About Face

Market Watch with Alan Brugler and Austin Schroeder

November 4, 2022

About-Face

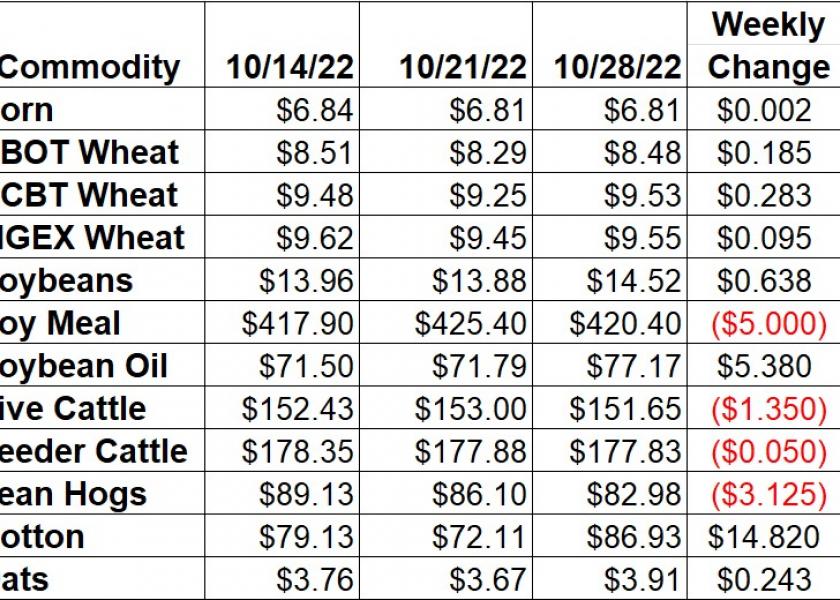

It was an eventful week in the markets. Most of the action got started over last weekend before trading even got kicked off. Russia, in response to a Ukrainian attack on naval vessels, suspended their participation in the trade deal that opened up a corridor for Ukrainian grain shipments. That sent the grains sharply higher on the Sunday open. However, by Wednesday, they made an about-face on their weekend statement and stepped back into the deal. That was following several commitments by Ukraine including that they do not use the corridor for military operations. The grains did not care for that and had given most of the Monday rally back by the Wednesday morning open. The other about-face came via a reversal in the cotton market, which had bled lower for the better part of 2 months. Traders decided that was enough and rallied with several limit up days on the week.

Despite posting a 21 ½ cent range on the week, mostly to the high side, December corn was just ¼ cent higher than last Friday’s close. Monday’s Crop Progress report indicated that the US corn harvest was 76% complete as of last Sunday, 12% faster than the normal pace. The monthly Grain Crushing report from NASS on Tuesday showed just 383.09 mbu of corn used for ethanol in September, a 5.91% drop from 2021. During the week of October 28, ethanol production ticked 7,000 barrels per day higher to 1.04 million bpd. Stocks of ethanol slipped 59,000 barrels to 22.232 million barrels. Thursday’s Export Sales report tallied corn export bookings at just 372,200 MT during the week of 10/27. That took the export commitments total to 14.467 MMT, the lowest in 3 years and just 26% of the USDA projection. Exporters would have typically sold and shipped 41% of that USDA forecast by now. The slow sales pace does have some thinking USDA may lower their projection next Wednesday. Monthly Export data from Census showed 2.63 MMT (103.55 mbu) of corn exported during September, a 4.5% increase on last year. CFTC’s Commitment of Traders report had managed money spec funds adding 7,586 to their net long position in corn futures and options in the week that ended on 11/1. That took them to net long 271,960 contracts as of Tuesday.

Wheat gapped higher out of the gates on Sunday night and gave most of it back by Wednesday. By the week’s end, they were higher. Chicago SRW futures rallied 2.23% (18 ½ cents), with KC HRW 3.05% higher (28 ¼ cents) and MPLS spring wheat 1.01% (9 ½ cents) in the green. The big story started last weekend, with Russia “suspending” their participation in the Ukraine grain trade deal. However, by Wednesday morning they announced they were back in, sending futures on a wild roller coaster before the week was half over. The weekly Crop Progress showed the US winter wheat crop at 87% planted, above the average pace by 2%. Emergence was at 62%, now 4% behind average. The initial condition ratings data was released at 28% gd/ex, or 281 on the Brugler500 index. That is the worst condition rating on record for the first week of the fall ratings. The weekly Export Sales report showed wheat export bookings at 348,100 MT in the week ending 10/27, down from the week prior. Total export commitments are now 12.252 MMT for wheat and products, the slowest start since the data set started in 1990. It is also 58% of the USDA forecast vs. the 63% average pace. September wheat exports were at a 9-year high of 3.048 MMT (112.01 mbu). Weekly CFTC Commitment of Traders data showed spec traders adding 1,097 contracts to their net short position in CBT wheat futures and options of 37,149 contracts as of Tuesday. In KC wheat they pared another 1,218 contracts from their net long, putting it at 23,408 contracts by November 1.

Soybeans gained some steam this week, as November was up 63 ¾ cents (+4.59%). The product values were mixed on the week, with soy oil holding the complex up, rallying 7.49%. Soybean meal was weaker, with a 1.18% loss. The US soybean harvest is nearing its end with 88% of the crop out by last Sunday according to the weekly Crop Progress report. That is 10% faster than normal. The monthly Fats & Oils report showed 167.59 mbu of soybeans crushed during September, a 2.11% increase over last year. The weekly Export Sales report indicated bookings of soybean for the week that ended on 10/27 slipping to 830,200 MT. That took the total export commitments to 33.3 MMT, or 58% of the USDA projected total. The normal export sales pace is for 57% of the forecast USDA total to be purchased by now. Census data from Thursday showed 2.12 MMT (78.01 mbu) of soybeans exported in September, an 8-year low for the month. Friday’s Commitment of Traders report showed managed money spec funds adding 25,918 contracts to their net long position as of Tuesday. That took it to 101,329 contracts by 11/1.

Live cattle were weaker this week, as December slipped 0.88% or $1.35. Cash cattle trade was mostly steady on the week, with $152-153 seen in the north, and $150 in the south. Dressed trade was $242 per hundred, up $242 on the week. Feeder futures managed just a nickel loss in the November contract on the week. The CME Feeder Cattle Index was up $2.21 from last week to $176.99. Wholesale beef prices were mixed this week. Choice was up just 49 cents (+0.2%) through the week. Select boxes were down $2.59 per hundred (-1.1%). Weekly beef production was slightly below from the previous week but 2.5% above the same week in 2021. Beef production YTD is up 1.5% on 1.6% larger slaughter. Thursday’s Export Sales data showed beef bookings slipping to just 9,200 MT in the week of October 27, with 3,000 MT destined for Japan. Monthly export data showed 275.78 million lbs of beef exported in September, a 5.7% drop from last year. Commitment of Traders data tallied spec funds at a net long position of 66,048 contracts in live cattle futures and options. That was a 326 contract increase in the week that ended on November 1. In feeder cattle futures and options, they increased their large net short position by 623 contracts to 6,494 contracts by Tuesday.

Hogs leaked lower for much of the week, as December was down $3.125 since last Friday. The CME Lean Hog index was $92.34, down $1.81 on the week. The pork carcass cutout value was down $4.62 this week, or 4.6%. Bellies were the big reason, with a 18.3% drop, as the rib and ham primals also leaked lower. Weekly pork production rose 1.1% from the previous week but was 2.1% below the same week in 2021. YTD production is down 2.4% on 2.9% fewer hogs. Weekly Export Sales data showed pork sales jumping out to 47,900 MT during the week that ended on 10/27. Mexico was a buyer of 12,700 MT, with China coming in to buy 11,200 MT. Census data showed 512.983 million lbs of pork was exported in September, a slight increase over 2021. Friday’s CFTC Commitment of Traders report showed spec funds adding 4,135 contracts to their net long in hogs, taking it to 59,568 as of Tuesday.

Cotton futures finally found a buyer, as December rallied a massive 20.55% on the week, a gain of 14.82 cents and taking out nearly 4 weeks of losses. Monday’s Crop Progress report tallied 55% of the US cotton crop harvested as of 10/30, 8% ahead of the average pace. USDA’s AWP for cotton was down 459 points on Thursday, to 64.46 cents/lb. Export Sales data showed 22/23 bookings jumping out to the third largest in the MY during the week of 10/27 to 191,800 RB. Shipments were reported at 119,000 RB. Thus far in the MY, 8.63 million RB has been sold or shipped, which is still 74% of the USDA forecast. Normally we would be 63% of that projection. The monthly Census data release on Thursday showed 703,536 bales of cotton (excluding linters) were exported in September, up 25.38% on 2021. The weekly Commitment of Traders report showed spec funds at a net long of just 5,443 contracts as of Tuesday November 1. That was a 7,837 drop from the previous week and the lowest net long position since June 2020.

Market Watch

Next week begins with Monday morning starting off with the Export Inspections report from USDA and the Crop Progress report in the afternoon. Wednesday is busy starting off with the EIA weekly ethanol production and stocks reports. We will also get the monthly update to the WASDE and Crop Production reports. The weekly Export Sales report will be released on Thursday. On Friday, the government will be closed in observance of Veterans Day, but the markets will be open. December cotton options also expire on Friday.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2022 Brugler Marketing & Management, LLC. All rights reserved.