Back to School in August

Market Watch with Alan Brugler

August 5, 2022

Back to School

School schedules vary quite a bit around the country. Some areas don’t start until Labor Day, due to a lack of air conditioning, and apparently a parental desire to keep the kids in their "work from home" office a few more weeks. On the other end of the spectrum, my wife works for Millard Public Schools in Omaha, and staff had to report to school on Friday, preparatory to the kids coming back this week. They take education seriously, as well as the desire to get out on summer vacation by Memorial Day!

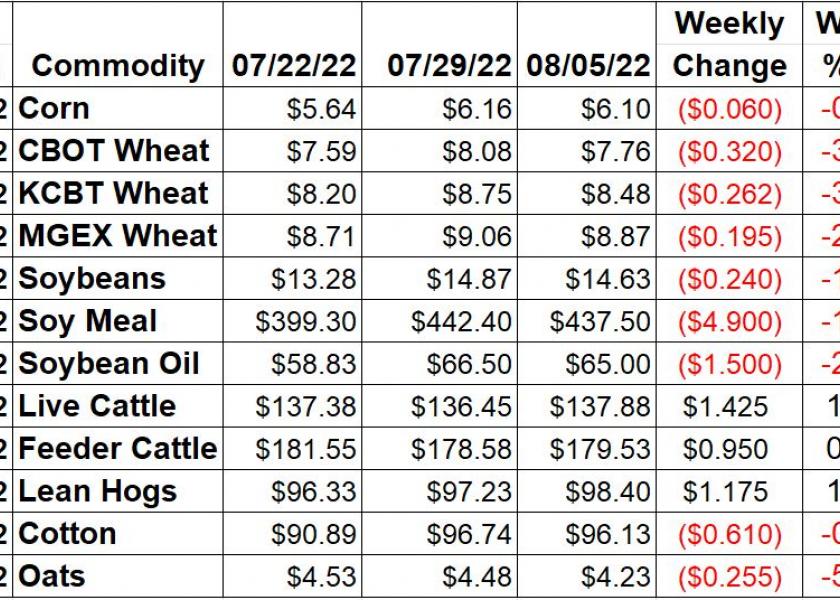

The markets have been schooling some folks this week. Those big gains (14% in soybeans) from last week? Just a distant memory. If you trade the news, or the weather forecasts, you often lose. We have also been reminded that August can still be a time of volatility and uncertainty about crop production. Historically, options implied volatility starts to decline in July, and they are cheapest over the winter. Is that that case this year? Corn implied vol peaked in March after the Russian invasion, but statistical vol (what futures are actually doing) peaked July 15. Soybean historical vol peaked on July 29, and implied vol, the so called fear gauge, set a new high for the year on August 5 according to our Optionvue software. The fear is of those 50 cent per bushel intraday moves. Get ready for the quiz, class!

Corn futures gave back 6 cents per bushel after gaining 52 cents the previous week. USDA’s Crop Progress report from Monday showed 80% of the corn crop silking as of 7/31. That was up from 62% last week and just 5% points behind the average pace. NASS said 26% of the crop had reached dough stage compared to 31% on average. Crop conditions dropped only 1 point in the Brugler500 index for the week (to 355), vs. trade ideas of a 3-4 point decline. The weekly Export Sales report tallied bookings at 57,900 MT for the week of 7/28. New crop sales were a little better at 256,700 MT. US old crop corn export commitments (shipped plus outstanding sales) are now at 60.658 MMT, 13% below last year at this time. That is 97% of the USDA export forecast, vs. the 103% average. Shipments are 91% of the forecast vs. the 92% average pace, and still lagging last year by 11%. The CFTC Commitment of Traders report had managed money firms at 129,921 contracts net long as of August 2. That was up 9,133 contracts from the previous week.

Wheat futures continued recent back and forth action, down on balance this week. KC HRW was down 3% for the week. Chicago SRW was down 4%. Spring wheat shed 2.2% after a gain the previous week. Crop Progress data from Monday showed Winter wheat harvest reached 82%. The 5-yr average pace would be 85% harvested by 7/31. For spring wheat, the weekly report showed 97% of the crop was headed, trailing the average by 2% points. Thursday’s Export Sales report showed wheat sales down 39% from the previous week, at 249,900 MT for the week that ended on Jul 28. Sales commitments YTD are 8.316 MMT, now 2% below last year. That is also 38% of the current USDA forecast, trailing the average buying pace of 39% for this date. Weekly CoT data showed the managed money spec funds were getting more bearish in CBT wheat. For the week, they added 4,579 contracts to their net short, bringing it to 14,970 contracts. Managed money firms were 9,992 contracts net long in KC wheat after reducing the position 1,049 contracts in the week that ended August 2. That was their smallest net long in that market since September 2020. Spec funds in MPLS also went net short for the first time since 2020 (-652 contracts).

Soybeans gave up a little this week, not surprising after the 14.1% single week gain the previous week. September futures were down 1.6% this week. New crop Nov was down 66 ½ cents after being up $1.52 per bushel the previous week. Product values fell back as well, with meal down 1.1% and soy oil down 2.3% for the week. It wasn’t for lack of trying on the bulls’ part, with September meal up $21/ton on Thursday. That was offset by big drops on Monday and Friday. NASS reported 79% of the soybean crop was blooming as of 7/31. That is just 1% point behind the average and up from 64% nationally last week. The Brugler500 index was up 2 points from last week at 357 as 1% of the crop rose from fair to excellent (not same physical acres). Traders had expected a decline. The weekly Export Sales report showed old crop soybean export sales again negative, with net cancelations of 11,000 MT. New crop export sales were 410,600 MT. Old crop export commitments are 101% of the full year forecast (typically 104% on this date). The cancellations and roll overs are having an impact. Accumulated shipments YTD are 91% of the WASDE forecast, with the average 93% for this date. CFTC’s update had spec funds 99,471 contracts net long as of August 2. That was up 11,795 contracts from the previous week.

Live cattle were up $1.42 or a little over 1% for the week. . USDA reported some $135-$136 trade in the South on Thursday compared to $140 in the North. WCB sales had been $141 - $145 for the week. Feeder cattle futures were up 0.6% for the week. The CME Feeder Cattle Index was up $3.12 from last week to $175.43. Wholesale beef prices were lower this week, with the Choice/Select spread back to $25.95. That’s still the biggest choice premium for this date since 2002 or earlier. Choice was down $4.62 (-1.7%) through the week. Select boxes were $3.58 per hundred (-1.5%) lower. Weekly beef production was down 2.6% from the previous week and 0.2% larger than the same week in 2021. Beef production YTD is up 1% on 1.2% larger slaughter. Thursday’s Export Sales report showed beef bookings dropping to 12,000 MT in the week that ended July 28. The Commitment of Traders report on Friday showed spec funds were adding 499 contracts to their net long in the week ending 8/2/22. They were net long 38,004 contracts as of Tuesday night.

Lean hog futures were up $1.17 in the October contract for the week. August is converging nicely with the CME Index and expires on Friday. The CME Lean Hog index was $121.61 up another $1.03 from last week. The pork carcass cutout value was down $2.31 (-1.8%) this week. Bellies were higher, while ribs and pork butts were a drag on the carcass value. US weekly pork production was up 1.9% from the previous week and 1.7% above the same week in 2021. YTD production is down 2.9% on 3.6% fewer hogs. FAS data from 7/21 reported pork export bookings up 43% from the previous week to 31,000 MT. China was the main buyer at 16,800 MT (this happened before the Pelosi visit). The Commitment of Traders report showed managed money spec funds were net long 56,750 hog futures and options contracts as of 8/2. That was up 5,675 contracts from the prior week and a two week jump of 11,405 contracts.

Cotton futures were down 0.6% on the week, after December was up 6.44% the previous week. USDA Crop Progress data showed 89% of cotton was squaring as of 7/31 and 58% was setting bolls. The average pace would be 87% squared with 50% setting bolls. Official June cotton exports were 1.697m bales according to the Census data. That was down 11% from May, but was 40% higher yr/yr. The full season’s total was marked at 13.774m bales with July yet to add. USDA’s July WASDE was looking for a 21/22 export program of 14.75m bales. The average July shipment would get there at 1.1m bales. Weekly cotton bookings from the Export Sales report were reported as 112,406 RBs of cancelations – mostly via China (-95k) and Vietnam (-15k). The 2.52m RBs of unshipped sales is still more than double this time last year with 1 week of reporting left. Cotton shipments reached 13.06m RBs through 7/28 – trailing last season by 12%. Export shipment accumulations are 91% of the USDA projection vs. the 99% average. USDA’s AWP for cotton dropped 15.04 cents to 89.44 cents/lb. The Commitment of Traders report had the spec funds 1,502 contracts less net long to 31,829 contracts as of August 2.

Market Watch

Cattle traders will start the week dealing with any surprise futures positions arising out of the August options expiration on the 5th. Delivery notices start on Monday, although they don’t make financial sense for a good chunk of the country at current basis. We’ll also get the weekly Export Inspections report on Monday morning and Crop Progress in the afternoon. The weekly EIA ethanol numbers will be out on Wednesday. Thursday is Mountain Day in Japan, and the weekly Export Sales report day in the US. Friday marks the last trading day for August hogs and soybeans, meal and bean oil. Not to be overlooked will be the first NASS Crop Production estimates for corn and soybeans at 11 AM CDT, along with the monthly WASDE supply/demand updates.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2022 Brugler Marketing & Management, LLC. All rights reserved.