Are You Using the Best Entity Structure for Your Farm?

Understand and weigh your operation’s options

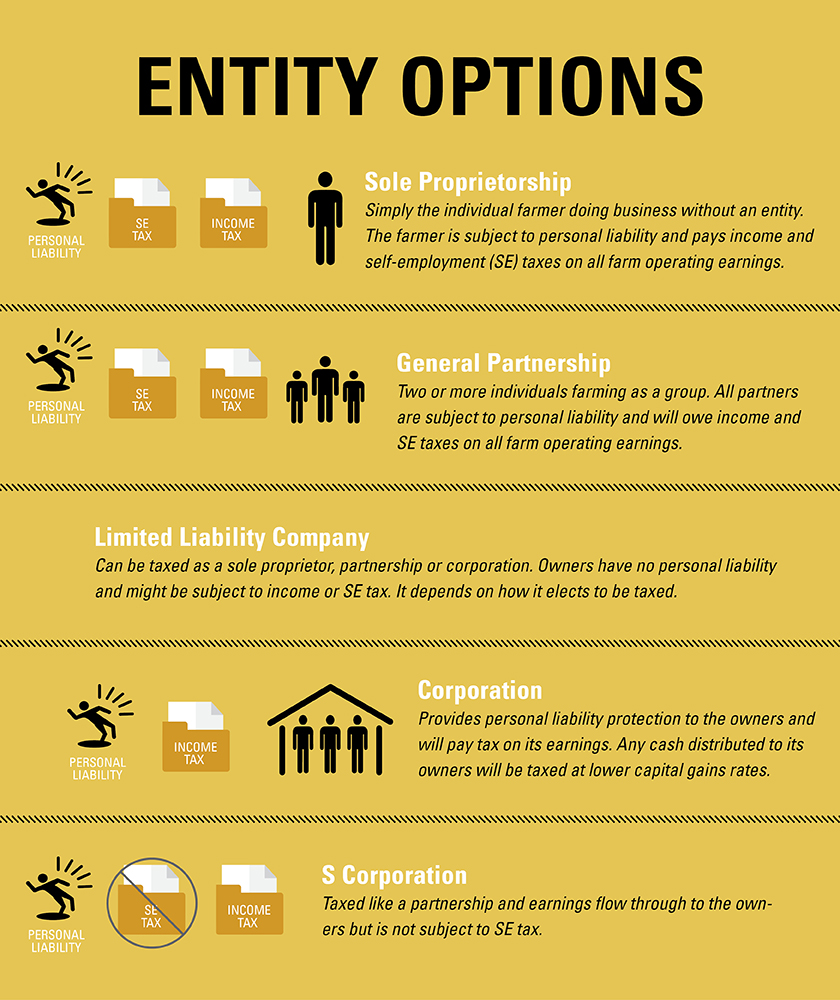

Before we dive into which entity option is the best for your farm, let’s review your options:

Sole Proprietorship: Simply the individual farmer doing business without an entity. The farmer is subject to personal liability and pays income and self-employment (SE) taxes on all farm operating earnings.

General Partnership: Two or more individuals farming as a group. All partners are subject to personal liability and will owe income and SE taxes on all farm operating earnings.

Limited Liability Company: Can be taxed as a sole proprietor, partnership or corporation. Owners have no personal liability and might be subject to income or SE tax. It depends on how it elects to be taxed.

Corporation: Provides personal liability protection to the owners and will pay tax on its earnings. Any cash distributed to its owners will be taxed at lower capital gains rates.

S Corporation: Taxed like a partnership and earnings flow through to the owners but is not subject to SE tax.

PARTNERSHIP AS OPERATING ENTITY

- Pros: The arrangement might be appropriate for the parent-child operating entity, with the land being leased from the parent. This allows for rent income earned by the parent to not be subject to SE tax.

- Cons: Because of SE tax considerations, a general partnership does not provide the same tax advantages as operating in the corporate environment, or a manager managed LLC. All earned income (minus rent income) is subject to SE tax for both the parent and child.

S CORPORATION FARMS

- Pros: The primary tax benefit of the S corporation farm is the reduction of SE tax as long as appropriate wages are paid to its owners for services provided to the corporation. The IRS has been successful in assessing payroll taxes when employee-shareholders are paid too little for the services performed.

- Cons: A primary disadvantage of operating as an S corporation relates to estate tax rules. Upon the death of the owner of a sole proprietorship, the inventory, land and depreciable assets of the farm are adjusted to fair market value (step-up in basis). The heirs who receive non-corporate assets may sell such assets with little or no taxable gain due to the adjustment. The shareholder of a corporation, however, owns stock in the corporation, not the individual assets inside the corporation. Therefore, these assets do not receive a basis adjustment to fair market value; rather, the stock of the corporation is adjusted. No matter what, the benefit provided will be substantially less than the benefit provided to the heirs of a sole proprietor or partnership.

REGULAR (C) CORPORATE FARMERS

- Pros: C corporations allow tax-free fringe benefit rules. For example, a C corporation may provide tax-free meals and lodging on corporate premises, which includes housing the corporation owns or leases. The C Corporation may provide medical insurance on a tax-free basis to a reasonable class of employees. Medical expenses not covered by insurance may be reimbursed by the corporation.

The C Corporation with excess income may push out income to the individual shareholder-landlords through the payment of reasonable rent. Reasonable wage payments for services rendered may also be paid to shareholder-employees. Wage payments to employees (including shareholder-employees) are subject to payroll taxes. Wages paid in the form of commodities are not subject to payroll taxes.

- Cons: Corporations are subject to a “double tax” since after-tax income distributed to owners are subject to tax, however, it is paid at the lower capital gains rate. But dividends paid to a person in the 15% or lower bracket are subject to a 0% federal tax rate which might eliminate part of the double tax.

REGULAR (C) CORPORATE FARMERS WITH FISCAL YEAR-END

A C corporation with a fiscal year-end has the same tax benefits as discussed above, with one more benefit thrown in: The payments from the corporation to the individual are not immediately taxed at the individual level. An element of deferral exists, which allows the individual more flexibility and time to tax-plan further.

LIMITED LIABILITY ENTITY FARMS

- Pros: A Limited Liability Company (LLC) has potential for limiting SE pass-through income, as an LLC can generally be drafted in a manner where some members have management/SE status and others do not.

Use of a manager-managed LLC with two classes of membership provides SE tax savings to the non-managing members. A manager-managed LLC may provide separate classes of membership for managers and non-managers. Managers are normally subject to SE tax on income from that interest. However, if there are non-managers who own at least 20% in the LLC and spend less than 500 hours with it, then both the non-managers and the managers can eliminate SE tax on their farm income.

The primary farmer owns a class of non-manager interests, identical to those held by the other non-managers, and a manager interest. This exception allows the person to be exempt from SE tax on the non-manager interest but is subject to SE tax only on the manager’s pass-through income and guaranteed payment. See the examples.

The estate tax benefits of step-up in basis for equipment and inventories will apply to assets held by the LLC.

- Cons: LLCs have few downsides, except they do not provide certain tax-free fringe benefits like other entities. Review what is best with your advisers.

EXAMPLE

Bear LLC is a farm owned by Papa and Mama, who are married. Mama is not active in the farm but is an equal owner. Because she does not work more than 500 hours for the farm and she holds at least 20% of the ownership, Papa’s membership interest could be structured as manager and non-manager units. He is provided a 2% manager interest and the appropriate guaranteed payment for labor and management. This 2% interest will be subject to SE tax, as will the guaranteed payments paid to Papa. The 49% non-manager’s interest each owned by Papa and Mama will not be subject to SE tax.

The manager can receive a larger LLC interest. This interest provides the reward to the manager for services to the LLC, without requiring a guaranteed payment.

EXAMPLE

Peter and Mary own PPM LLC, a corn and soybean farm. Although they own everything 50-50, Mary operates the farm and Peter is a full-time house builder.

In structuring the LLC ownership, they determine Mary should receive a 20% profits interest for her farm management and labor. Remaining profits will be split 50-50 between the owners; Mary and Peter each received 40% non-managers interest in the LLC for the contribution of the equipment and other tangible assets to the LLC. No guaranteed payments will be paid, as the members determined the profits interest represents reasonable compensation for the labor and management provided.

The Bottom Line

All entity planning must incorporate all aspects of the proper entity structure. This includes liability protection, proper income and estate tax planning and making sure to achieve proper FSA payment limitations. These need to be closely examined by appropriate professionals to determine the right structure for your farm.