Do Market Conditions Warrant $8 Old Crop Corn And $7.50 New Crop Corn?

Missed a recent article by Jon Scheve? Get it sent to you directly every week. Send a request by email: jon@superiorfeed.com

Market Commentary for 5/16/22

India Changes Wheat Exports

After trading closed for the weekend, the Indian government issued a statement saying they would restrict India’s wheat exports. This is partially due to recent hot and dry weather there, and it seems like a way to curtail hoarding by other world buyers. This announcement sparked an increase in US wheat prices when markets opened Sunday night and pulled corn and bean prices higher with it.

However, the Indian government’s wording in the statement suggests they could change the policy at any time for any reason, so this could lead to more volatility in the market moving forward.

USDA Report Highlights

Last time corn’s planting pace was this slow was 2013. Just like in 2013, the USDA decreased the estimated yield from what the Economic Forum published in February. It seems the market was already trading a perceived 177 yield, so a price premium was already built in going into the report.

Considering current prices, the market is pushing for more corn acres to be added during planting season. However, weather is making this difficult. There continues to be concerns in the northern belt about when and how many acres will get planted. The longer it takes to get crops planted, the less likely the 177 yield the USDA posted in their report this month can still be achieved. Regardless, June and July growing conditions will be more crucial to the final yield than anything else.

The USDA also decreased next year’s feed usage for corn by about 5% compared to this year. It seems their approach in this report was to assume the cure to high prices is high prices. Ethanol usage remained flat year over year. Export pace dropped slightly, based on the likelihood South America would produce average yields during their next crop cycle. Considering there is 16 months until the 2022 US crop is fully marketed, these first estimates are a probably a good place to start.

Moving forward price direction will be driven heavily by old crop export pace, especially to China. There is concern that China’s domestic corn prices are now lower than US corn delivered to China. If the US’s export pace cannot meet the current USDA estimates, prices the market is currently trading are likely overvalued.

Do Market Conditions Warrant $8 Old Crop Corn And $7.50 New Crop Corn?

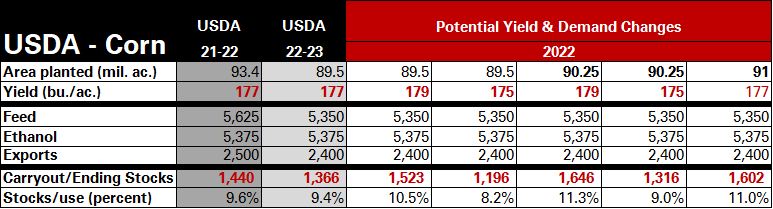

The chart below provides several possible market scenarios suggesting corn could trade higher if yields pull back or acres are not added.

Usage values and carryout are in millions of bushels

While I am not currently anticipating an export increase in this chart, such a move would be bullish and could pull carryout values lower for both crop years while pushing prices higher, regardless of smaller acre or yield changes to the upcoming crop. A carryout estimate below 1.2 billion bushels has led to $8 corn over the last year. But if carryout is closer to 1.5 billion bushels, then prices will likely pull back from current values.

Want to read more by Jon Scheve? Check out recent articles:

Are The Highs In? War And Weather Make Predicting Difficult.

Will Corn Go To $10 This Summer Or Hit $5 By This Fall?

Corn Prices Continue To Trend Higher, But Can It Continue?

Will Corn Be Worth $7 This Fall? Can Beans Remain Above $14?

High Prices Usually Cure High Prices, But Are These Prices High Enough?

Futures Have Turned Sideways. Does Basis Need To Work Higher?

Jon Scheve

Superior Feed Ingredients, LLC