Bill Biedermann: Grain Demand Curves Have Shifted

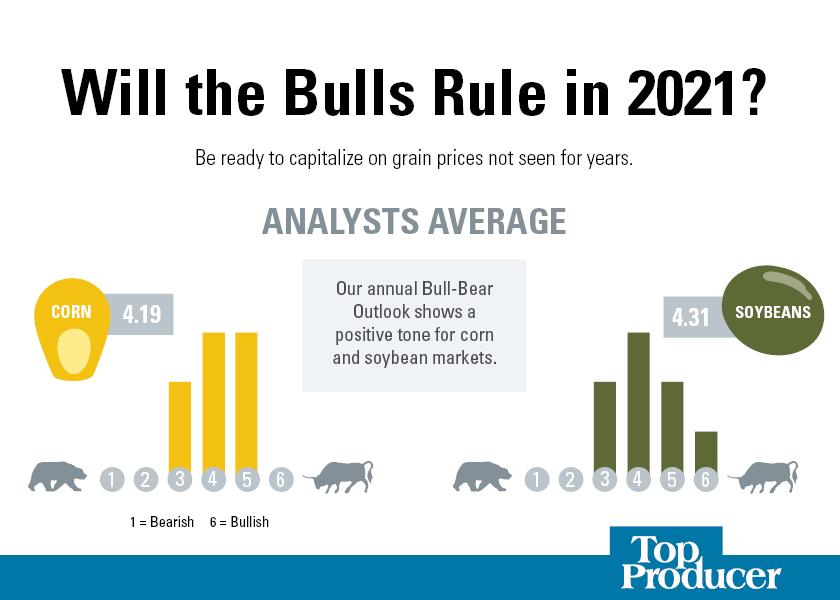

The rare occurrence of a downtrend in supply and an uptrend in demand put the grain markets on an upward trend to close out 2020. For 2021, be prepared for a good old-fashioned acreage battle. In response, create a disciplined marketing game plan. We asked eight analysts to provide their best estimates on price direction and market strategies you can employ in 2021. Here is one of eight.

Bill Biedermann, AgMarket.Net

The demand curve for both soybeans and corn has shifted. Most of the soybean shift is due to the reallocation of world market share, as lower tariff rates and a weaker U.S. dollar have made U.S. soybeans a favorable market.

The demand curve shift in corn is due to the increase in China’s grain consuming animal units (GCAUs), which has outpaced their production ability for the past four years.

If South American weather causes total soy production to fall below 130 million metric tons (MMT) and 100 MMT of corn, the U.S. will see a surge in summer-fall demand.

There is no reason to put your operation in financial jeopardy. If a good profit margin can be locked in and you can gain revenue as prices move higher, go for it. Looking ahead, I’m watching:

Fiscal Stimulus: If consumer spending, consumer confidence, mortgage refinances, real estate prices and wages are trending higher, expect money flow to move to fuel and food commodities.

The U.S. Dollar: From 2006 to 2008, the U.S. dollar fell from 92 to 75. The U.S. dollar in 2020 breached 92 and continues to move lower, making U.S. commodities cheaper to international buyers.

U.S. Acres: If corn and soybean acres each top 90 million, the market will find little reason to go up without weather issues.

Read More

Brian Basting: Lock in A Floor, Maintain Flexibility

Naomi Blohm: Watch Global Energy Policies

Disclaimer: This material has been prepared by a sales or trading employee or agent of these analysts and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions and agree that you are not, and will not, rely solely on this communication in making trading decisions. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that these analysts believe are reliable. Such information is not guaranteed to be accurate or complete, and it should not be relied upon as such. Trading advice reflects good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice provided will result in profitable trades.