Frost is on the Punkin

Market Watch with Alan Brugler

October 21, 2022

Frost is on the Punkin

As James Whitcomb Riley put it, this is the time of year when “the frost is on the punkin and the fodder’s in the shock”. The poem (read it here: https://poets.org/poem/when-the-frost-is-on-the-punkin) was an ode to this time of year as his favorite. It is the favorite of a lot of our farmer clients as well, with ag prices at or not too far from multi-year highs, and grain harvest going rapidly thanks to the spell, admittedly too long, of dry weather. We went a little past frost this week, with Omaha dipping to a record low 16 degrees (and expected to be 80 this weekend!). The growing season is over, and the market focus will typically shift to ability to make and ship exports, eventually rotating to whether South America will be able to deliver their part of the annual world supply once the North American products are through the pipeline.

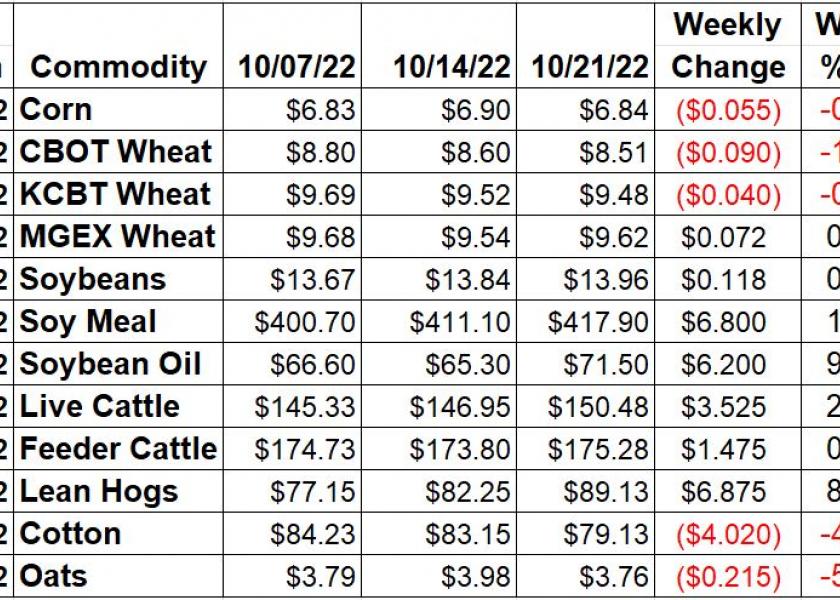

Corn futures flirted with the $7 mark but closed @ $6.84 ¼ on Friday, down 5.5 cents from last week. Monday’s Crop Progress report indicated the US harvest pace now 5% above normal at 45% as of last Sunday. Condition ratings for corn slipped 3 points on the Brugler500 index to 334, with gd/ex ratings down 1% to 53%. Ethanol production was up a considerable 84,000 barrels per day to 1.016 million bpd in the week of 10/14. Stocks of ethanol were down 19,000 barrels to 21.844 million barrels. The weekly Export Sales report showed an uptick in corn export bookings during the week of 10/13 at 408,300 MT. That progressed the total export commitments 13.831, the lowest in 3 years and just 25% of the USDA projection. Exporters would have typically sold and shipped 37% of that USDA forecast by now. The weekly Commitment of Traders indicated managed money spec funds reduced their net long position in corn futures and options by 13,116 contracts in the week that ended on 10/18. That took them to net long 254,261 contracts as of Tuesday.

Wheat was mixed this week. Chicago SRW futures were down 1,1%. KC HRW slipped 0.4$, but MPLS spring wheat was up 7 ¼ cents for a 0.8% gain. The weekly Crop Progress showed the US winter wheat crop at 69% planted, above the average pace by 1%. Emergence is off to a slower start thanks to the dryness, at just 38%, 6% behind average. The Thursday Export Sales report tallied wheat export bookings dropping MY low of just 163,100 MT in the week ending 10/13. Total export commitments are now 11.371 MMT for wheat and products, the slowest start since the data set started in 1990. It is also 54% of the USDA forecast vs. the 60% average pace. Commitment of Traders data from CFTC showed spec traders in CBT wheat futures and options added 2,549 contracts to their bearish position as of Tuesday to a net short22,051 contracts. In KC wheat they pared a modest 238 contracts from their net long, putting it at 26,270 contracts by October 18.

Soybeans were helped by a strong weekly export sales report on Thursday and a sharply rising soy oil market. November beans were up 0.8% (11 ¾ cents) on the week. Soy meal was up 1.7%. Soy oil, last week’s laggard, was up 9.5%! Harvest is progressing rapidly in warm and dry conditions, with the weekly Crop Progress report showing the crop 63% harvested as of last Sunday. That is 11% faster than normal. The final crop condition rating was unch at 57% gd/ex and 347 on the Brugler500 index. The weekly Export Sales report from FAS showed an impressive 2.336 MMT of soybean bookings for the week that ended on 10/13, a MY high. That large set of purchases took the total export commitments to 30.524 MMT, or 55% of the USDA projected total. The normal pace is for 52% of the forecast USDA total to be purchased by now. Friday’s CFTC report showed managed money spec funds at a net long position of 66,862 contracts on October 18. That was up 1,124 contracts from the previous week.

Live cattle rounded out the week with October up a total of $3.52 or 2.4%. Cash cattle trade was stronger this week, with $151-152 seen in the north, and $148 in the south. Dressed trade was $236 per hundred. Feeder futures were up less than the fats, rising $1.47 for the week. The CME Feeder Cattle Index was down $1.17 from last week to $172.94. Wholesale beef prices were higher this week, with the Choice/Select spread narrowing to $29.25. Choice was up $6.73 (+2.7%) through the week. Select boxes were up $7.42 per hundred (+3.4%). Weekly beef production was up 1.9% from the previous week and 1.5% larger than the same week in 2021. Beef production YTD is up 1.4% on 1.6% larger slaughter. Weekly Export Sales data showed beef bookings at 16,600 MT in the week of October 13, with 7,100 MT destined for South Korea. Weekly CFTC Commitment of Traders data showed spec funds adding 2,237 contracts to their cattle net long in the week ending October 18, taking it to 37,299 contracts. In feeder cattle futures and options, they shrank their previously record large net short position by 778 contracts to 9,018 contracts by Tuesday. Friday’s USDA Cattle on Feed report came very close to trade expectations in all categories, with On Feed 99.13% of year ago. September placements were 96.16% of September 2021, and marketings were 3.97% larger than the same month in 2021.

Hogs totally erased their epic late September sell off, with December rising another 8.4% and now within $1.40 of the life of contract high. The CME Lean Hog index was $93.76, up $1.09 for the week. The pork carcass cutout value was down 92 cents this week, -0.9%. Bellies were up 4.1%, but hams and loins pulled back by 3.6 and 3.5% respectively. Weekly pork production was up 1.3% from the previous week and 2.5% below the same week in 2021. YTD production is down 2.5% on 3% fewer hogs. Thursday’s Export Sales report tallied pork bookings at 40,800 MT during the week that ended on 10/13, the largest weekly purchase total since Match 31. Mexico was a buyer of 14,800 MT, with Japan coming in to buy 11,000 MT. Commitment of Traders data showed spec funds jumping into hogs with both feet, expanding their net long by 14,763 contracts in a week, taking it to 35,787 contracts as of October 18.

Cotton bulls still haven’t been able to find solid ground, as December futures were down another 4.8% this week. Most of the damage came on Wednesday. A stronger US Dollar Index and recessionary fears linger over the market. The Crop Progress report from Monday showed 37% of the US cotton crop was harvested as of 10/16, 5% ahead of the average pace. Condition ratings were unch on the Brugler500 index at 273, with the gd/ex ratings were up 1% to 31%. USDA’s AWP for cotton was down 369 points on Thursday, to 73.76 cents/lb. Weekly Export Sales data showed 22/23 bookings backing off on the week of 10/13 to 84,500 RB, with 4,400 RB for next MY. Shipments were down to 165,700 RB. Thus far in the MY, 8.370 million RB has been sold or shipped, which is still 71% of the USDA forecast. Normally we would be 69% of that projection. The weekly Commitment of Traders report indicated spec funds were trimming another 4,812 contracts from their net long in cotton during the week ending October 18. That left them 22,032 contracts net long by Tuesday evening.

Market Watch

Traders will spend Monday morning reacting to the Cattle on Feed report from Friday. On Monday, we get the weekly Export Inspections and Crop Progress reports, along with the monthly Cold Storage report. Skip ahead to Wednesday with EIA publishing their weekly ethanol production and stocks update. Thursday morning is the weekly Export Sales report from FAS. October feeder cattle futures and options will also expire on Thursday.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2022 Brugler Marketing & Management, LLC. All rights reserved.