Market Surprise: Lower-Than-Expected Planted Acres Send Prices Higher

USDA’s June 30 Acreage report is known to offer a few surprises, and the 2021 edition delivered.

For 2021, USDA estimates:

- Corn: 92.7 million acres, up 2% or 1.87 million acres from 2020.

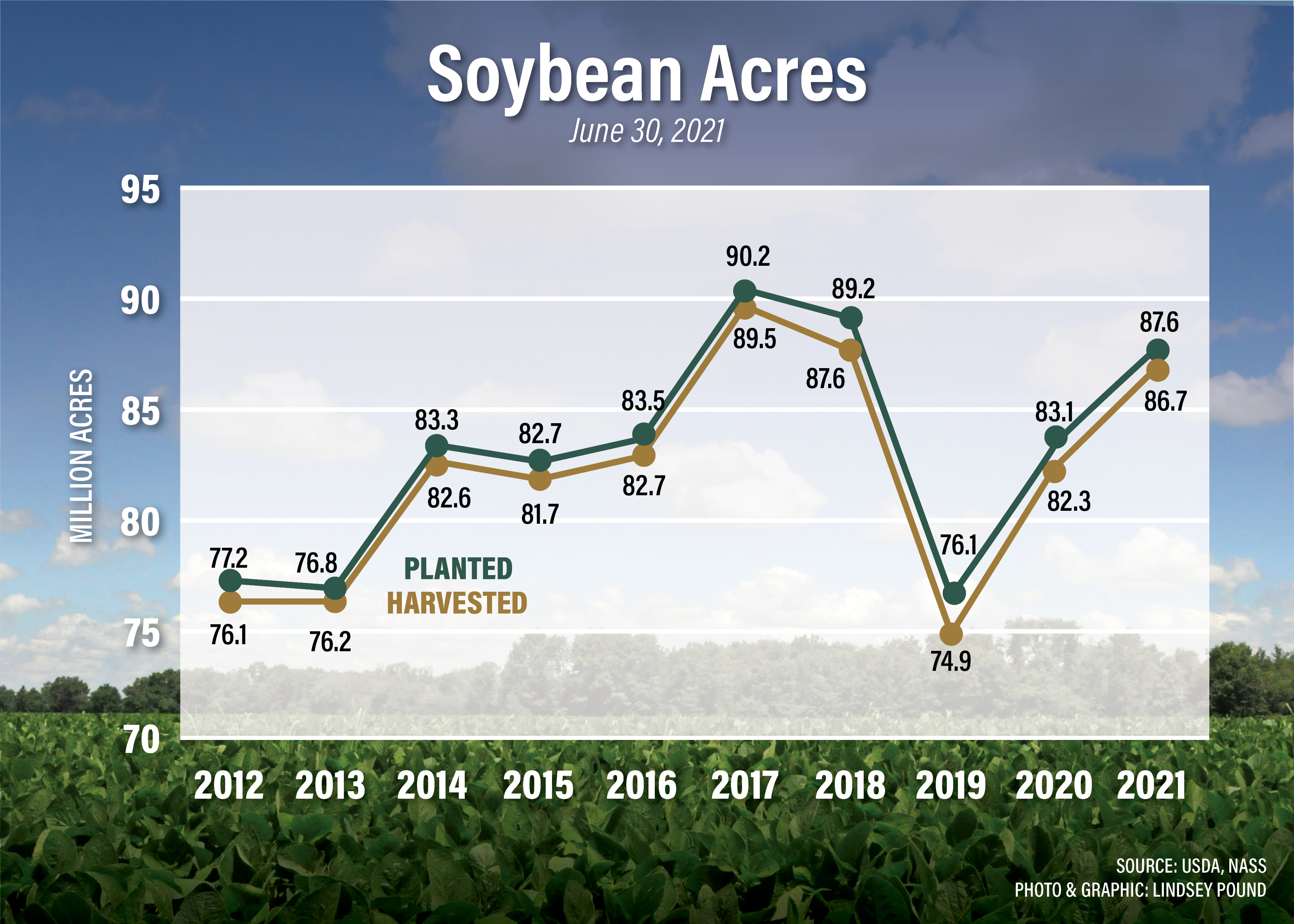

- Soybeans: 87.6 million acres, up 5% from 2020.

- All Wheat: 46.7 million acres, up 5% from 2020.

- All Cotton: 11.7 million acres, down 3% from 2020.

Ahead of the report, analysts surveyed by Reuters expected corn plantings to rise notably from March intentions to around 93.787 million acres with soybean plantings climbing to 88.955 million acres. Wheat plantings were expected around 45.940 million acres. Cotton plantings were expected at 11.856 million acres.

“Everyone was surprised in March at low acreage estimates, and now they are surprised again,” says Jarod Creed, owner of JC Marketing Services. “Expectations were that total acres would be 183 million or lower, and we did not get there.”

Total corn and soybean acres sit at 180.3 million, per USDA’s latest update.

For Grain Stocks, USDA estimates:

- Corn stocks in all positions on June 1, 2021 totaled 4.11 billion bushels, down 18% from June 1, 2020. Of the total stocks, 1.74 billion bushels are stored on farms, down 39% from a year earlier. Off-farm stocks, at 2.37 billion bushels, are up 11% from a year ago. The March - May 2021 indicated disappearance is 3.58 billion bushels, compared with 2.95 billion bushels during the same period last year.

- Soybeans stored in all positions on June 1, 2021 totaled 767 million bushels, down 44% from June 1, 2020. On-farm stocks totaled 220 million bushels, down 65% from a year ago. Off-farm stocks, at 547 million bushels, are down 27% from a year ago. Indicated disappearance for the March - May 2021 quarter totaled 795 million bushels, down 9% from the same period a year earlier.

- Old crop all wheat stored in all positions on June 1, 2021 totaled 844 million bushels, down 18% from a year ago. On-farm stocks are estimated at 142 million bushels, down 38% from last year. Off-farm stocks, at 702 million bushels, are down 12% from a year ago. The March - May 2021 indicated disappearance is 467 million bushels, up 21% from the same period a year earlier.

Ahead of the report, analysts expected corn, soybeans and wheat stocks to all tighten dramatically.

Following the reports’ release, corn, soybean and wheat prices all surged higher.

Creed says the markets will now be focused on weather.

“With lower acres, the weather will have a greater emphasis,” he says. “In the last few days, forecasts have become a little more favorable for crop production than 48 hours ago.”

Even with the surge in prices, Creed suggests sticking to your grain marketing plan.

“As of June 30, there is no data to suggest that a marketing plan from one month ago should be any different than today,” he says.

Check the latest market prices in AgWeb's Commodity Markets Center.