Speer: The Better Investment

My column several weeks ago highlighted the market’s impressive gains that occurred in 2022 – all against the backdrop of record-high beef production. It’s evidence of the importance – and subsequent benefits – of building beef demand over time.

Broken Market: Nevertheless, the “market is broken” narrative persists. That’ll be re-energized as the new Congress convenes; lawmakers hearing renewed appeals for legislation to fix the cattle industry.

For example, some recent commentary highlighted profitability data from USDA. The data is specifically referenced in making the case for the need to, “…fix your industry’s broken market.”. The commentary stating: 1) cow/calf producers earned negative returns during the five years leading up to the previous drought (’11-’13); 2) profitability then exceeded $350/cow in next two years; and 3) by 2019 returns had fallen to their lowest level in nine years.

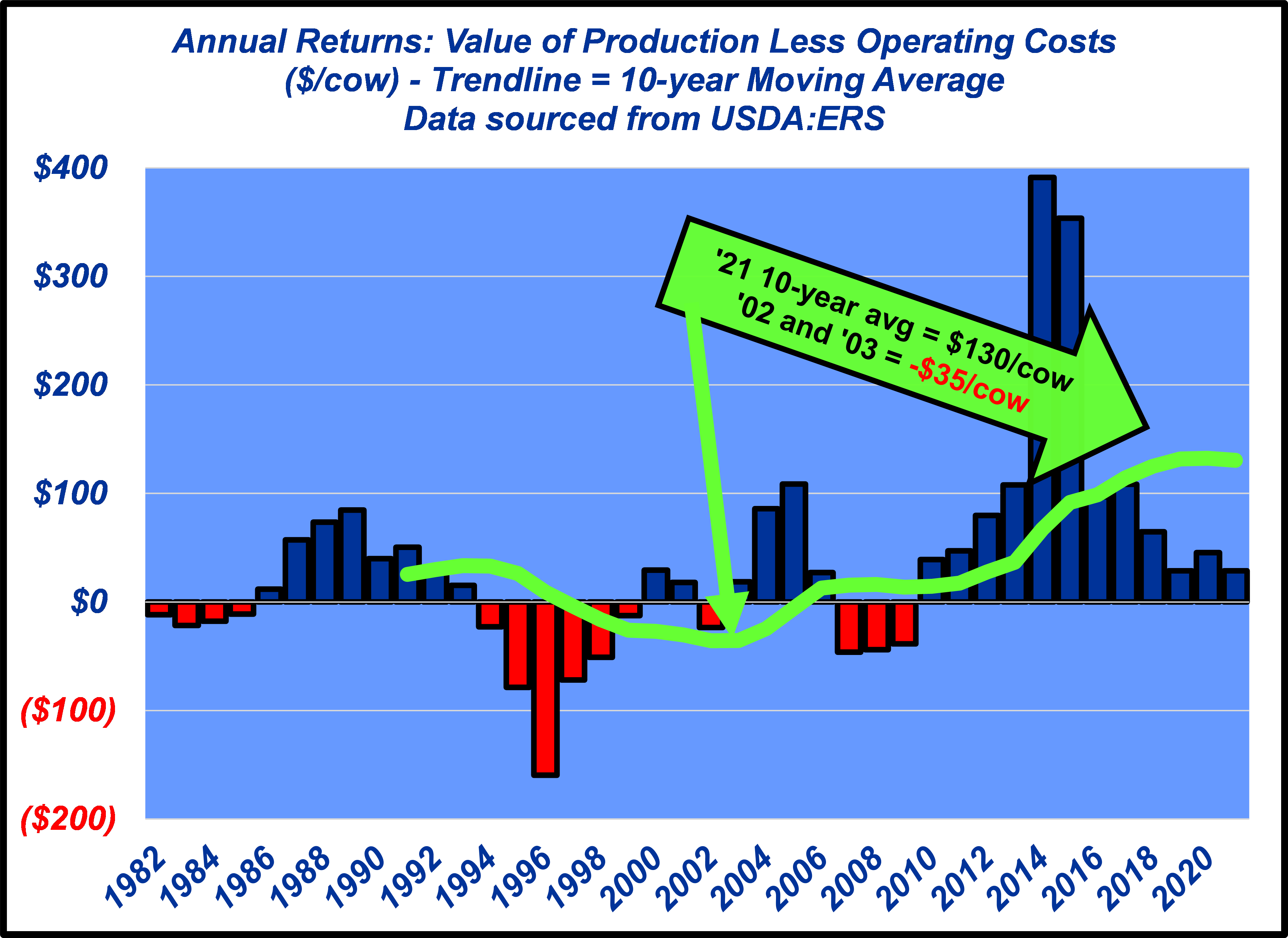

USDA Data: It’s important to understand the data that’s being referenced. It represents annual cow/calf returns (revenue less operating costs – there’s no accounting for allocated overhead). USDA provides three distinct time series: 1.) ’82-to-’89, 2.) ’90-to-’95, and 3.) ’96-to-’21. While the methodology varies across the series, the data provides some valuable and substantive insights over the long-run.

The first graph represents annual returns across the entire time series. Note that returns were negative only three years (’07-’09) prior to 2010 – not five as stated in the commentary. Note, too, while current returns are sharply below the 2014/2015 pinnacle, the ten-year running average is $130/cow - $165 better versus 20 years ago.

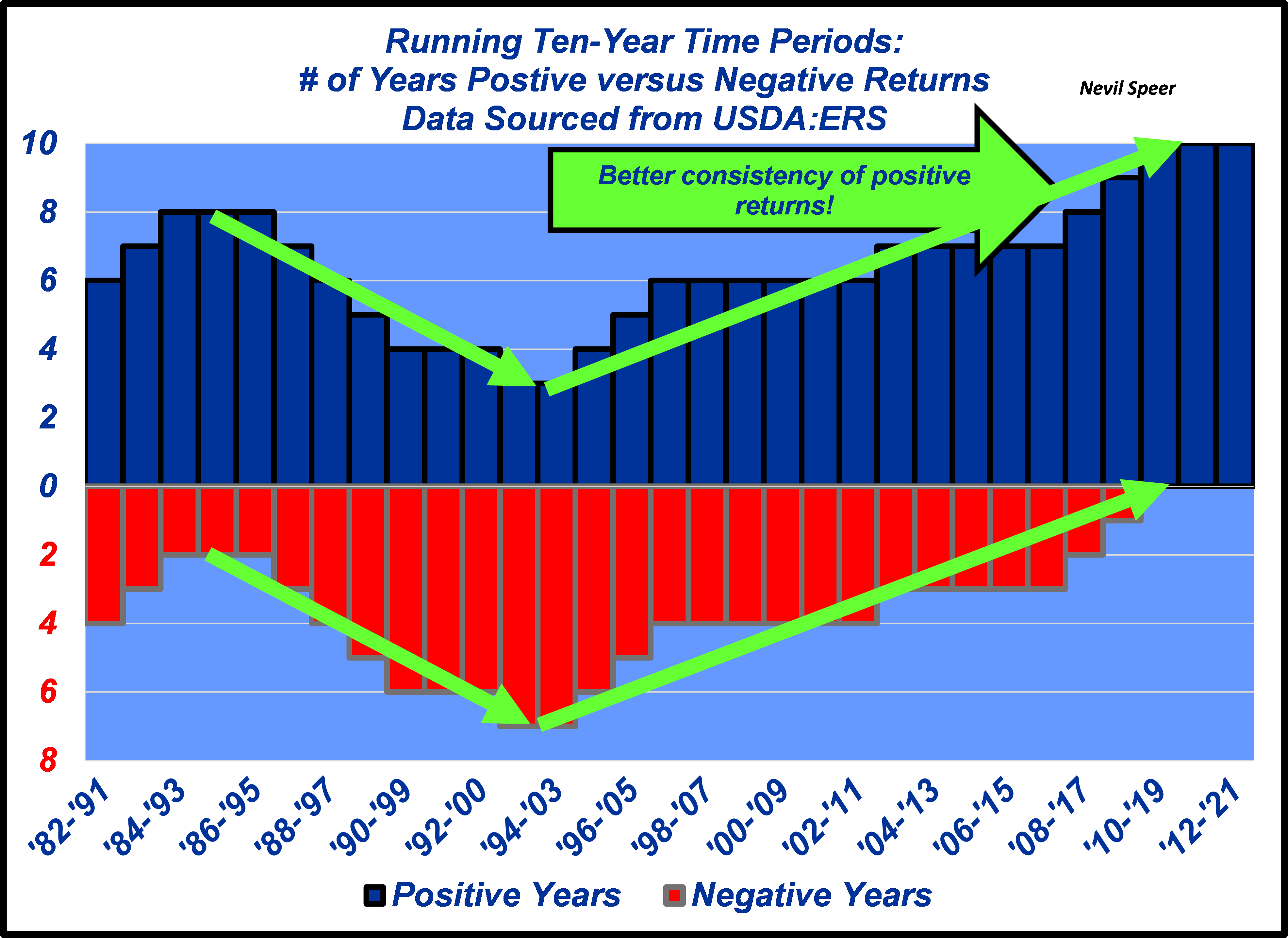

Trend: Now, let’s look at the data in a different way. The second graph details the same data categorized on a ten-year running basis: number of years with negative returns versus those with positive returns. It provides a very different perspective versus the “broken market” mantra.

Returns are consistently more favorable versus the mid-90s. And even if we debated the 2019 calculation, don’t let that detract from the unprecedented consistency of positive returns year-over-year during the past decade. Moreover, that’ll continue through at least the middle of the decade.

Caution: Any assertion about cow/calf returns (i.e the commentary mentioned above) needs to come with a note of caution. First, there are key differences among measures of “profitability”; in this instance, the USDA data reflects operating profit (again, no consideration for overhead – that’s another column for another day). Second, regardless of the measure, there’s HUGE variation among producers as it relates to returns or profitability (see overview of Kansas Farm Management Association (KFMA) returns to management).

Last, and most important, conventional wisdom generally links revenue to profit. While the market is certainly important, it’s often NOT the difference maker – the real profit driver over time comes on the cost side. KFMA summarizes it best: “…while both production (weight) and price do impact profit, they are much less important in explaining differences between producers than costs.”

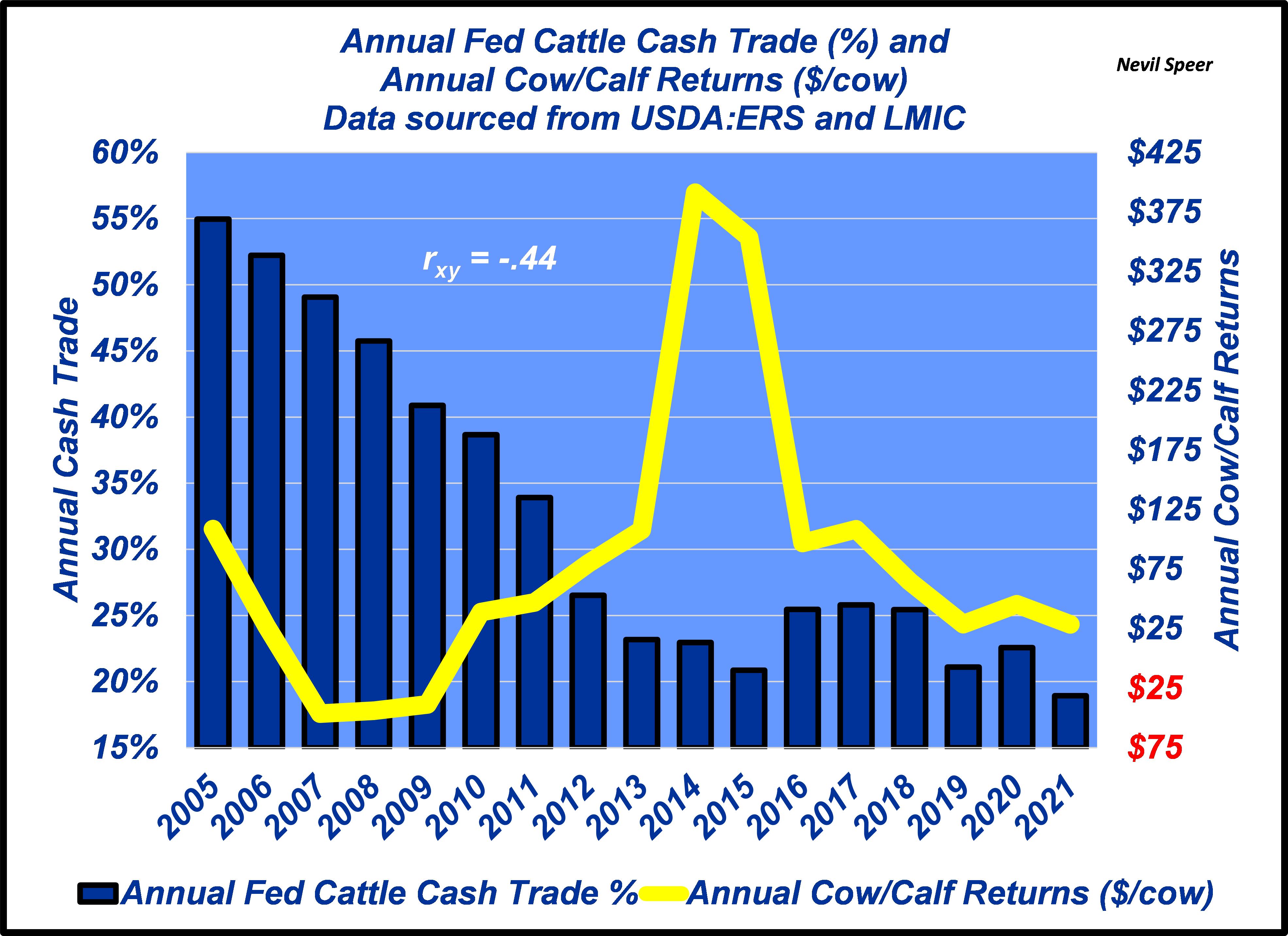

Profit Zone: Ultimately, any attempt to tie the level of cash trade to cow/calf returns is a self-defeating (and senseless) argument. After all, returns were peaking in 2014 and 2015 while cash trade percentages were plummeting (the correlation is negative .44). (see third graph)

All this brings us back to the less crisis, more opportunity framework. Perpetual grumbling about the market (crisis) doesn’t hold water – and conjuring up some legislative fix proves to be wasted time and energy (never mind unintended consequences).

Simultaneously, USDA data tells a positive story. There’s more consistency to the upside versus twenty-five years ago (opportunity). That’s directly attributable to better demand and stronger spending over time - consumers are the difference maker.

Alongside those ongoing industry efforts, producers are well served to keep sharpening their pencils while also pursuing the numerous value-added opportunities available in the marketplace. Both prove a better investment where profit gets advanced.