Rental Rally: Don’t Let High Cash Rents Sink The Farm

Farmers riding the wave of higher commodity prices in 2022 are likely to deal with increased competition for land in 2023. It’s evident in the record-high sale prices being reported across the Midwest.

RISING TIDES

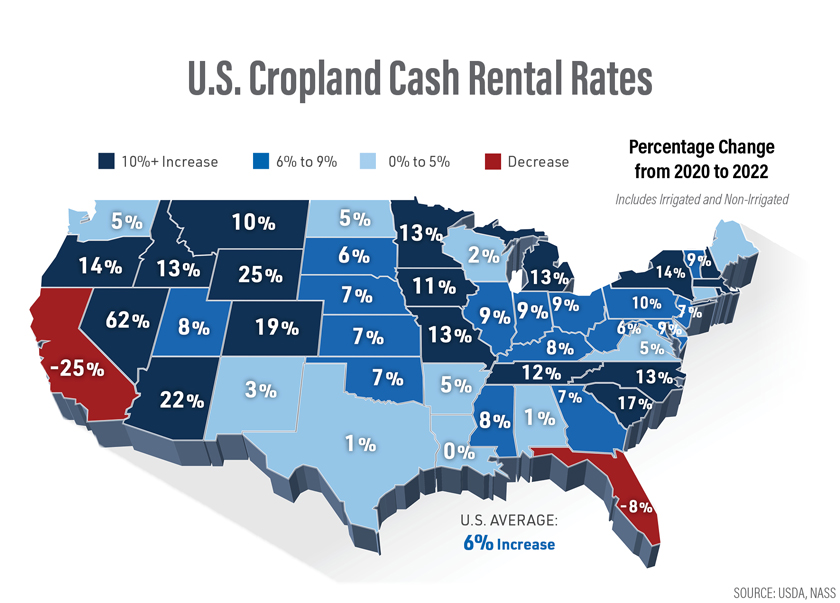

However, these aren’t the only ballooning land costs. Over the past two years cash rental rates are up 6% nationally, according to USDA. Depending on the state, that two-year jump hits double digits.

In Illinois, a recent survey by professional land managers shows rental rates for excellent farmland were $309 in 2021. In 2023, rents for that high-value land class are expected to hit $386 per acre — a 25% increase.

In Iowa, an Iowa State University report shows the 2022 state average rental rate is $256. That’s up 10% in just the past year and 15% higher than 2020. This year’s rent is also the third-highest price on record.

BIG WAVES AHEAD

Just as every land sale is local, so are cash rent prices, says Alan Hoskins, president and national sales director at American Farm Mortgage and Financial Services. He says some landlords are already asking about adjusting rents higher for next year.

“Anytime you have years of higher profitability, it gets the wheels spinning with landowners and even land investors who are working on their capital return rate,” adds Shay Foulk, Illinois farmer and consultant with Ag View Solutions. “At the end of the day when marketing a bushel of corn, it doesn’t matter whether it came from owned land or rented land. What matters is the cost per bushel.”

Both believe the best approach to the coming 2023 cash rent conversation is an open, data-driven discussion void of emotion.

“There are times where the landlord looks at farm numbers, and they say, ‘Wow, I didn’t realize some of these numbers, and I didn’t realize the expense side was adjusting so rapidly,’” Hoskins says.

When visiting with your landlord share data, such as yield, commodity prices and outlook, gross income and the current cost of inputs.

Also, share what you are nervous about.

“Candidly, there are times where landlords say, ‘I’m not really concerned about the bottom side; instead, I’m more concerned about the top side because I need additional revenue,’” Hoskins says.

FLOAT OTHER BOATS

Depending on the landlord and the relationship, value can be created in ways beyond dollars, Foulk says. He sug-gests proposing win-win alternatives to straight cash rent increases.

“Instead, look at ways to invest back into the farm,” he says. “Is there a timber stand that needs cleared? Is there drainage tile that can be installed?”

Be honest about how a piece of ground fits into your portfolio, as in its benefits and limitations.

“If 30% of the acres are poor timber, 30% need drainage and 40% are awesome, maybe you agree to an increase on the higher-value land,” Foulk says. “Have your talking points together and remember if you come into a debate un-prepared, you’re going to lose.”

Think ahead, know your target rent and what price is simply too high.

“We’ve run scenarios with farmers who had opportunities to pick up land in the last 18 months where the cash rents were higher than what they wanted, but when we spread their fixed costs out over it, it’s a positive move for them,” Foulk says.

Red Flags Flying

Be on the lookout for these red flag warnings, suggest ag lender Alan Hoskins and consultant Shay Foulk.

- An “I can’t lose that farm!” mindset. “Emotional decisions, particularly in challenging times, are red flags,” Hoskins says.

- A high-rent farm that is not beneficial to the overall operation. “If you farm a farm for 20 or 30 years, yes, it would be extremely hard to see that farm go away,” Hoskins says. “But it’s even harder to see your whole farm go away.”

- Pay me now. “A farmer I know said 10 years ago 10% of his landlords wanted their rent upfront,” Hoskins says. “This year that number is 80%.” To avoid frustration, put in writing when you’ll pay.

- Good land, sketchy relationship. “A lot of land will change hands in the next five to 10 years,” Foulk says. “So, No. 1, what’s the relationship like?” You might want to upgrade negative or needy relationships.