Are We There Yet

Market Watch with Austin Schroeder

May 12, 2023

Are We There Yet?

I’m sure anyone who’s ever been on a road with children has heard this question. “Are we there yet?” is a question likely as old as time, though I would have hated to sit through that constant inquiry on the Oregon Trail or in the Mayflower… It sure seems to be a favorite question of the little ones, as well as an annoyance of parents. I mean there is a movie named after it, as well as a song (curse you Cocomelon). When it comes to the markets, I am sure plenty of producers have been thinking this same question to themselves over the past month or more. New crop corn is approaching the $5 mark, with November soybeans near $12. Chicago wheat can’t seem to find any footing, with steady weakness this week. And then there’s hogs, which no bull wants to touch with a 10-foot pole. Finding the low is tricky, but as they say, “bottom pickers get stinky fingers.” Are we there yet? Well, we’ll have to wait and see, but as we have been saying for a while, we are in the midst of the long tail on the grains. Unless a weather story pulls us out of it, high prices from the last couple years have cured the same high prices.

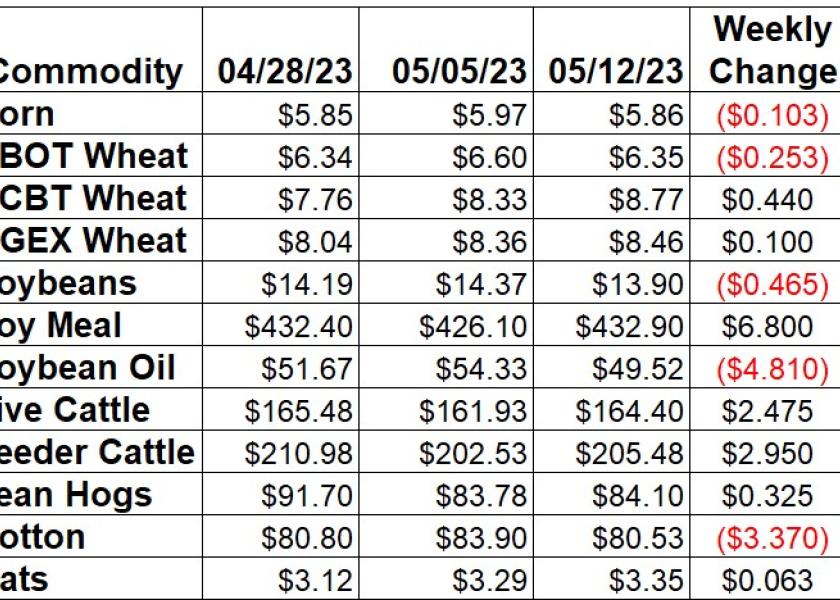

Corn futures slipped back lower this week, with July giving back 10 ¼ cents. New Crop December was not as lucky, losing 26 cents since last Friday, a 4.86% move. Producers picked up the pace in the week that ended on May 7, as Crop Progress data showed 49% of the US corn crop planted, now even 7% faster than the average pace. Weekly EIA data indicated ethanol production pulled back by 11,000 barrels per day in the week ending on May 5 to 965,000 barrels per day. Stocks slipped another 72,000 barrels tighter to 23.291 million. Export Sales for old crop were just 257,279 MT, which was an improvement over last week’s net reduction. However, it is still slow to meet the USDA projection, which was cut to 1.775 bbu on Friday. Old crop corn export commitments are now 85.2% of the new USDA forecast. The normal 5-year average pace is to be 95% sold by this date. Friday’s WASDE report showed a 75 mbu increase to the US old crop balance sheet, now at 1.417 bbu on a cut to exports. The initial new crop projection was pegged at 2.222 bbu, a 56.7% jump on the year if realized. Managed money spec funds in corn futures and options trimmed back their net short position during the week of May 9 by 8,503 contracts to 109,643 contracts.

The wheat complex was mixed this week, with the hard red contracts taking control. Kansas City was up another 44 cents to post a 2-week rally of just over $1. MPLS spring wheat was just a dime higher on the week for the July contract. Chicago futures slipped 25 ¼ cents in the July contract on the week. The weekly Crop Progress report tallied the winter wheat crop at 38% headed, vs. the 35% average pace. Crop ratings were up another 1% at 29% gd/ex, but the Brugler500 index slipped back 1 to 269 points. Spring wheat crop planting pace continues to be slow, with just 24% planted by Sunday, compared to the 38% average. Thursday’s Export Sales report showed old crop bookings at a MY low 26,263 MT, with new crop sales a MY high of 333,624 MT. Export commitments for 22/23 wheat bookings are now @ 19.024 MMT as of 5/4. That is still 3% below a year ago and 90% of the USDA full year export projection, vs. the 105% average pace. Actual Census data is running ahead of the FAS total. The only change to the US wheat balance sheet on old crop was the average cash price reduced by a nickel, as carryout was unch at 598. New crop totals were noted at 556 mbu for ending stocks, as the initial NASS production estimate was 1.13 bbu for all winter wheat. US total wheat production was seen at 1.659 bbu in the WASDE tally. Weekly Commitment of Traders data showed the spec funds paring back their net short position in Chicago wheat by 9,418 contracts to -116,906 contracts as of May 9. They flipped back to net long in KC wheat by Tuesday, now at 7,446, a net 12,910 contract move on the week.

Soybeans gave in to the bears demands this week, as July was 46 ½ cents lower, a 3.24% move. New crop took a brunt of the hit, down 4.39% (56 ¼ cents). Meal tried to hold things up, with a $6.80 gain, but the bean oil bears were too much, as July was down 8.85%. Monday’s Crop Progress report soybean planting continuing to move right along, now 35% complete by 5/7, vs. the 21% average. Weekly Export Sales data showed bean bookings dropping to 62,170 MT in the week that ended on May 4. Commitments are now 93% of USDA’s forecast total, still within reaching distance of the 5-year average pace at 98%. USDA gave us updated totals for the old crop balance sheet on Friday, raising stocks by 5 mbu to 215 mbu, with a larger import figure. The initial new crop balance sheet showed projected carryout at 335 mbu. CFTC’s weekly Commitment of Traders report indicated managed money spec funds slicing another 7,914 contracts from their net long in soybeans in the week ending 5/9. That took the position to just 48,459 contracts, the lowest since December 2021.

Live cattle gained some renewed strength on the week, as June was up $2.47. Cash cattle was weaker again this week as sales were confirmed around $170 in the South, $2 lower. The North exchanged hands at $175-176, steady to $1 lower on the week. Feeders enjoyed the stronger fats and weaker corn, as May was up $2.95 on the week, held back by the index, with August rallying $7.55. The CME Feeder Cattle Index was $200.58, back up $1.12 this week. Wholesale boxed beef prices slipped lower this week. Choice boxes were down 1.5% ($4.58/cwt), with Select boxes 1.2% lower ($3.48/cwt). Weekly beef production was 3.5% larger than last week and 1% lower vs. a year ago. Year to date production is down 4.7% on 3.1% smaller slaughter runs. Export Sales data showed beef booking slowing to 16,600 MT during the week of May 4. Shipments also slowed to a 6-week low of 14,773 MT. Commitment of Traders data from Friday showed managed money trimming back 12,272 contracts from their net long in live cattle futures and options May 9 to put it at 95,279 contracts. In Feeder cattle, they cut 2,221 contracts from the net long of 12,366 contracts as of Tuesday.

Hogs posted a $3.17 range this week in the June contracts, as it was up 32 cents by Friday’s close, despite a new contract low. The CME Lean Hog Index saw another climb this week, gaining $1.16 to $75.40. On Thursday, the Supreme Court sided with a California law, Prop 12, that bans the sale of pork from sows in confinement of 24 square feet or less. The pork carcass cutout was up another $1.54 this week. The picnic and ham primals were the driver of the upward movement, up 5.2% this week, with all other primals reported higher. Weekly pork production was 3.1% lower vs. last week, but up 0.2% vs. the same week a year ago. YTD Pork production is up 0.9% on 1.5% larger slaughter. Export Sales backed off of to 30,000 MT for pork during the week that ended on 5/4. Shipments also slowed to 36,900 MT. Friday’s Commitment of Traders report indicated spec funds piling 10,847 contracts back on to their net short position in the week ending on May 9. That took them to a net short of 17,670 contracts.

Cotton futures pulled back this week, with July down 4.02%. The weekly Crop Progress report had US cotton planting progressing to 22% planted as of 5/7, now 1% behind the 23% average pace. Export Sales data tallied bookings at a 6-week high of 246,817 RB of upland old crop in the week that ended on May 4. Weekly Shipments backed off from last week’s MY high but were still decent at 330,020 running bales (RB). Cotton export sales commitments are now 15% smaller than a year ago. Compared to the USDA projection, they are still on pace, at 105% of USDA’s new 12.6 million bale WASDE forecast. The 5-year average pace would be 109% of that projection. The FSA raised the Adjusted World Price for cotton by 128 points on Thursday, to 67.97 cents/lb. The monthly WASDE update from USDA showed cotton production for old crop finalized at 14.47 million bales. That, along with a 400,000 bale increase to exports cut the carryout by 600,000 bales to 3.5 million bales. The initial balance sheet for new crop has ending stocks for July 31, 2024, at 3.3 million bales. Friday’s Commitment of Traders update tallied managed money spec funds cutting 8,046 contracts to their cotton net short in the week ending 5/9, taking it to -13,842 contracts.

Market Watch

Next week quiets down some report wise, as we start things off on Monday morning with the weekly Export Inspections report and the NASS Crop Progress report in the afternoon. We will also get April crush data from NOPA that morning. Skip to Wednesday and EIA will release their weekly ethanol production and stocks report. Thursday will have the weekly Export Sales report in the morning. Finally on Friday, NASS will publish the monthly Cattle on Feed report.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2023 Brugler Marketing & Management, LLC. All rights reserved.