Speer: Packers and the Knowledge Problem

A reader recently emailed with me the following comment: “…one thing that I don’t see in your articles…is addressing what seems to me to be the lack of competition in the processing side of the industry.” It was especially timely. I had just finished up a column addressing a Kansas City Star guest editorial around that same theme.

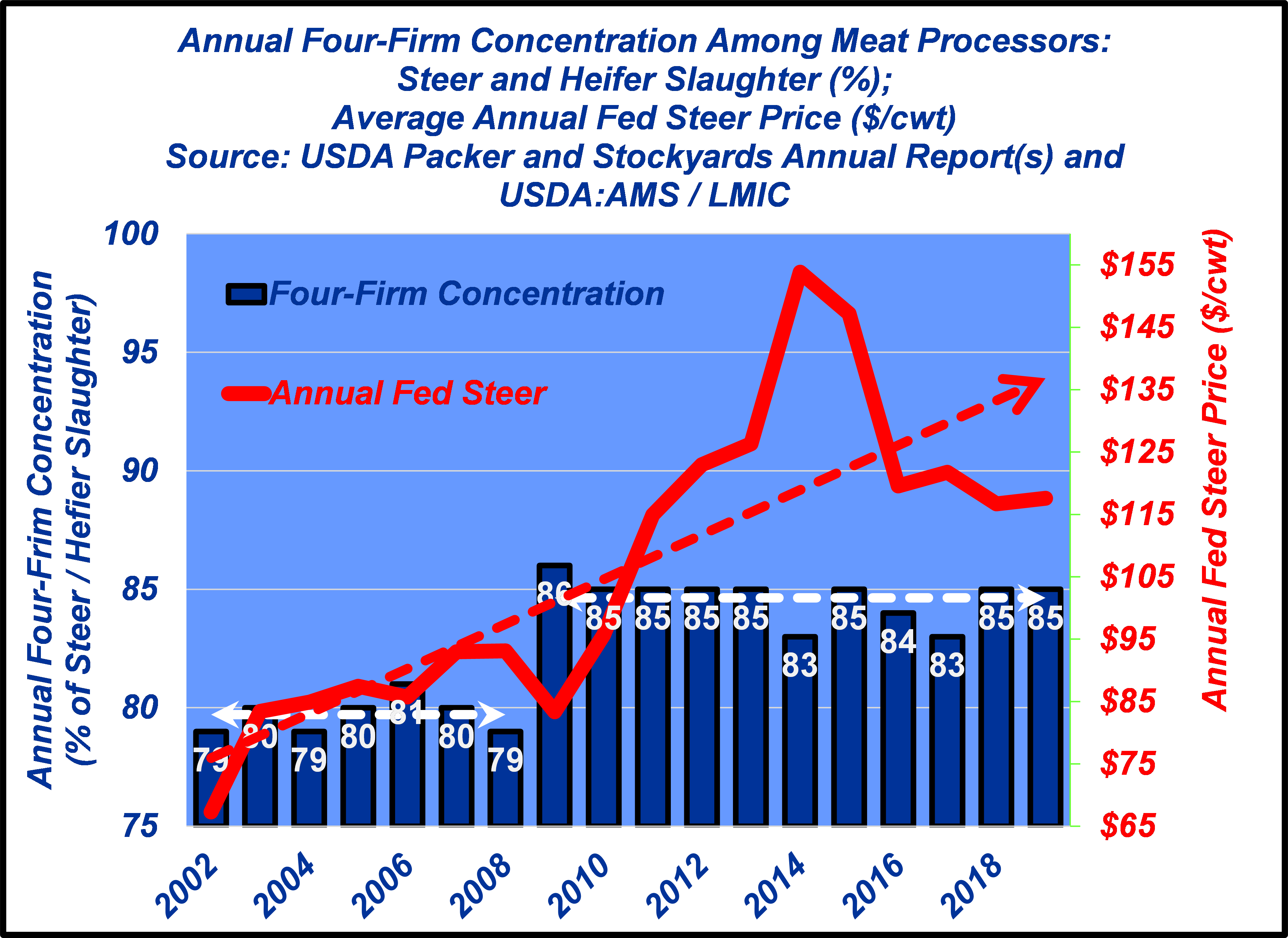

Packer angst has been re-energized in recent years – but it’s not new. For example, in 2010 R-CALF was asserting that: “…88 percent of all the fed cattle…are ultimately marketed through only four dominant beef packers. This unprecedented level of market concentration gives the dominant beef packers the ability to control, restrict and manage access to the market.” Given all that, a couple of things come to mind.

The Rule of Three: I emailed my reader urging some exploration around the ideas outlined in the book by that title. Author Raj Sisodia summarizes it like this: “Name any industry and more likely than not you will find that the three strongest, most efficient companies control 70 to 90 percent of the market.”

Most mature industries evolve to match that description (or something close to it). Some fitting examples include:

- Airlines (American, United, Delta, Southwest)

- Pick-up manufacturers (Ford, GM, Ram)

- Farm Equipment (Deere, CNH, AGCO)

- Cell phone manufacturers (Apple, Samsung)

- Animal Health (Zoetis, Elanco, Merck, BI)

- Freight / Delivery Services (UPS, FedEx, DHL)

Packers: The meat processing industry is no different; it’s subject to basic business principles. That’s especially true considering it's low-margin and capital-intensive – survival is dependent on obtaining economies of scale. Dr. Stephen Koontz (Colorado State University) describes it this way: “… the structure that we see today of the meatpacking and cattle feeding industries has been determined by economics and the [business] environment.”

The critics don’t like that reality. They argue meat processing should be different. And regardless of broader business principles, the packing industry is too concentrated and has too much power. So, what about that?

The graph below details the four-firm concentration of fed steer/heifer slaughter and annual fed steer price. Packer concentration is unchanged over the last ten years (and only 6% higher versus the previous seven years) – yet, fed cattle prices were 75% higher in 2019 vs 2002.

Knowledge problem: What number of companies would resolve all this concern about “lack of competition”? Should there be 6, 8, 10, maybe 50? There’s no good answer. And therein enters a basic tenet of economics - the knowledge problem.

Let’s circle back to the airline industry. Deregulation (1978) removed unnecessary restraints that hampered the industry. No longer hampered by government, business subsequently evolved. The outcome being more options and lower prices for all sorts of travelers - not to mention helping to drive economic growth.

The case study provides a powerful lesson. None of us (especially legislators) have perfect knowledge nor expertise to really know what the industry should look like. More importantly, it’s impossible to know the future; therefore, any sort of legislative directive is always looking backward.

The Kansas City star guest editorial noted above conveniently avoids all of this. The author naively declares lawmakers, “…should break up the enormous meatpackers for the betterment of both the consumer and the producer.” That statement defies logic.

And inherently invokes one of the great observations by Nobel Prize economist F.A. Hayek. He’d counter that any proclamation of a “carefully worked out plan” (i.e. regulatory solution to create competition) – even if it was perfect - is fleeting. After all, it’s subject to any-and-every “…passing whim of the consumer.” It’s a fool’s errand.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.