Record-High Optimism Buoys Already Strong Farmland Prices

Have you seen the shift in your area? Once-sleepy farmland prices are awake and shooting higher.

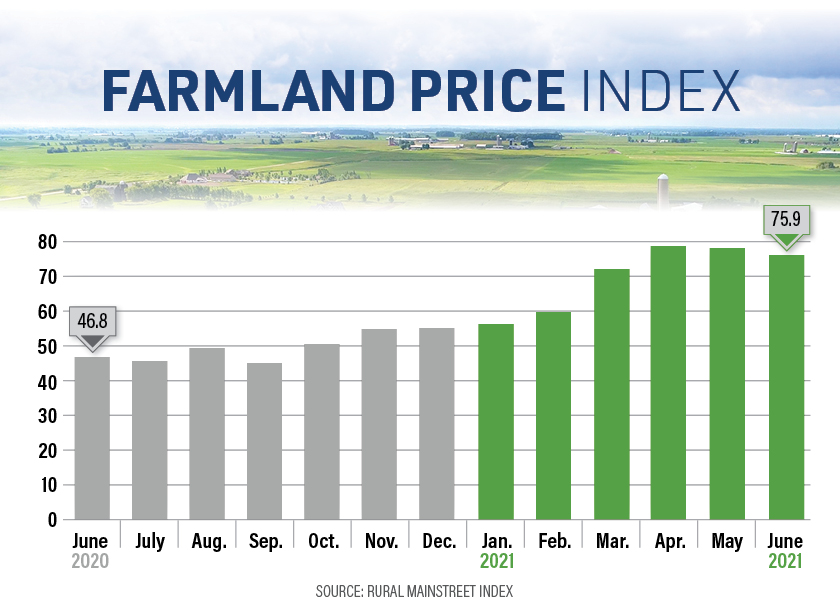

The June Rural Mainstreet Index farmland price index is at 75.9. While that’s slightly down from May’s 78.1, it is the first time since 2013 that Creighton’s survey has recorded nine straight months of farmland prices above growth neutral.

In addition, the June Purdue University/CME Group Ag Economy Barometer saw farmers’ optimism over farmland values reached a record high of 158, according to the Long-Run Farmland Value Expectations Index.

Right now, Hensley, president of Hertz Real Estate Services, shares these key themes driving the market:

- Strong crop prices

- Low interest rates

- Expectations of high farmer profitability

- Reduced inventory for sale

“This has created a real sense of optimism throughout the countryside,” Hensley says. “That optimism is coming from both farmers and farmland investors alike. It’s clear the land market has moved higher and there’s more demand than supply.”

While some areas may be seeing less farms for sale, the land hitting the market is earning high-dollar bids. The dramatic increase in financial stability across farm country is propelling farmers to bid more aggressively for additional land than has been the case during the past six years, according to Farmers National Company, based in Omaha, Neb.

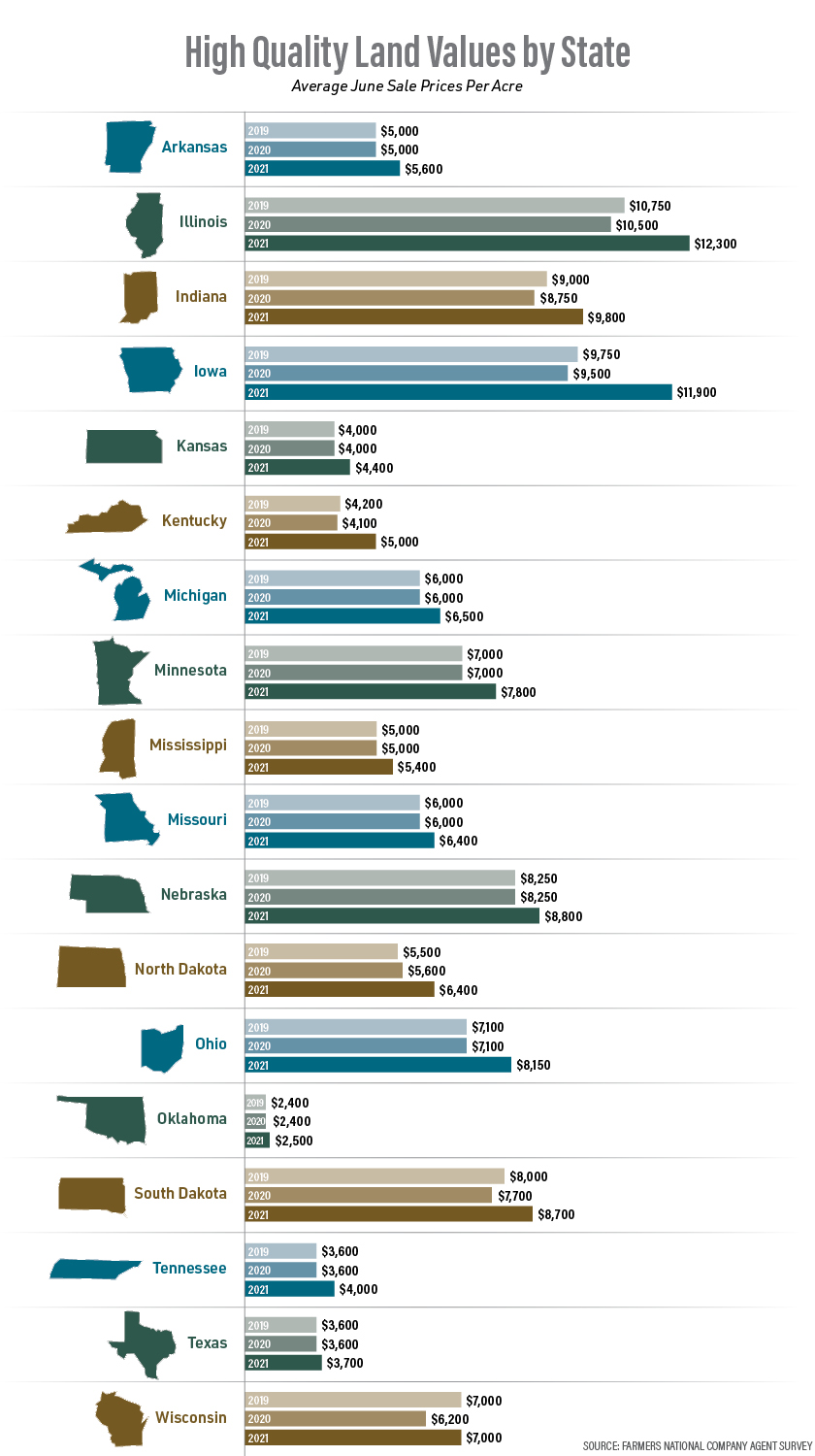

“Farmland sales prices are up 5% to 15% in the past six months with most of the increase coming since the first of the year,” says Randy Dickhut, Farmers National Company’s senior vice president of real estate operations. “Competitive bidding among interested buyers is really pushing land prices right now.”

Individual investors, both first-time and experienced buyers, are stepping into the land market as they search for a safe, long-term real estate investment in a low interest rate environment. Investor buyers seldom outbid farmer-buyers for a good farm unless they have 1031 tax-deferred exchange funds to spend in a short time period, he adds.

Dickhut says competitive has been pushed sales prices for good cropland to levels approaching 2014 values. Currently, the demand for good farmland is outstripping the supply of farms for sale, he notes. The strong demand to own farmland is one of the main factors pushing prices higher.

Farmers National Company’s land sales activity has already been very brisk and above the market the past seven months with dollar volume of land sold up 60% over last year and up 67% over the average of the past three years. The number of acres sold in this time period is up 64% from last year.