Speer: Cow Inventory And Producers’ Share

Beef Cow Inventory: The cow herd has been the primary focus of the past several columns – including the most recent one explaining the following:

“The critics will keep pointing to waning cow numbers – contending it’s an indication of the business’ demise...[but] cow inventory is NOT a reliable proxy of the industry’s viability. Things aren’t always what they seem.”

Just as that column was nearing the finish line, I had some correspondence regarding producers’ share of the retail dollar and what that ultimately means for the industry over the long run. As such, it’s useful to explore the two measures (beef cow inventory and producers’ share) simultaneously because both are often referenced by those critical of the industry’s innerworkings.

Producers’ Share: As quick review, the measure isn’t very meaningful. Dr. Brester (Montana State University) et al. point out investment by processors and retailers to enhance demand inherently reduces producers’ share. However, that investment ultimately makes the industry better off over the long run.

That is, the pie gets bigger. But producers’ share doesn’t reflect that occurrence over time. Rather, it represents sectors antagonistically - “as competitors for a fixed value, rather than as partners in the production of greater value.” (For more on this concept, see Pan Beats Knife)

Cow Herd: Let’s now come back to beef cow inventory. The argument generally goes something like this: 1) the packer has too much power, 2) the market is broken, 3) fed prices are too low, and 4) calf prices suffer as a result and too many producers are quitting the business. Therefore, a negative turn in producers’ share ultimately drives sell-off at the farm or ranch level.

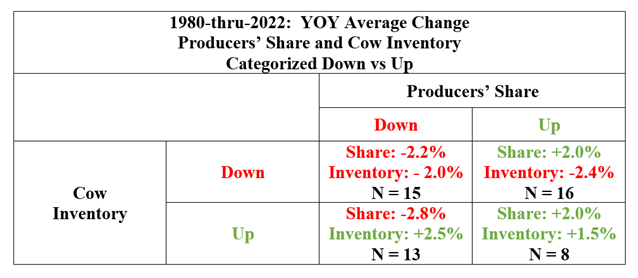

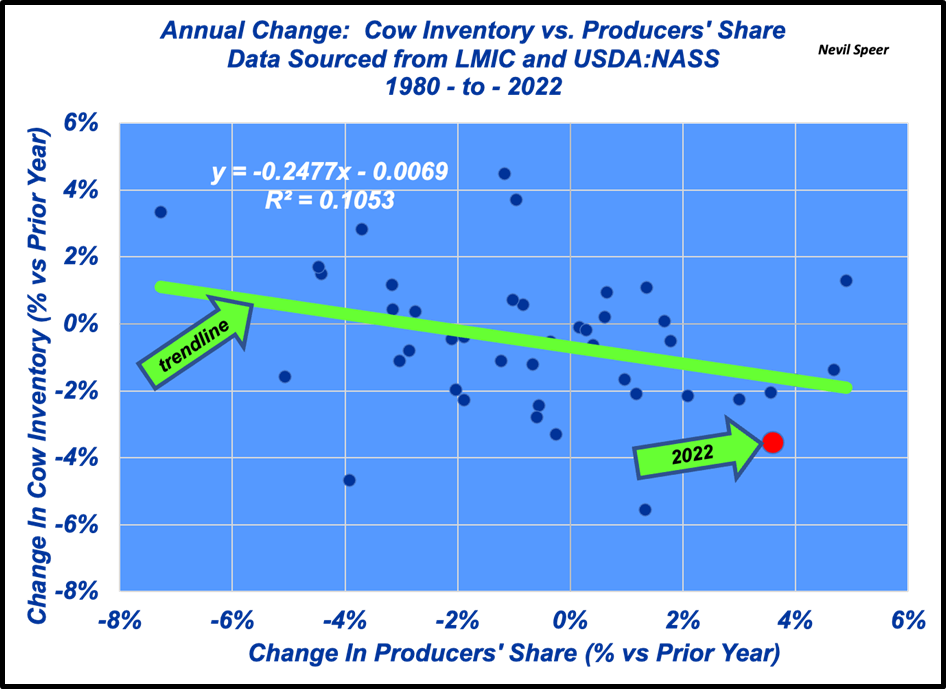

The graph below addresses that line of logic Note the direction of the correlation; it contrasts the reasoning outlined above. Most important, the relationship is weak; that’s further demonstrated within the table outlined below; over the span of five decades the distribution of inventory change versus producers’ share is well balanced.

What’s It All Mean?: An editorial last fall asked, “…how many producers and small feedlots are going to go out of business before our elected representatives do something?” The permabears contend: one, producers’ share is eroding margins available to the production sector; two, declining cow numbers represent the ultimate manifestation of that reality. And seemingly it’s all very sinister.

However, as noted in a previous column:

Substantial gains have resulted from enduring commitment to better quality, improved consistency and enhanced promotion. As a result, beef spending has outpaced the competition since 2000. The beef industry has recaptured market share and cattle prices have risen as a result. Singular focus on farmers’ share misses that favorable outcome.

In the end, the only measures that really matter center around beef demand and consumer spending (see Keep The Main Thing The Main Thing). In tandem, they prove to be the ultimate indicator, and driver, of prosperity.