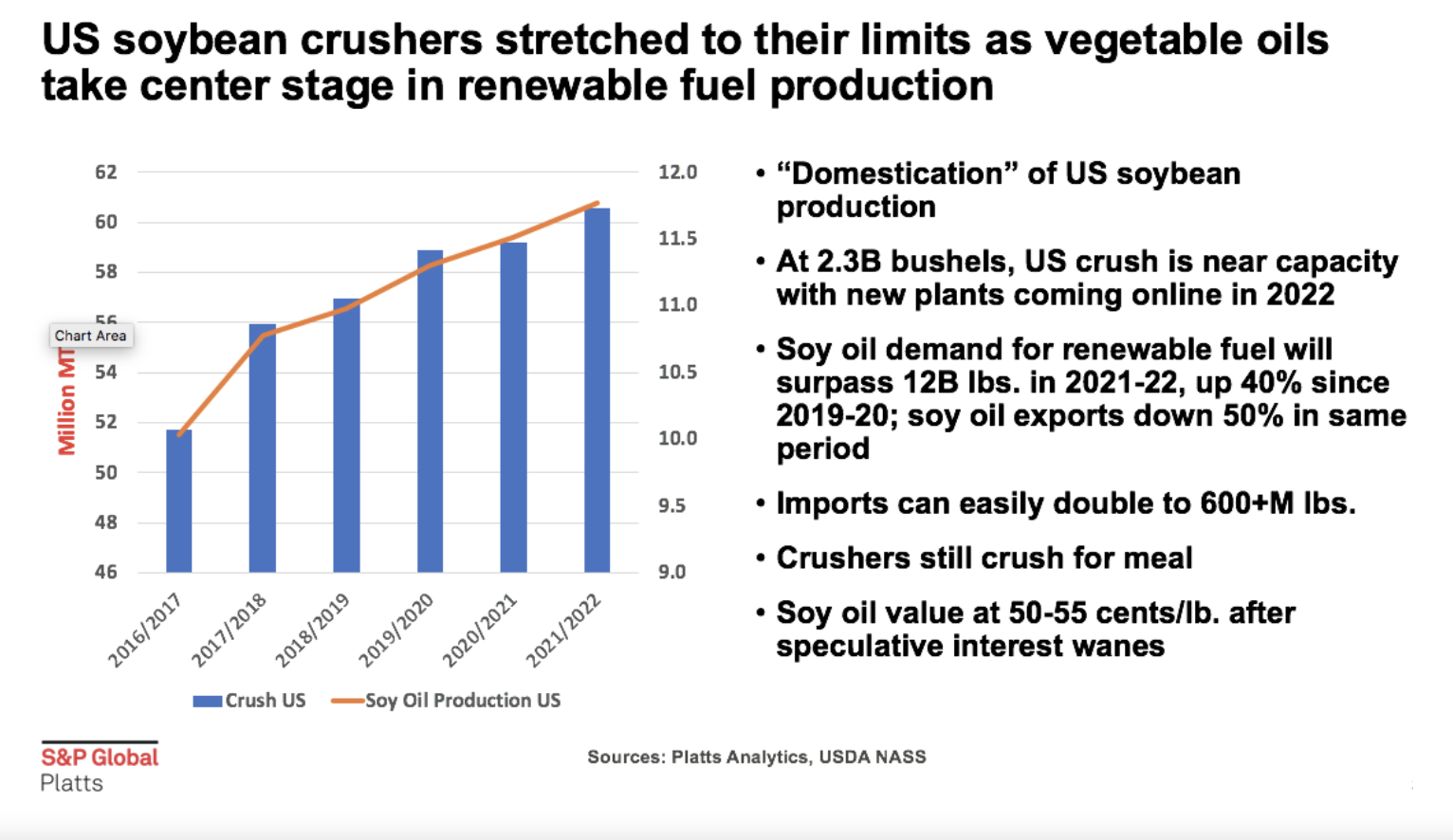

Meyer told Farm Journal last fall that currently, the U.S. is only producing 12 to 14 billion pounds of fats and tallow a year, which is a far cry from the 40 billion needed. And Meyer thinks the gap can happen with the help of soybean oil.

“We believe it can be filled domestically,” says Meyer. “But the problem there is we need more crush plants. Because in the U.S. at the moment, crush plants are kind of running at full capacity, and almost running to their capacity. If our math is right, we're going to need 25 billion pounds, and that's all the soy oil we produce on a yearly basis.”

Meyer says the latest announcement from Indonesia isn’t causing S&P Global Platts to change its timeline, as more U.S. crush plants are projected to come online in the next two to three years.