Long Seasons

Market Watch with Austin Schroeder and Ryan Nielsen

September 9, 2022

Long Seasons

Football is back! Each level of the fall sport is now underway with the Thursday night kickoff for the NFL, though high-school games are going on week 3/4 already. My younger brother’s varsity team, which was highly rated at going into their season, had a rough start. They began the season facing the #1 team and defending state champs for their class and followed that by facing the #2 team for their class. Both games were brutal to watch, as they lost a combined 104-13. However, when discussing the games, my brother remains optimistic by reminding us it’s a long season. ‘Sure it’s off to a rough start’ he says, ‘but this is a playoff caliber team and we should win or keep it close going forward’. In the corn market we see a ‘second wind’ rally as yield forecasts are again leading headlines. Time will tell how these two are analogous, perhaps it doesn’t matter how beat up you get because you can still be good enough – corn yields and a football team; or perhaps the analogy lies in the second wind comparing a late season win streak for the corn bulls and for the bulldogs.

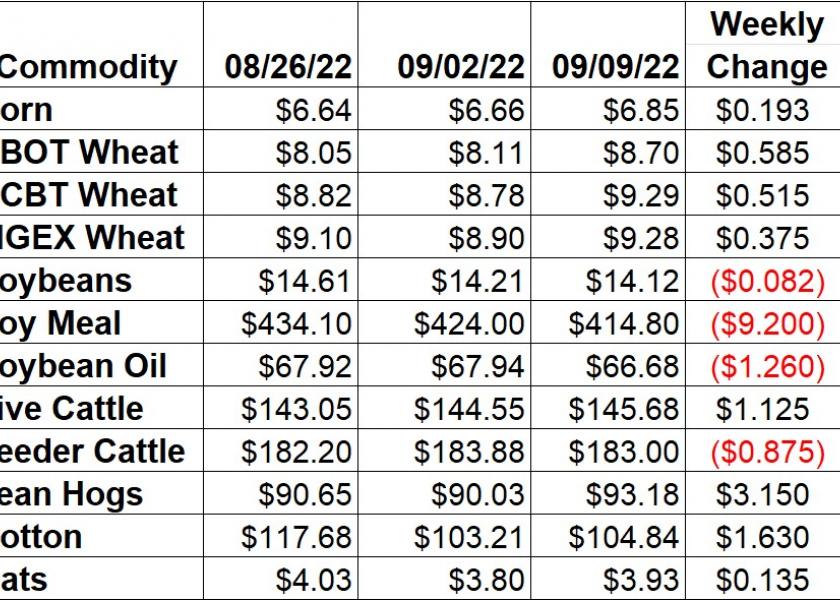

Corn futures printed a 29 cent range during the week, and closed out near the top end. Friday strength helped cement a gain for the week, which ended up as a net 19 1/4 cents for the Dec contract. CME had no deliveries against Sep corn through 9/8. The Tuesday edition of the Crop Progress report showed 63% of the crop was dented, with 15% reaching maturity, lagging the normal pace by 4% and 3% respectively. NASS crop condition ratings dropped another point on the Brugler500 index for the week (to 338), with gd/ex ratings down unch at 54%. Monthly Census data showed July exports at 4.58 MMT (180.4 mbu). That was a 16.57% drop from June and down 16.26% from July 2021. Ethanol shipments were more than double last year and a 5.7% increase over June. Weekly Ethanol data from EIA showed production dropping 19,000 barrels per day in the week of 9/2 to 989,000 bpd. Stocks dropped again in that week, down 395,000 barrels to 23.138 million barrels. Friday’s CFTC Commitment of Traders report showed light new buying and light short covering from the spec funds through the week of 9/6. That left the managed money net position 5,012 contracts more net long in corn to 226,479 contracts. Commercial corn hedgers lifted long hedges for a 6,552 contract stronger net short of 456,538 contracts as of 9/6.

Wheat markets traded in sympathy with corn through the week, taking turns as the leader and as the follower. Friday’s rally in Dec SRW was not enough to overtake the Wednesday high, but was the highest close since July 11th. Dec SRW was a net 58 cents higher on the week. KC wheat futures were a net 5.87% stronger Friday to Friday, and MPLS gained 4.2% through the week. Russia’s Vladimir Putin spooked the market when he mentioned the Ukrainian export corridors were not working as intended, and that Russia may need to reconsider the deal. The White House has since said they do not believe the deal is in danger of losing Russian support. The weekly Crop Progress indicated the spring wheat harvest was 71% complete, still 12% below normal pace. Winter wheat planting was added his week, showing 3% of the crop seeded normal with the average pace. The monthly release of Census trade data showed 1.52 MMT (55.7 mbu) of wheat was exported in July. That was a 4.8% drop from June and the lowest July number since 1971 (down 26.1% from the same month in 2021). CFTC data had SRW spec traders at 21,431 contracts net short as of the 9/6 settle. That was a 816 contract weaker net short through the week on reduced OI. For KC wheat, the specs were 11,087 contracts net long after long liquidation. Managed money firms were reducing their net short in spring wheat through the week, taking it to 1,038 contracts as of the 9/6 close.

Soybean futures rallied on Friday into the weekend, but it was not enough to fully erase earlier weakness. Beans were a net 8 cents weaker for the week in the Nov contract, but printed a wide 59 cent range in the process and spent most of the week battling at the $14/bu mark. Meal was down the most for the complex, closing 2.17% weaker wk/wk, with BO’s 1.85% loss taking some crush margin premium off as well. The weekly Crop Progress report showed 10% of the soybean crop was dropping leaves as of 9/4, now 4% point behind the average. The Brugler500 index was down 3 points from last week at 348 as the good to excellent ratings were unch at 57%. Monthly Census data indicated that 2.32 MMT (85.36 mbu) of soybeans were shipped in July. That was more than double 2021 and 2.29% larger than the previous month. Managed money soybean traders were closing more longs than shorts through the week of 9/6. The 7,242 contract lighter OI left the specs 2,172 contracts less net long to 99,629 contracts. Commercial bean traders lightened their net short by 5.7k contracts to 133.6k via net new buying and closing short hedges.

Live cattle’s Friday strength cemented a gain from Friday to Friday as October closed up $1.30 for a weekly gain of $1.12. Cash cattle trade was slow to establish after the Labor Day holiday, but picked up around $141 in the South and $143 in the North – steady with last week. Feeders stayed in the red from Friday to Friday, giving back a net 0.48% in the Sep contract wk/wk. The CME Feeder Cattle Index was down only a net penny weaker through the week to $181.24. Wholesale beef prices were lower this week. Select continued to drop faster than Choice, widening the spread back to $22.53 – following along 2019’s trajectory. Choice was a net $2.16 (0.8%) lower as Select dipped $3.85 (1.6%). Monthly export data from Census showed 306.9 million lbs of beef shipped during July, a record for the month. Weekly CoT data showed managed money firms were adding longs through the week that ended 9/6. That left the group 1,143 contracts more net long at 61,886 contracts. In feeder cattle, the funds had flipped back to net long after 2k shorts were closed. That left the group 1,474 contracts net long after a week of being net short.

Lean hog futures had a wide ranged back and forth trading range this week. October ended as a net $3.15 higher, though Dec was only up 42 cents. The Oct – Dec spread widened to back above $10. The CME Lean Hog index fell $6 flat to $100.26 through the week. The pork carcass cutout value was again stable this week on a 62 cent (0.6%) increase. Butts led the increase, followed by Picnics, as most other cuts were a smidge weaker. Census data indicated July pork exports of 483.99 million lbs, a 4-year low. CFTC reported managed money firms were 9,965 contracts less net long in lean hogs through the week that ended 9/6. The long liquidation left the group 45,498 contracts net long – a 7-week low.

Cotton futures continued their draw down, but found support and recovered later in the week for a net gain Friday to Friday. December was up 1.58%. Federal Reserve Chairman Jerome Powell hinted at a 0.75% rate hike for the end of the month’s FOMC meeting, as other countries begin raising their interest rates. Monday’s Crop Progress data from NASS had 39% of the cotton crop’s bolls open. That was up from 28% last week, and 7% points ahead of the average. As for cotton conditions the report showed 35% good/ex at the national level which converted to a 294 on the Brugler500 index. That is up from 286 last week. USDA’s AWP for cotton was a substantial 9.94 cents lower to under $1. FAS reported 94.92 cents/lb. The Commitment of Traders report had cotton spec traders at 50,109 contracts net long as of 9/6. That was a 3,784 weaker net long fueled by long liquidation. Commercial hedgers also reduced their shorts for a 7.7k contract weaker net short of 696,353.

Market Watch

Next week starts out normal with the weekly Export Inspections report released in the morning. Then, at 11:00 am CDT, it gets a little busier with the Crop Production, Cotton Ginnings, and WASDE reports from USDA. That afternoon will also see the release of the NASS Crop Progress report. On Wednesday the weekly EIA report will release ethanol stocks and production data with Sep contracts expiring at the close. On Thursday, we will finally get a look at the last 4 weeks of Export Sales data.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2022 Brugler Marketing & Management, LLC. All rights reserved.