Speer: It’s Really Two Enterprises

Review: My previous three columns focused on profitability in the cow/calf sector. All in reference to claims fed cash trade needs to be “fixed”. Let’s start with a quick review:

- One: Claims of dwindling cash trade negatively impacting cow/calf producers are unfounded. For instance, returns peaked in ’14 and ’15 while cash trade bottomed out.

- Two: USDA succinctly summarizes the sector: “…operators of beef cow-calf farms have a diverse set of goals for the cattle enterprise.” Meanwhile, USDA NAHMS survey results indicate most producers do NOT consider the operation to be a primary source of income.

- Three: The revenue difference between high vs. low profit producers in the KFMA data set is $56/head. Meanwhile, the difference on the cost side is six times bigger (high-profit producers consistently possess nearly a $350/cow cost advantage versus the low-profit group).

Income Statement vs. Balance Sheet: Those previous columns were wholly focused on the income statement; an assessment of profit / loss over a specific period of time (generally, on an annual basis).

However, that doesn’t completely reflect a business’ financial position over time. One must also consider the balance sheet: a snapshot summary of assets (what the company owns – including retained earnings from ongoing operations) and liabilities (what the business owes).

It’s Really Two Enterprises: Most cow/calf producers function as owners / operators of two separate enterprises under the umbrella of one business. There’s some form of a real estate investment / holding company (the first enterprise). It’s the overwhelming portion of the assets in most farming / ranching businesses. Then comes investment in, and operation of, beef cows (the second enterprise).

They should be considered as separate entities. However, in many operations the overlap can become somewhat murky (internal cost accounting is always challenging). That’s why accurate enterprise analysis is so important – it enables determination of each entity’s financial health within the broader operation.

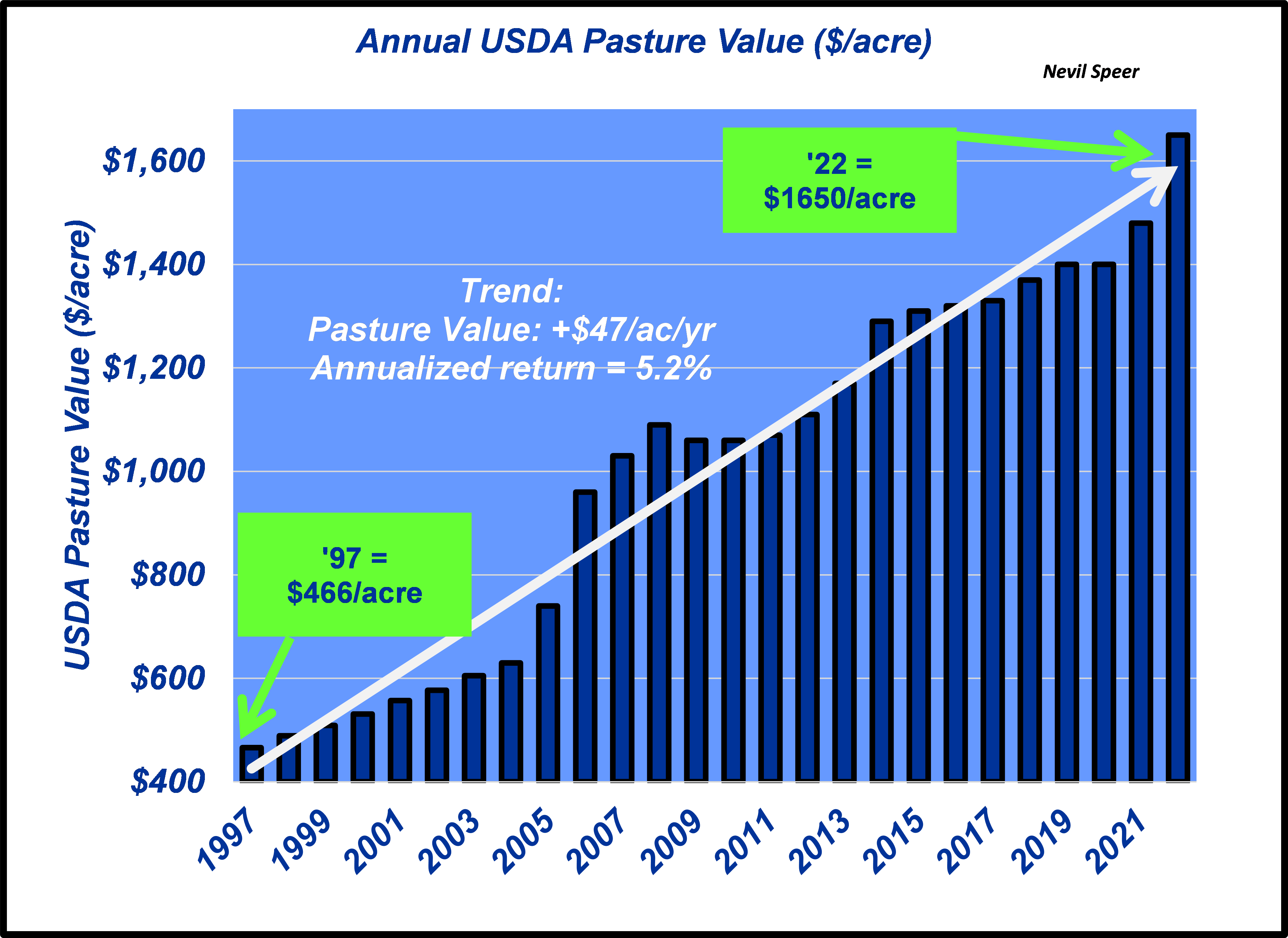

Land Values: All this inherently leads to the longer-run story around land values (balance sheet). The graph below highlights USDA annual assessment of pasture values ($/acre) since 1997. These values vary widely across the United States depending on the carrying capacity – however, the aggregate value serves as an important benchmark year-over-year.

Pasture values have increased nearly $1200/acre since 1997 (equivalent to $47/acre/year). More importantly, the annualized return is nearly 5.2%.

There’s a secondary consideration, regarding the income statement. In the simplest manner, one leases the land to a cow/calf operator (either externally or internally). Let’s peg that annual lease cost at 1% of land value (thus, average pasture cost in 2022 averaged ~$17/acre).

Comparative Returns: Land appreciation plus lease income has netted a total annualized return of ~6.2% during the past 25 years. During that same period the S&P500 – including dividend yield – has returned roughly 8.5%. However, the extra stock market return also comes with added volatility – land value returns are remarkably steady over time (low beta!).

Of course, land appreciation (balance sheet) doesn’t solve cash flow challenges (income statement). Moreover, one has to sell the land to reap the benefit of higher values. Those considerations aside, farm/pasture ground has proven, and continues, to be an excellent investment.

Wrap Up: What’s the bottom-line here? No matter how you adjust your dams and cuts, it’s impossible to irrigate uphill. The same goes for chasing some sort of legislative “fix” to the market – it’s a frivolous pursuit.

Conversely, given the fundamental importance of the land enterprise to any farming/ranching business, time and energy are better directed towards things that really matter – like guarding against the never-ending barrage of regulation (e.g. inheritance taxes, restricted property rights) constantly threatening business continuity over time.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.