Farmland Values Rising Faster in Western Corn Belt Vs. the East, Will It Continue?

AgDay 09/27/21 - Farm Real Estate Values

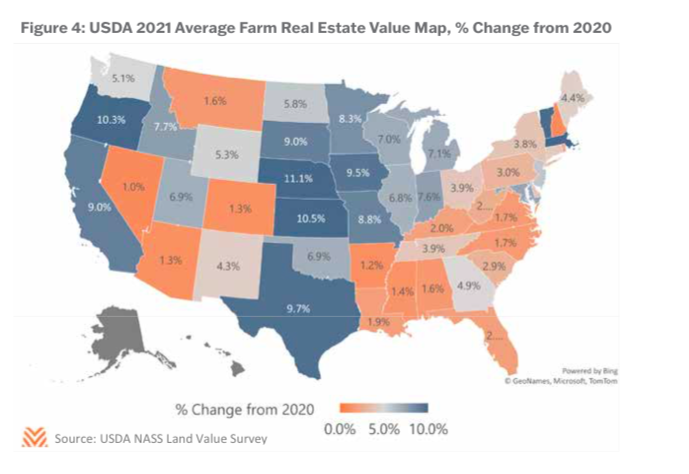

According to Farmer Mac’s The Feed Fall Edition, USDA shows overall farm real estate values in the U.S. are up 7% compared with 2021. Jackson Takach, Farmer Mac economist, says when you adjust for inflation, farmland returns are still on solid footing and viewed as a safe investment.

“Farmers all the way to institutional investors look at farmland as a good hedge to inflation. Historically, it has been like most real assets — it has performed very well against rising inflation when in an inflationary environment,” Takach says. “That's certainly at play today when people think about a good safe storage for the U.S. dollar in a higher price environment. Farmland is part of that discussion, as it should be.”

West Vs. East

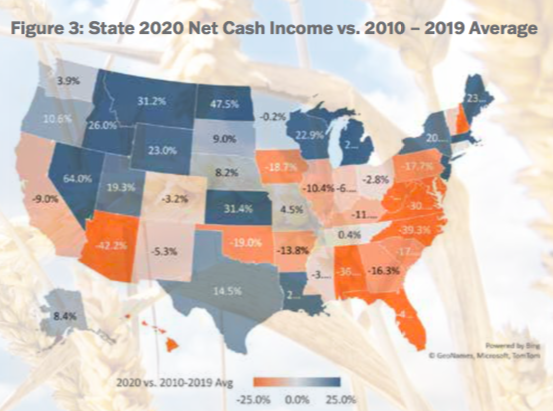

Farmer Mac's The Feed shows the rate at which real estate values have increased from 2020 is a quicker pace in the Western Corn Belt compared with the East. States such as Nebraska and Kansas are seeing farmland values up more than 10%. Iowa’s values increased 9.5% while Illinois, Indiana and Ohio are seeing farmland values rise at a slower rate. However, the storyline could switch for 2022, as indicated in USDA's updated Net Farm Income picture released in September.

“I think the eastern Corn Belt is probably going to experience a much bigger 2021 than 2020,” Takach says. “If you look at weather conditions, you look at the health of the crop today in that area, it's looking like a really bumper crop for the eastern Corn Belt. That wasn't necessarily true the last couple of years; when you get out to Indiana and Ohio, they had a couple of short years, a couple of drier years. I think that influenced the investment activity in the those states when leading up to 2021, so certainly it's going to be a different profitability picture in 2021. That could influence how people think about land they want to put up for sale and how much other people are willing to pay for it.”

Takach says as interest rates for agricultural production remain near historic levels, the lower interest rate environment impacts farm finances in two major ways. According to the Feed, lower interest rates decrease interest expense with farm debt, as farmers can save between 7% and 14% in debt costs annually, depending on the term and tenor of financing. Farmer Mac says a lower interest rate environment also reduces the required return investment threshold in farmland to make the investment attractive.

Yet, Takach says when looking at some of the record land sales recently produced in Iowa, for example, it’s not necessarily lenders financing the purchase, as buyers have more equity to finance their purchases.

“We're still seeing really strong loan to values of 50% and 60%,” Takach says. “So, it's not as if farmers are trying to reach for those higher leveraged sales and lever up those purchases. They're able to put more equity into those transactions, or even purchasing with cash. I've heard several examples of all cash sales. As there's more liquidity out there in the marketplace, you do start to see more key numbers and property is going up for sale at very high prices. But that's not necessarily because of lending activity — sometimes it's just demand in that local region.”

Farmland Real Estate Values Outlook

Takach says low interest rates, better commodity prices, inflation and solid cash inflows are all factors contributing to the rapid rise in farm real estate values. He points out while the fall harvest season typically produces a season slowdown in the real estate market, but he thinks farmland values could continue to see support into 2022.

“Persistent upward pressure on commodity prices and downward pressure on interest rates will likely help boost farmland values into 2022,” Takach and other economists pointed out in The Feed. “Auction markets continue to see strong bidding and limited supply of land coming to market, which bodes well for the farm real estate assets that do come to market in the coming months. Markets may hit some resistance in 2022 if Federal Reserve monetary policy tightens or commodity prices back off recent levels. Water availability could also play a role in Western states. Access to adequate water may prove to differentiate property values, rather than move the average. Slowing cash liquidity could also present a headwind to values in 2022; while commercial bank deposits remain at all-time highs, the growth stalled in May."

Farmer Mac says the latest USDA data shows many producers will receive their strongest farm incomes since 2014, especially when looking at the row crop sector, with considerable government spending adding to a strong year for cash receipts.