Known News

Market Watch with Austin Schroeder and Alan Brugler

July 23, 2021

Known News

I was asked by a producer attending the Brugler Marketing Summer Seminar “Why are soybeans down today when the long range weather forecast is still hot and dry?” Several possible answers were pondered internally including somebody setting up a bear trap, pre-weekend profit taking, Act of God and algorithmic trading programs. What actually came out of my mouth was a warning about known news. Futures prices at any one time reflect all known news, as well as some non-news components such as index fund buy or sell programs tied to cash flow. Prices typically react to news as soon as it hits the wires, and fully price in the item over a week or two as more facts present themselves. At some point, the problem may be ongoing, but the market has already priced in the best or worst possible outcome. Brazil’s second crop corn is being harvested, and is still being hurt by drought. However, prices are likely discounting an eventual drop to 87 or 88 MMT for total production, and have cut expected exports far below the WASDE July number. Further adjustments will likely be ignored. On the soybean question, the drought in the Upper Midwest has been built into prices with fairly stiff yield loss assumptions for those states. Yet another dry forecast doesn’t change the math much, and a competing wet forecast would be bearish by challenging the worst case assumptions. Known news should come with an expiration date!

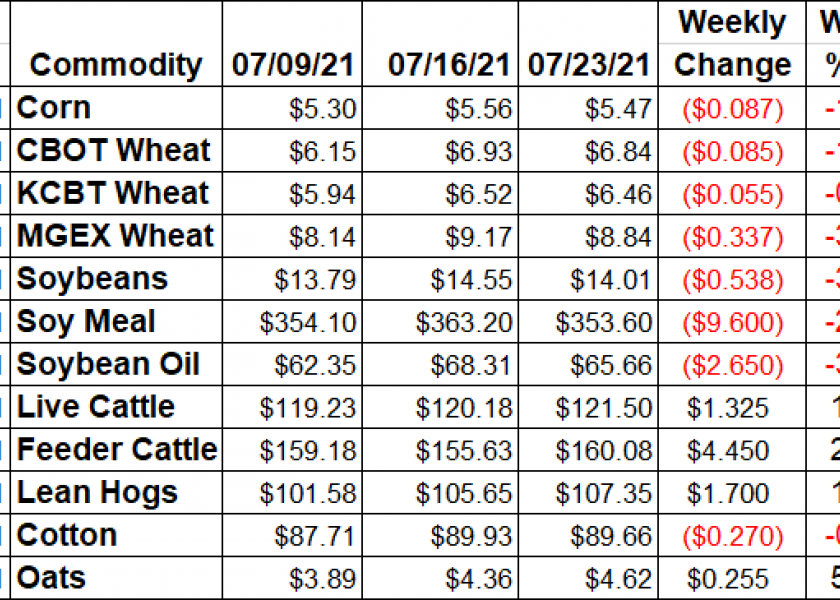

Corn futures were down 1.6% for the week after a 5% gain the previous week. Monday’s Crop Progress report showed the US corn crop was 56% silking, 4% faster than normal, with 8% in the dough stage. Condition ratings were mostly unchanged at 65% gd/ex, with the Brugler500 at 369. EIA data showed a 13,000 barrel per day reduction in ethanol production for the week ending 7/16. That left production still above the 1 million bdp mark at 1.028 million bpd. Stocks rose a considerable amount by 1.384 million barrels to 22.518 million. Export sales data showed old crop bookings at net reductions of 88,500 MT for the week of July 15. That is not out of the ordinary for this time of year, but does not make it any easier to hit the USDA export projection. Total commitment of shipped and unshipped sales are 96% of that SUDA forecast vs. the 102% average. New crop sales were just 47,700 MT for the week. CFTC’s Commitment of Traders report showed spec funds adding back another 14,503 contracts to their net long in corn futures and options as of 7/20. That took them to a net long 223,302 contracts on Tuesday.

Wheat futures were lower in all three markets this week. MPLS had been the bull leader, but was down 3.68% this week after posting new life of contract highs. Chicago SRW wheat was down 1.2% this week after gaining 12.6% the previous week. The KC HRW dropped 0.8%. USDA’s Crop Progress report showed the winter wheat harvest moving along 73% cut, now just 1% behind normal. The spring wheat crop advanced to 92% headed, even with the average pace. Condition ratings continue to deteriorate for HRS, down another 5% to at 11% gd/ex. That dropped the Brugler500 index score to 220, down 21 points from the previous week. USDA Export Sales data showed wheat export sales through July 15 the largest so far in the short MY at 473,200 MT, besting last week by ~50,000 MT. Commitments of shipped and unshipped sales are now 32% of USDA’s projected number, 3% below the normal pace. The weekly Commitment of Traders report indicated that spec funds in Chicago slashed 19,866 contracts from their net short position in the week ending July 20. That trimmed the net short 3,770 contracts. In KC HRW, they added just another 6,078 contracts to their net long position for the week, to 27,745 contracts.

Soybean futures were down a sharp 53 ¾ cents this week, down 3.7% from the previous Friday. Soy Meal was down 2.7% for the week and soybean oil (previously carrying the complex) was down 3.9%. NASS Crop Progress data indicated 63% of the US soybean crop was blooming, with now 23% setting pods, both ahead of the normal pace. Condition ratings as of July 18 were up 1% at 60% gd/ex and 2 points higher on the Brugler500 index to 357. USDA’s total soybean export commitments are now 100% of the USDA projection, vs. 103% average for this date. Old crop sales still to be shipped are down 60% from year ago at 3.13 MMT. Friday’s Commitment of Traders data showed managed money spec funds increasing their net long position by 13,101 contracts for the week ending July 20. That took them to a net long of 95,874 contracts of futures and options on Tuesday afternoon.

Live cattle futures managed a 1.1% gain for the week, rallying into the USDA Cattle on Feed and Cattle Inventory reports on Friday afternoon. Those reports showed we are further into the liquidation phase of the 8-12 year Cattle Cycle, with 1.27% lower overall numbers and a 650,000 head decline in beef cow numbers. The COF report showed July 1 inventory down 1.29% from year ago. Fat cattle cash trade was again divided this week with the North trading $120-125 and the South at $117-120. Feeders joined the buying, as the slight gains in fats and lower corn both allowed more to be paid for the walking inputs. August futures were up 2.9% for the week. The CME feeder cattle index is $152.03, up $.63 from the previous week. Wholesale beef prices were down this week. Choice boxes dropped $1.31 (-0.5%), with Select down $1.85/cwt (-0.7%). Weekly beef production was down 0.2% from last week, and 0.6% lower than last year. YTD beef production is now 4.8% above year ago on 4.6% larger slaughter. Weekly Beef export sales much improved @ 25,100 MT, an 8 week high. CFTC data on Friday showed spec funds trimming another 487 contracts from their net long in cattle futures and options, taking it to 54,627 contracts as of Tuesday.

Lean hog futures found support near the $100 level, with futures up again this week by 1.6%. The CME Lean Hog index was up $0.91 this week @ $112.25. The pork carcass cutout value was up $2.43 for the week, a 2% gain. The belly was the largest contributor, up 8.26% for the week. Weekly pork production was up 2.0% from the previous week, but down 10.1% from the same week in 2020. Pork production is now 0.3% smaller YTD vs. last year, with 0.6% fewer hogs slaughtered. Weekly pork export sales rebounded to 24,531 MT. Shipments to China have slowed in recent weeks, to about 5,400 MT in the week ending July 15. In the weekly Commitment of Traders report, managed money spec funds added 7,618 contracts (net) back to their net long in lean hog futures for the week ending 7/20. They were net long 77,064 contracts on that date.

Cotton futures faded the 2.53% gain from the previous week, dropping 7 points or 0.30% for the week. Crop Progress data from Monday showed the US cotton crop 69% squared, now 4% behind normal. Just 23% of the crop was setting bolls, vs the 30% 5-year average pace. Ratings rose another 4% to 60% gd/ex, with the Brugler500 Index just 2 points higher to 360 as some poor ratings shifted around. Cotton export export commitments are 107% of the full year WASDE forecast. They would be 112% on average, due to rollovers and deferrals. Export shipments are 7% larger than year ago at this point, and 95% of the USDA forecast, matching the last 5 years. Weekly Commitment of Traders data released on Friday showed large managed money spec funds net long 59,492 contracts on July 20, adding 2,670 contracts on the week.

Market Watch

Next week is fairly quiet on the report side of things. Cattle traders will start out on Monday reacting to Friday afternoon’s Cattle on Feed and Cattle Inventory reports. USDA will release the Export Inspections report on Monday morning, with the Crop Progress report out that afternoon. On Tuesday and Wednesday, the FOMC meet. EIA will release updated ethanol production and stocks data on Wednesday as well. Export Sales data will be out on Thursday morning per usual, with Friday being first notice day for August bean, meal, and oil futures.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2021 Brugler Marketing & Management, LLC. All rights reserved.