Groundhog and Other Forecasts

Market Watch with Alan Brugler and Austin Schroeder

February 3, 2023

Groundhog and Other Forecasts

You may or may not have noticed that Thursday was Groundhog Day. That’s the holiday that is basically just an excuse for a party in the dead of winter (not to be confused with Super Bowl Sunday), and perhaps create a hope of early spring. Punxsutawney Phil and his imitators/cousins around the world (including one in Ukraine called Tymko III) allegedly predict whether it will be an early spring or six more weeks of winter by whether it is bright enough at the time of the official forecasting time for them to cast a shadow. According to scientific sources, Phil’s historical accuracy is only around 39% when calling for extended winter, but closer to 47% when calling for an early spring. Of course, Phil may say spring is around the corner and another groundhog a state over has the opposite outcome. We could use a more accurate version of Phil in the grain markets right now. Will we have six more weeks of the rising regression channel in March soybeans? Or six more weeks of the declining channel in December corn?

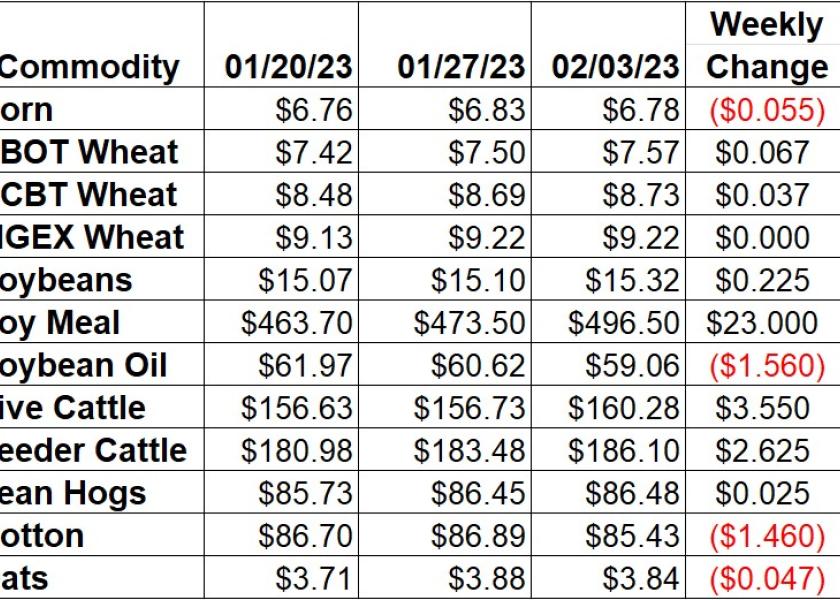

Corn futures have been trading on either side of $6.80 for the last 3 weeks, with March down 5 ½ cents this week. The Wednesday EIA report showed a 16,000 barrel per day increase in daily ethanol production (and corn use) to 1.028 million bpd. Ethanol stocks backed off by 635,000 barrels to 24.442 million barrels, with a bulk of the reduction from the Midwest. The monthly Grain Crushing report showed the lowest December corn grind total since the report’s inception in 2014 at 425 mbu. That was down 11% vs. last year. Weekly Export Sales data showed corn bookings of 1.593 MMT during the week of 1/26. That was the largest in the last 10 weeks and up 75% over last week. Old crop corn export commitments (shipped and unshipped sales) are now at 25.632 MMT, which is now down 43% vs. last year but picking up pace. That is also 52% of the USDA forecast, compared to the 68% average pace.

The wheat complex was firm again this week. MPLS was the lead weight with March unch, staying within 11 cents of last Friday’s close all week. Kansas City posted new highs for 2023 and gained 0.43% (3 ¾ cents) on last week. Chicago was the leader as March rose 6 3/4 cents, or 0.9%. Individual state Crop Progress reports were released for the end of January on Monday. Kansas winter wheat ratings were reported at 21% gd/ex and 256 on the Brugler500 index, down 36 from last year. Texas ratings were up 49 points from last year at 237. The National report will be out on a weekly basis beginning in April. Thursday’s Export Sales report tallied wheat bookings at a 3-week low of 136,383 MT, coming in below estimates. That was also the third lowest weekly total this MY. Total wheat export commitments are now 16.256 MMT as of January 26. That is still 7% below year ago and 77% of the USDA export projection. Normally we would have 86% of the projection sold/shipped by now. Actual shipments are 56% of the projected full-year total, 6% back of the average pace.

Soybeans gained a little more traction this week, as March was up 1.59% (22 ½ cents). All of the strength from the product values was via soy meal, as March posted fresh contract highs and gained $23/ton (4.86%) since last Friday. Soy oil was the anchor, losing another 156 points (2.57 %). USDA released monthly crush data on Wednesday via the Fats & Oils report, with December crush at a 3-year low of 187.4 mbu. Soy Oil stocks were tallied at 1.902 billion lbs, a 6.55% reduction from last year’s total. The weekly Export Sales report indicated soybean export bookings backing off to a 3-week low of 735,951 MT in the week of 1/26. Commitments are now 47.27 MMT, or 5% larger than last year at this time. They are 87% of USDA’s forecast total, still 8% faster than the average pace. The window for sales and shipments is getting narrower as Brazil’s bean harvest approaches 10% complete.

Live cattle continued their march higher, as Feb was up another 2.27% on the week. Cash trade was again slow to get moving, but some $160 trade was being reported in the WCB by Friday afternoon. Feeder futures were up another 1.43% since last Friday, a $2.625 move. The CME Feeder Cattle Index was $181.45, up $2.65 from last week. Tuesday’s Cattle Inventory report confirmed what the market has known for a while, as the All Cattle count was down 3.04% at 89.27 million head. Beef cows were 3.55% lower at 28.917 million head, with replacement heifers showing a 5.8% drop to 5.164 million head. Both of those combined tally to the smallest beef herd numbers on record. Wholesale boxed beef prices were mixed this week. Choice boxes on average dropped 1.1% ($3.02/cwt). Select boxes were dup $1.07 (0.4%). The Choice/Select spread is frequently under pressure in February and dropped to $13.13 on Friday from $17.22 a week earlier. YTD totals are 1.7% lower vs. 2022 on 0.2% more head. That implies lighter weights with this week’s dressed totals down 19 lbs vs. last year. Weekly beef production was down 3% from the previous week and 1.3% lower than the same week in 2022. The weekly Export Sales report tallied beef export bookings at 25,191 MT. Export shipments totaled the largest weekly amount since August at 18,934 MT.

Hogs are fighting with gravity and spec shorts, as Feb was down 1.12% on the week. April bulls a better fighting back futures a single tick higher. The CME Lean Hog Index is starting to bottom, with a 33 cent gain this week, to $72.85. The pork carcass cutout was down $0.16 this week (-0.2%). Pork bellies rebounded 2.3%, but loins and some of the other primals were still under pressure. Weekly pork production was up 1.5% vs. the previous week and was 2.8% higher vs. the same week in 2022. YTD production is down 2.8% vs. the same time in 2022. Export Sales data released on Thursday showed pork bookings at 30,939 MT, down vs. last week. Shipments, on the other hand, were the largest for any week since November 2021 at 35,496 MT. Mexico received a majority of that, with 16,400 MT headed their direction and 5,700 MT shipped to China.

Cotton futures felt a little pressure this week as March was down 1.68% on the week, with Monday and Friday weakness the major reason. Cotton classing data from USDA released on Friday showed 13.84 million bales of all cotton had been classed as of February 2. Thursday’s weekly Export Sales report showed cotton bookings backing off from the previous week to 171,160 RB for old crop during the week that ended on 1/26. New crop sales totaled 20,240 RB. Cotton export shipments YTD have been 18% larger than last year, as unshipped sales commitments are 40% smaller. That is mainly indicative of the smaller crop. It puts total commitments down 21% in total vs. last year. They are still 84 % of USDA’s forecast total, 1% behind normal.

Market Watch

Monday is first notice day for Feb live cattle futures. We start the week with the Export Inspections report released in the morning. On Tuesday, Census will release US trade data for December. Skip ahead to Wednesday and EIA will begin the day with the release of weekly ethanol production and stocks data. Later that morning, USDA will publish their monthly WASDE report with updates to the US and World balance sheets, as well NASS Cotton Ginnings and Crop Production reports. Thursday morning will see the release of weekly Export Sales data.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2023 Brugler Marketing & Management, LLC. All rights reserved.