Not The Only Game in Town

Market Watch with Alan Brugler and Austin Schroeder

January 27, 2023

Not The Only Game in Town

While we focus on cash and futures prices in this column, they aren’t the only revenue management issues for US producers. There are also government safety net programs (ARC and PLC) that can pay out in the case of major crop losses, and numerous flavors and combinations of crop insurance. The ARC and PLC programs paid out $255 million for 2021 crops in the fall of 2022. The deadline for ARC-CO, ARC-IC and PLC signups is March 15. On the insurance side, the most widely used are the RP (revenue protection) policies, with or without harvest price exclusion. The prices used to determine payments for corn and soybeans under RP are the monthly average of December corn futures and the monthly average for November soybeans during February. Wednesday is February 1, the beginning of the computation period. It is worth noting that these are rarely the highest prices of the year. The 12 month high price (different than the average for insurance) for December corn has fallen in February only twice since 1976. November soybeans have yet to print an annual high in either January or February in those 48 years.

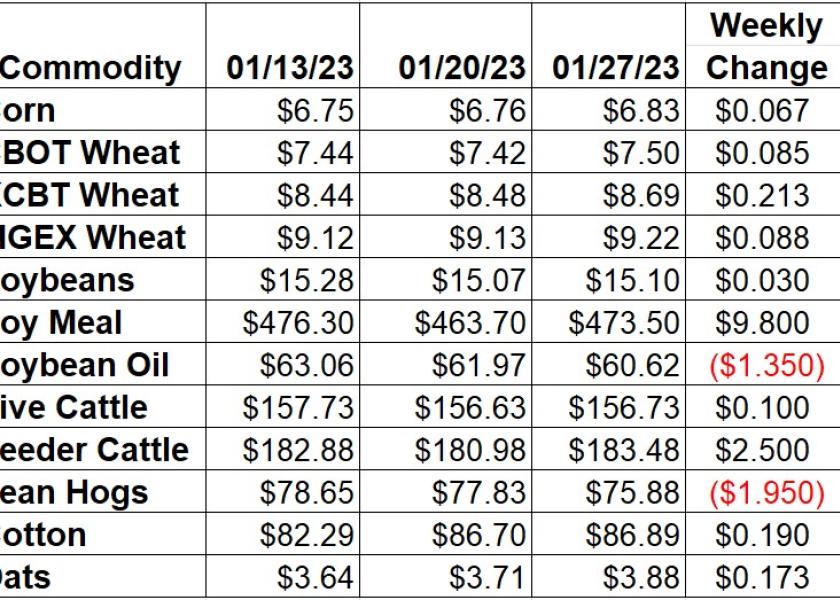

Corn futures got some follow through this week, as March was 6 ¾ cents or 1% higher since last Friday. Wednesday’s EIA data release showed a 4,000 barrel per day increase in daily ethanol production (and corn use) to 1.012 million bpd. Ethanol stocks rose a massive 1.675 million barrels to 25.077 million barrels, the largest increase in a single week on record. The weekly Export Sales report indicated corn bookings of 910,400 MT during the week of 1/19. That was down 19.6% from the week prior but still the second largest in the last 6 weeks. Old crop corn export commitments (shipped and unshipped sales) are now at 24.039 MMT, which is down 45% vs. last year. That is also 49% of the USDA forecast, compared to the 63% average pace. The weekly Commitment of Traders report tallied spec funds adding another 9,660 contracts to their net long position in corn during the week ending Jan 24. That put them net long 201,797 contracts as of Tuesday night.

The wheat complex was stronger this week, with Kansas City leading the way, up 2.51%. Chicago was 8 ½ cents or 1.15% higher, with MPLS up 8 ¾ cents (0.96%). This week’s Export Sales report showed wheat bookings at a 9-week high of 500,429 MT. Total wheat export commitments are now 16.12 MMT as of January 19. That is still 7% below year ago and 76% of the USDA export projection. Normally we would have 85% of the projection sold/shipped by now. Actual shipments are 54% of the projected full-year total, 7% back of the average pace. CFTC’s weekly Commitment of Traders data indicated managed money spec traders adding another 8,844 contracts to their net short position in Chicago wheat futures and options in the week ending January 24. That took the net short position to 73,933 contracts, the largest since May 2019. In KC wheat, they pared back 459 contracts from their new net short position to 6,832 contracts as of Tuesday.

Soybeans took back a couple cents of last week’s drop, as March was up 3 cents or 0.2%. Soy Meal was again the leader of the complex, this time with gains of $9.80 (2.11%). Soy oil was down another 135 points (2.18 %). The market shrugged off early week losses following rains across South America last weekend. Thursday’s Export Sales report showed soybean export bookings at a 6-week high of 1.146 MMT in the week of 1/19. Commitments are now 46.54 MMT, or 5% larger than last year at this time. They are 86% of USDA’s forecast total, now 8% faster than the average pace. They need this buying pace to continue with Brazil soon to come into the market. Commitment of Traders data showed money managers trimming their net long position by 22,037 contracts in soybean futures and options during the week ending 1/24. That took them to a net long position of 146,261 contracts.

Live cattle saw just a dime gain on the week. Cash trade was very light this week, with most steady on the week at $155. Feeder futures were stronger, with March up $2.50 since last Friday. The CME Feeder Cattle Index was $178.80, up $1.73 from last week. Wholesale boxed beef prices were down again this week. Choice boxes on average dropped 1.5%. Select boxes were down 2.3%. The Choice/Select spread is frequently under pressure in January and February but rose to $17.22 on Friday vs. $15.29 a week earlier. Weekly beef production was up 1.9% from the previous week but 1.3% lower than the same week in 2022. Monthly Cold Storage data tallied December 31 beef stocks at 543.96 million lbs, a seasonal 3.95% rise from November and still 7.26% larger vs. 2021. The weekly Commitment of Traders report indicated spec funds cutting another 7,815 contracts from their net long position in live cattle during the week ending January 24. That backed off their larger net long position to 76,857 contracts by Tuesday night.

Hogs continued the weakness in the nearby Feb contracts, down $1.95 on the week. April did find footing, up 72 cents. The CME Lean Hog Index was down another 76 cents this week, to $72.52. The pork carcass cutout was down $0.74 this week (-0.9%). Pork bellies were down 11.4% to account for most of the weakness. Weekly pork production was up 0.7% vs. the previous week and was slightly higher vs. the same week in 2022. The NASS Cold Storage report showed pork stocks at the end of December of 458.142 million lbs. That was up 1.46% from November and a 15.6% jump from last year. CFTC’s Commitment of Traders report showed managed money flipping to a net short position of 3,672 contracts as of Tuesday. That was a flip of 14,672 contracts on the week to the largest net short position since December 2019.

Cotton futures saw some midweek strength as March was up 19 points on the week. Thursday’s Export Sales report had cotton bookings at the largest total since September 1 at 213,680 RB during the week that ended on 1/19. Cotton export shipments YTD have been 22% larger than last year, as unshipped sales commitments are 39% smaller. Total commitments are down 20% in total vs. last year and are 82% of USDA’s forecast total, 1% behind normal. Friday’s Commitment of Traders report showed spec funds flipping back to net long in the week ending 1/24, by a change of 9,052 contracts on the week. That took them to net long 7,122 contracts by Tuesday.

Market Watch

Monday starts with the Export Inspections report released in the morning. On Tuesday, the USDA will release their Cattle Inventory report. Fast forward to Wednesday and EIA will release they weekly report showing ethanol production and stocks. Wednesday afternoon the Fed will announce their next interest rate decision. We will also get the monthly Fats & Oils, Grain Crushing, and Cotton Systems reports. Weekly Export Sales will be out on Thursday morning. Friday is expiration day for February live cattle options.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2023 Brugler Marketing & Management, LLC. All rights reserved.