Grain Futures Prices Rally on Declining Crop Conditions

Grain futures prices rally on declining crop conditions. Hot and dry weather conditions throughout the Midwest continue to raise concerns over drought.

Grain markets were firm today, with corn, soybeans, and wheat all finishing the day in positive territory. At the close, front month July corn futures were 10 ½ cents higher, settling at 608. The new crop December contract was 4 cents higher to 541. On the soybean side, we saw July futures 3 ¼ cents higher at the close, settling at 1353 ¼. The new crop November contract settled the day a nickel higher to 1184 ¾. July Chicago wheat futures were sharply higher in the early morning trade but finished the session about 20 cents off those highs, settling just 3 ¾ cents higher to 627 ¾.

Yesterday’s crop progress report showed good to excellent conditions for corn at 64%, this was a decline of 5% from last week. The “I” states, Iowa, Illinois, and Indiana all saw meaningful drops in conditions. Hot and dry weather has been the big concern and yesterday’s report validates those concerns with ratings dropping 19% in Illinoi, 10% in Indiana, and 5% in Iowa. For soybeans, it was the first condition ratings of the year. Good to excellent ratings for soybeans were reported at 62%, 3% below the average analyst estimate.

Yesterday’s weekly export inspections were largely in line with expectations. We did get some more export data this morning in the way of a flash sale. Private exporters reported sales of 165,000 metric tons, or about 6 million bushels soybeans for delivery to Spain during the 2022/2023 marketing year.

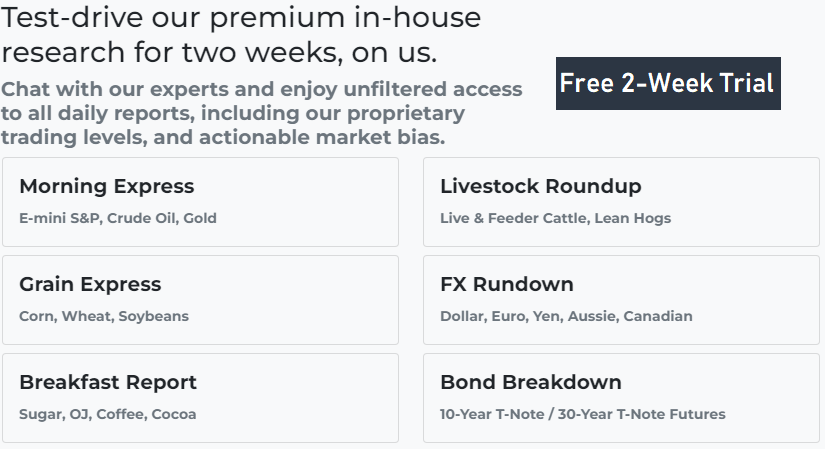

Sign up below for a FREE trial of our daily fundamental and technical commentary!

Futures trading involves substantial risk of loss and may not be suitable for all investors. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Blue Line Futures is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that the NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians or markets. Therefore, carefully consider whether such trading is suitable for you considering your financial condition.

With Cyber-attacks on the rise, attacking firms in the healthcare, financial, energy and other state and global sectors, Blue Line Futures wants you to be safe! Blue Line Futures will never contact you via a third party application. Blue Line Futures employees use only firm authorized email addresses and phone numbers. If you are contacted by any person and want to confirm identity please reach out to us at info@bluelinefutures.com or call us at 312- 278-0500