Holiday Sale

Market Watch with Alan Brugler and Austin Schroeder

December 9, 2022

Holiday Sale

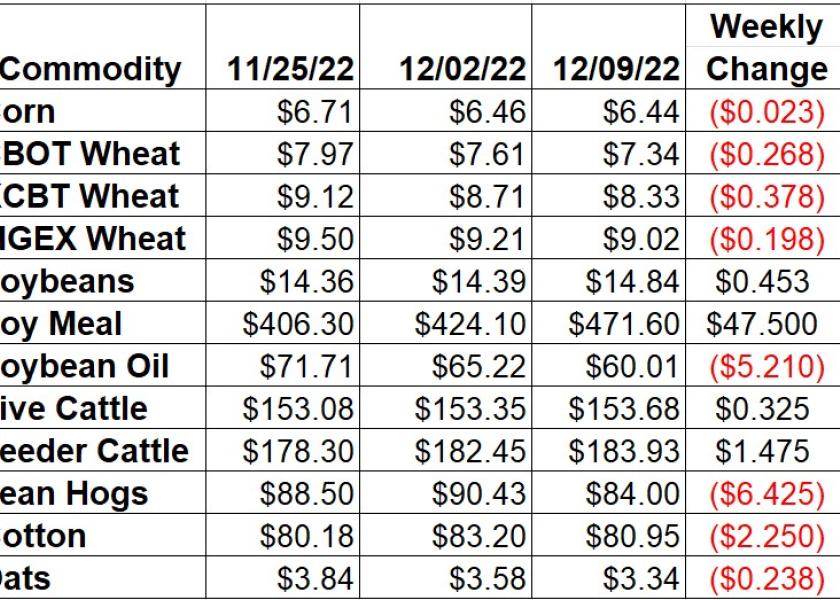

Christmas is right around the corner and Black Friday was just two weeks ago. It’s the perfect time to get your loved one something special! While the jewelry stores are busy advertising some great holiday offers or other stores are trying you in the doors (or to their website) via holiday specials, some of the ag markets are having their own sale. We have corn at the lowest prices in nearly 4 months, with bean oil the cheapest since July. Hogs recently backed off to 2-month lows, with KC wheat at 4-month lows and Chicago wheat on clearance!

Corn futures saw slightly stronger action in the last half of the week to help ease early losses. March was down just 0.35% on the week. USDA released their monthly WASDE report on Friday, showing a 75 mbu reduction to exports for the current MY. That raised the US carryout number by the same amount to 1.257 bbu. US left the South American crops alone but trimmed both Russa and Ukraine’s output numbers to cut the world ending stocks by 2.36 MMT to 298.4 MMT. The weekly EIA report tallied US ethanol production jumping 59,000 barrels per day to 1.077 million bpd during the week of December 2. Stocks were still building with a 323,000 barrel increase to 23.257 million barrels. Thursday’s Export Sales report showed corn sales of 691,556 MT for 22/23 in the week that ended on 12/1. Total export commitments (of both shipped and unshipped sales) now total 19.044 MMT. That is just 36.12% of the newly revised USDA full year projection. That still lags the average pace of 51%. CFTC’s Commitment of Traders report indicated a large reduction of 71,418 contracts from the managed money net long position in corn futures and options in the week ending on December 6. That too that position to net long just 120,213 contracts as of Tuesday, the smallest in more than 2 years.

The wheat complex was lower again this week. Kansas City led the way to the downside, as March was down 4.34%. Chicago was right behind, losing 3.52%. MPLS spring wheat held up better but was still down 2.14%. Friday’s WASDE showed no changes to the US balance sheet other than trimming the cash average price a dime to $9.10. On the world side, they reduced the world carryout by just 0.49 MMT to 267.33 MMT. Thursday’s Export Sales report showed another weak round of booking at just 189,858 MT of all wheat was booked during the week ending on December. Total export commitments of all wheat and wheat products have limped along to just 13.723 MMT. That is 65% of the USDA forecast, vs. the normal pace of 72%. Friday’s Commitment of Traders report showed spec traders increasing their net short position in Chicago wheat futures and options by another 9,314 contracts in the week of 12/6. That took the net short to the largest position in over 3 ½ years to 63,382 contracts. In KC wheat, they cut back another 7,400 contracts from their net long position as of Tuesday, taking it to 9,729 contracts.

Soybeans saw a week of strength, with January 3.15% higher vs. last Friday. Much of the rally was due to the meal market, which was 11.2% higher. Bean oil was down another 7.99%, with the 2-week move at -16.32%. Other than the meal strength, China and unknown were active buyers of 1.47 MMT of soybeans via the daily announcement system this week. The USDA changed nothing in the US soybean supply and demand forecast on Friday, leaving the carryout at 220 mbu. World stocks were up just 0.56 MMT to 102.71 MMT, as the South American production was left unchanged. The Export Sales report released on Thursday showed soybean bookings jumping out to a 3-week high at 1.72 MMT. That progressed soybean export commitments to 70% of the projected USDA total, now 3% faster than the 5-year average. They are now above last year at 38.874 MMT. CFTC’s Commitment of Traders report indicated spec funds adding slicing 2,650 contracts from their net long position in soybean futures and options as of Tuesday to 99,454 contracts.

Live cattle were up just 0.21% on the week in the nearby December contract. Cash cattle trade was mixed this week, with the South anywhere from $2 lower to $1 higher at 153-156. Light trade in the north was picked up at $156, which would be down $1-2 on the week. Feeder futures saw some strength with January $1.47 higher. The CME Feeder Cattle Index was up 82 cents from last week to $179.22. Wholesale boxed beef prices were weaker this week. Choice was down $1, with Select $3.30 lower. Weekly beef production down 1.4% from the previous week and 2.5% below the same week in 2021 as Saturday kill was backed off. Beef production YTD is up 1.3% on 1.4% larger slaughter. The weekly Export Sales report tallied beef bookings for the week of 12/1 at just 1,601 MT for 2022, with 2023 sales at a large 16,349 MT and 13,100 MT headed to South Korea. For the monthly data, Census showed a record of 301.084 MT of beef exported in October. Commitment of Traders data showed managed money trimming their net long in live cattle by just 527 contracts to 59,317 contracts as of Tuesday December 6th. In feeder cattle they slashed their net short position by 4,990 contracts to 3,246 contracts.

Hogs gave back most of last week’s late gains as February was 7.11% lower. The CME Lean Hog Index was $82.47, down 77 cents on the week. The pork carcass cutout was down a total of just 38 cents this week, with the belly weighing the whole cutout down at a 11.9% drop. Weekly pork production was down 0.8% on the week and was 1.4% below the same week in 2021. YTD production is down 2.4% on 2.8% fewer hogs. The weekly Export Sales report showed net reductions in pork export sales of 7,900 MT in the week of 12/1, with cancellations coming from a number of countries. Census tallied October pork exports at 539.68 million lbs a slight increase over the previous year, but shy of the 2020 record. Friday’s CFTC Commitment of Traders report indicated spec traders adding to their net long in lean hog futures and options by 8,270 contracts as of December 6th. That took their net long position to 49,754 contracts as of Tuesday.

Cotton futures took a downturn this week with March slipping 2.7% lower. USDA’s AWP for cotton was back up 214 points from the previous week on Thursday, to 75.17 cents/lb. The NASS crop Production report on Friday showed a 211,000 bale increase to cotton production at 14.242 million bales. The WASDE showed a slight cut to domestic demand and a 250,000 bale reduction to exports. That tool the US carryout to 3.5 million bales, up 500,000. The Export Sales report showed an uptick from last week’s light sales to just 32,640 RB for 22/23 upland cotton sales. Shipments were reported at 141,145 RB, a slight increase. Thus far in the MY, 8.734 million RB has been sold or shipped, which is 76% of the new USDA forecast, compared to the normal 71% pace. Commitment of Traders data on Friday showed managed money spec funds in cotton futures and options adding back 3,344 contracts to their net long position to 18,257 contracts as of Tuesday.

Market Watch

Next week starts out with the weekly Export Inspections report on Monday morning. The Fed will meet next Tuesday and Wednesday, with most expecting another rate hike to come out of it. December grain futures expire next Wednesday, as well as lean hog futures and options. Also on Wednesday is the EIA weekly ethanol production and stocks report. On Thursday will see the Export Sales report released in the AM, with NOPA releasing November crush data later that morning.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2022 Brugler Marketing & Management, LLC. All rights reserved.