Speer: Mandates Cost Producers

Mandates cost producers? That headline, posed as a question, was in response to a recent Texas A&M publication. The industry observer didn’t like the message. So, he decided to simply attack the messenger: “Texas A&M University and College Station is so far removed from commercial cattle feeding that they have to pay admission to even watch…” That was a cheap shot: the report, The U.S. Beef Supply Chain: Issues and Challenges, results from collaboration of seventeen ag economists representing twelve land grant institutions.

Similarly, R-CALF USA criticized the report but with more of a conspiratorial approach: “We’ve witnessed this scenario several times during the past two decades. Each time cattle producers have offered meaningful marketplace reforms; a cadre of experts are enlisted to defend the status quo. Congress needs to see through this and take steps to fix our chronically dysfunctional market.” That’s not surprising; the organization routinely sidesteps economic principles and works to undermine the beef industry’s success during the past twenty years.

And so the report’s critics leave us with two options. One, the authors don’t know anything because they either work at, or work with, Texas A&M University. Or two, the authors actually are industry experts but for whatever reason they’re motivated in relegating the industry to the status quo.

Never mind the critics, there’s a third option available here: we recognize the authors truly are professional experts, they possess meaningful commitment to their discipline, and operate with judicious objectivity. Accordingly, we acknowledge the findings make sense in the real world (regardless of whether we like them or not). To that end, the authors summarize twelve main findings including:

- While not necessarily a popular position, most economic research confirms that the benefits to cattle producers due to economies of size in packing largely offset the costs associated with any market power exerted by packers. Research indicates that there is market power, but its effect has been small.

- While some argue that imposing mandatory minimums on negotiated (or cash) transactions would improve price discovery in the fed cattle markets – accruing benefits to the cow/calf producer in the process – authors in this book argue it could have the opposite effect, potentially imposing huge costs that are passed down to cattle producers in the form of lower prices.

With that in mind, perhaps the most poignant portion is found in the first chapter. Dr. Derrell Peel (Oklahoma State University) details the industry’s complexity and history in which he quotes (twice) Dr. Wayne Purcell (Virginia Tech University) dating back to 1999:

"The big danger is that all the attention on short-run and highly visible issues will block recognition of the problems that are long run and structural in nature and, in the process, prevent efforts to move to programs and policies that have a legitimate chance of helping."

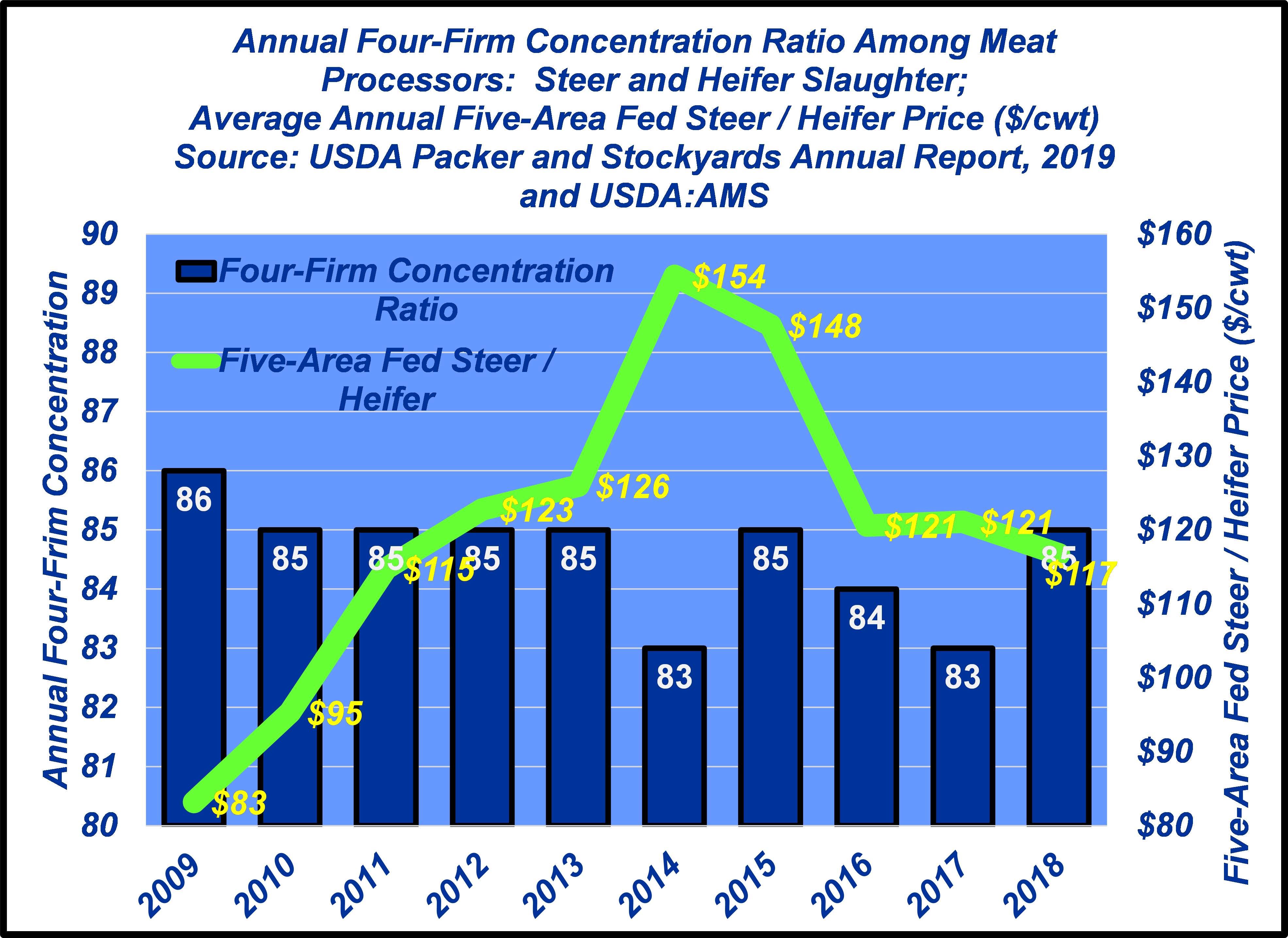

In other words, market leverage ebbs and flows (see graph), but principles are enduring.

That is, the report appropriately cautions against implementing government regulation and losing focus on the consumer. That would leave industry participants worse off – not better. Therefore, it’s not a question, but rather an exclamation mark that ends the statement: mandates cost producers!

Nevil Speer is based in Bowling Green, KY and serves as Director of Industry Relations for Where Food Comes From (WFCF). The views and opinions expressed herein do not necessarily reflect those of WFCF or its shareholders. He can be reached at nspeer@wherefoodcomesfrom.com.