The Food Business

Market Watch with Alan Brugler and Austin Schroeder

November 25, 2022

The Food Business

Part of the secret of a success in life is to eat what you like and let the food fight it out inside.

-Mark Twain

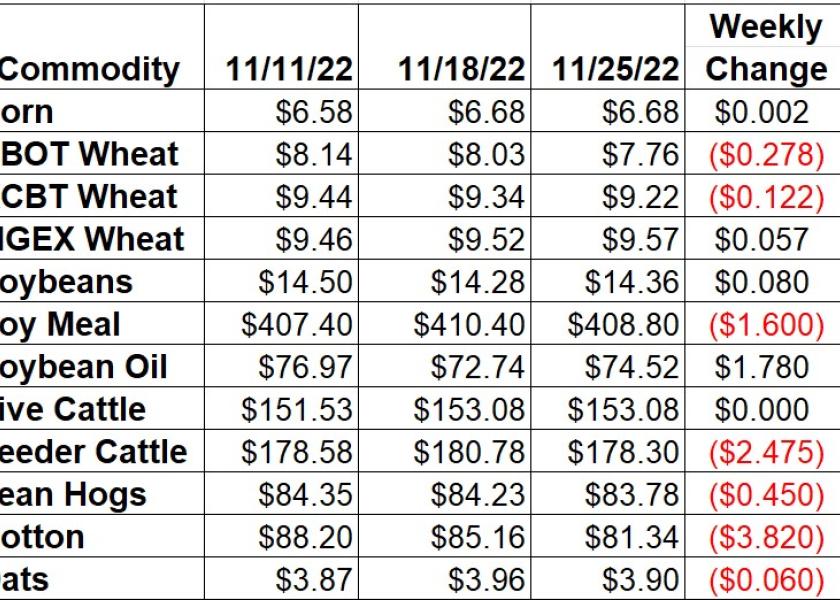

We’re now past Thanksgiving in the US, and marching ahead toward Christmas. While agriculture produces fiber (and increasingly fuel) its most important role is food production for 8 billion people around the globe. As is often said in the cattle and hog business, they can’t eat paper! Neither can people. Food consumption is celebrated at Thanksgiving, along with gratitude about having it to eat. The Pilgrims just barely scraped by that first winter and were thankful for better crops and hunting and fishing in the next trip around the calendar. Ag producers are often on the knife edge between producing too little and producing too much. The markets this week were a bit uncertain about whether we have too much or not enough. The weekly changes were small by 2022 standards, with the possible exception of the 4.5% drop in cotton.

Corn futures managed to squeeze out a ¼ cent gain over the course of the week, with December rallying on Friday. The US corn harvest is wrapping up across the country, with 96% complete as of last Sunday. That is 6% faster than the normal pace according to NASS. Weekly ethanol data from EIA showed production of 1.041 million barrels per day, up 30,000 bpd in the week that ended on November 18. Stocks had a buildup of 1.531 million barrels lower to 22.829 barrels. That was the third largest weekly stocks build on record. The delayed Friday morning Export Sales report tallied corn bookings at 1.85 MMT for 22/23 in the week that ended on November 17. That was the largest weekly total since March 3. New crop sales totaled 628,054 MT. Much of the total was previously announced via the daily export system. Export sale commitments (both shipped and unshipped) now total 17.75 MMT, just 33% of the USDA full year projection. That would normally be 47% of USDA’s forecast by now. The lag has narrowed from 16% to 14% with the larger sale totals in the last couple of weeks.

Wheat was mixed across the three exchanges this week, with the winter wheat heading lower. Chicago was down 27 ¾ cents on the week (-3.45%). Kansas City HRW contracts were 12 ¼ cents lower (-1.31%). MPLS was again the strongest, up 0.61%, or 5 ¾ cents. Monday’s Crop Progress data indicated the US winter wheat crop was 87% emerged, 1% above the normal pace. Condition ratings were unch at 32% gd/ex, with the Brugler500 index 2 points lower at 289. Export Sales data released on Friday included 511,769 MT of all wheat booked for export in the week ending on November 17th, a 4-week high. Much of that was of the HRS variety, with 351,244 MT in sales. Total export commitments (shipped and unshipped sales) have pushed along to 13.377 MMT for wheat and products, which is now 63% of the USDA forecast vs. the 69% average pace.

Soybeans headed higher during Thanksgiving week, with January up 8 cents. Soybean oil took back some of the previous week’s weakness, as December BO was up 2.45% or 178 points. Bean Meal was weaker with December down $1.60 (0.39%). The weekly Export Sales report indicated soybean bookings sank to a 9-week low of just 690,140 MT in the week that ended on 11/17. Soybean export commitments are 66% of the projected USDA total, now 3% faster than the 5-year average. They are also 1% above last year at 36.6 MMT. Export shipments for bean oil are running well behind last year (by 80.9%) at 8,982 MT, with commitments down 87.2% vs. the same time in 2021 at 32,539 MT.

Live cattle futures stalled out as Dec was unch, with late week weakness taking back Monday/Tuesday gains. Cash cattle trade strengthened and was $3 higher this week, with $154-155 reported in the south and $157-158 in the north. Feeder futures took out the Monday CoF gains, with nearby January down $2.47 on the week. The CME Feeder Cattle Index was down $0.53 from last week to $174.83. Wholesale beef prices were down this week. Weekly beef production was down 13.7% from the previous week due to the holiday but 1.5% above the same week in 2021. Beef production YTD is up 1.4% on 1.6% larger slaughter. Weekly Export Sales data pegged beef bookings for the week of 11/17 at 12,886 MT, a 3-week low. The lead buyer was South Korea at 4,700 MT, with Japan buying 4,200 MT. The monthly Cold Storage report showed 509.95 million lbs of beef stocks at the end of October. That is up 7.64% from last year but backed off the record levels. It also took a contra seasonal turn with a 3.08% drop from September.

Hogs continue to trend sideways, as December leaked lower by 0.53% on the week. The CME Lean Hog index was $86.17, down $1.97 on the week. Weekly pork production was down 14.4% on the week due to the holiday and was 2.2% below the same week in 2021. YTD production is down 2.4% on 2.9% fewer hogs. The Friday morning Export Sales report indicated pork bookings bouncing to the third largest in 2022 to 45,800 MT in the week of 11/17. Mexico was the buyer of 18,200 MT, with Japan in for 10,200 MT. October stocks of pork were tallied at 511.06 million lbs via the monthly Cold Storage report. That was an increase of 15.53% over last year but was 4.83% lower vs. September.

Cotton took another tumble this week with Dec futures down 4.49% or 3.82 cents. The US Cotton harvest has moved along to 79% complete as of last Sunday, 8% faster than normal. USDA’s AWP for cotton was down 317 points from the previous week on Thursday, to 74.61 cents/lb. Export Sales data released on Friday showed a net reduction of 116,428 RB for 22/23 upland cotton bookings. That was a MY low, and the largest net reduction since April 2020. Most of the cancellations were for China (109,500 RB), with 15,400 RB for Pakistan. Shipments were reported at 143,698 RB. Thus far in the MY, 8.685 million RB has been sold or shipped, which dropped to 74% of the USDA forecast, compared to the normal 68% pace.

Market Watch

Next week starts out in typical fashion, with the Export Inspections report on Monday morning. The final NASS Crop Progress report for the season will be released that afternoon. Skip ahead to Wednesday and EIA will release ethanol production and stocks data. It is also first notice day for December grain futures. Thursday is the first day of December, with the Export Sales report out that morning. USDA will release monthly domestic use data that afternoon, via the Grain Crushing, Fats & Oils, and Cotton Systems report. Friday rounds out the week with the expiration of December live cattle options.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2022 Brugler Marketing & Management, LLC. All rights