Estate Tax Changes?

Customer Support 03-13-21

Jeremy Miner, from Williamsburg, Iowa asks about new estate tax laws:

“With a new administration in the White House, there are concerns on how some suggested tax laws could impact how farms are passed down to the next generation. My wife & I are in our mid 40’s with parents who have or soon will retire from the farm. Estate planning is something we’ve all talked about, but not in great detail yet. Can you explain how some of these new tax laws, if passed, may impact our families and how farms are passed on?”

First of all, you can’t talk too soon or too much about transition planning, especially with non-farm family members, so congratulations of beginning these conversations. Second, I have no particular insights or sources in the administration to even speculate on specific ideas concerning estates. The razor thin Congressional majority makes me skeptical large changes are politically possible. That said, the various forms of estate taxation are tempting targets. Using the famed bank-robber principle – you rob banks because that’s where the money is – the rapidly expanding wealth inequality here and around the world means significant government revenue sources will likely include wealth taxes.

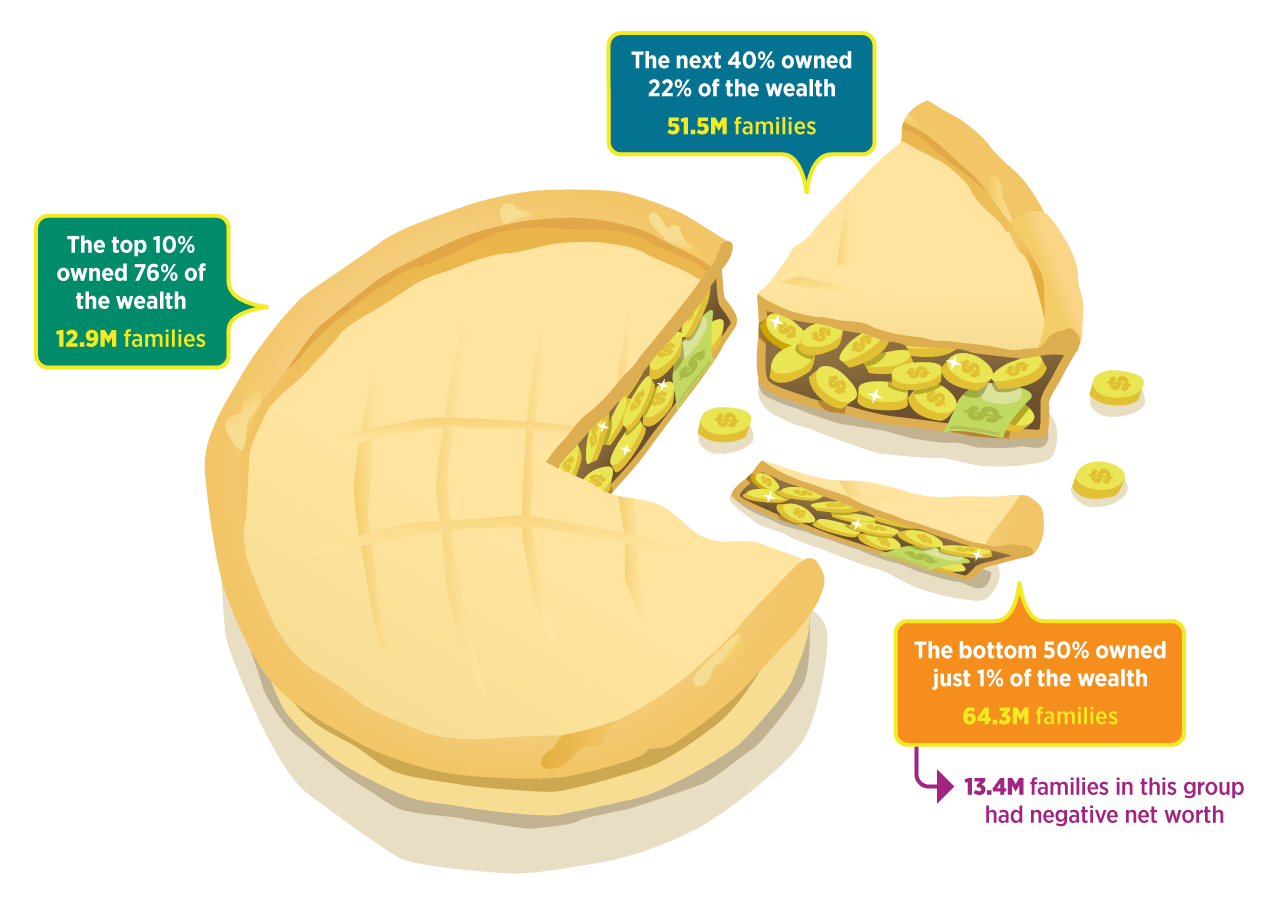

Here’s the reason: the top 10% of families in the US (that’s owning more than $1.2M) own over ¾ of the $96T of American wealth.

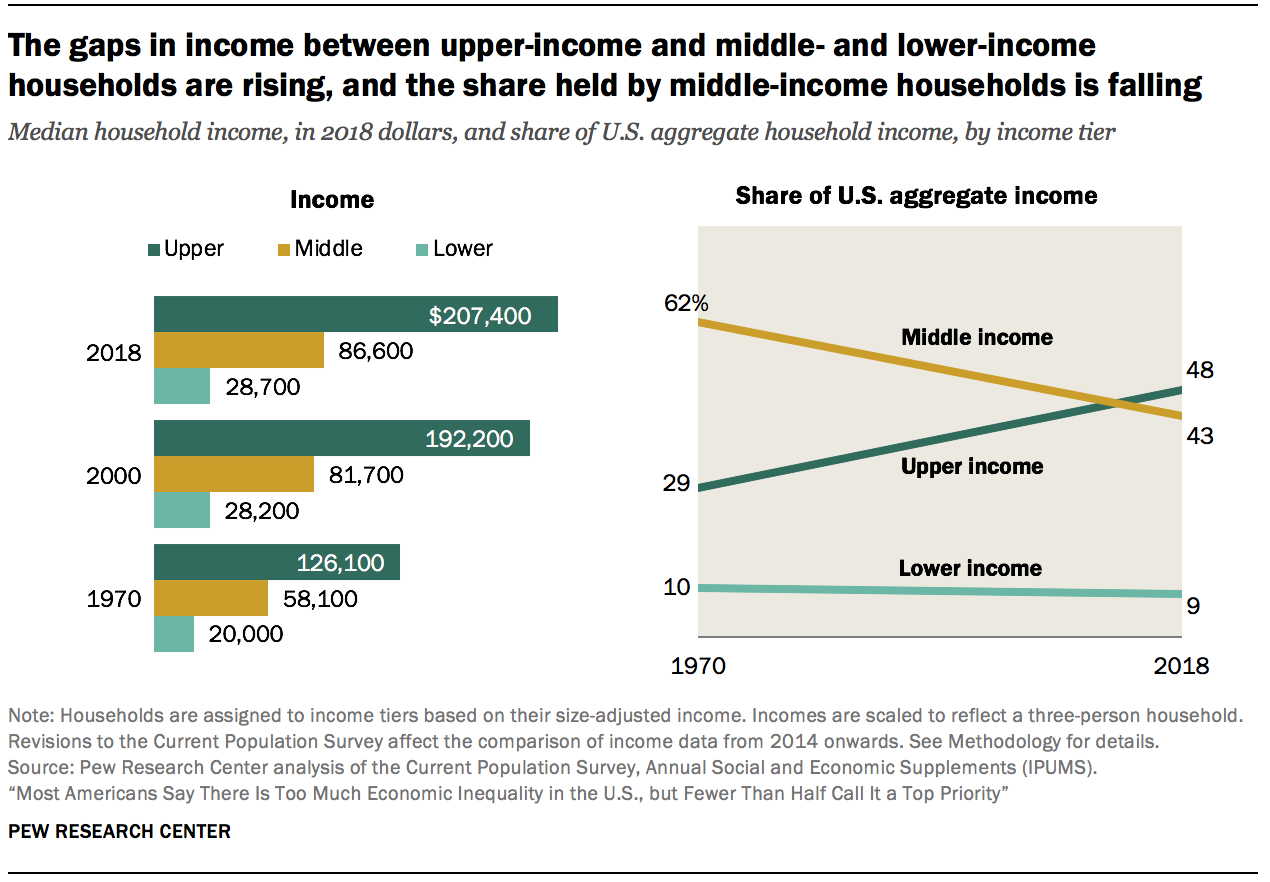

The same is true for income – upper income earners make most of the income in the US.

Both these trends are continuing, if not accelerating. Figuring out who to tax is less about politics and more about math these days. Wealth taxes are also considered by most economists the most effective way to even out wealth distribution.

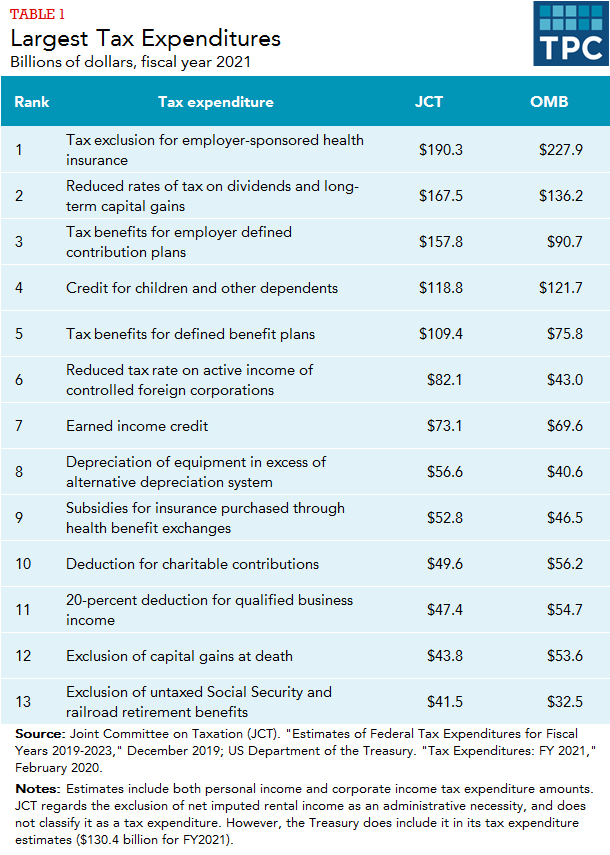

There is another factor to keep an eye on – the basis step-up, where heirs avoid paying capital gains that would otherwise occur when assets are sold. This is categorized as a tax expenditure – a revenue loss from a special exclusion to an existing tax. It’s not the largest such, but it has a smaller constituency than many of the others on this list.

Our tax and political experts will be watching these and other possibilities closely but letting your planning sessions center on minimizing taxes can complicate plans and disappoint all involved. I suggest deciding what outcome you all think would be the best compromise, and then work with professionals to most effectively get there.