Growing Concerns Over Rising Input Costs, Climbing Cash Rents Evident in July Ag Economy Barometer

AgDay 08/04/21 - July Ag Economy Barometer

A new look at farmer sentiment shows sentiments appear to be stabilizing some in farm country.

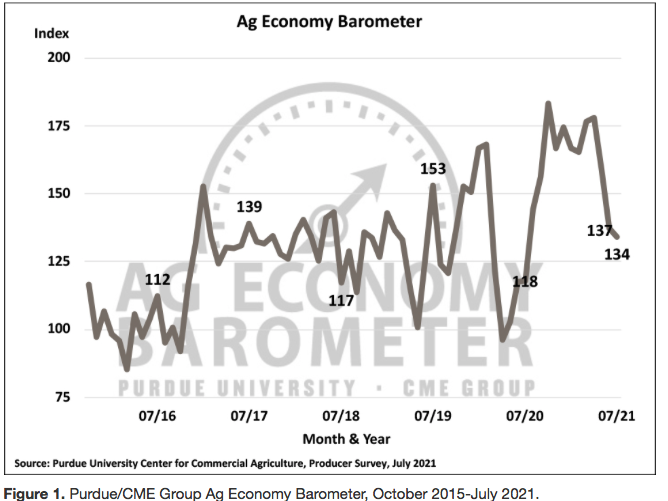

The new July Purdue CME Group Ag Barometer data comes on the heels of a sharp two-month decline.

The latest Ag Economy Barometer posted a a reading of 134 in July, which is nearly steady with July, coming in just three points below last month's reading. However, this months sentiment index was the weakest barometer reading since July of last year. Just a month after the barometer showed a 20-point drop, surveyors say farmers are still concerned about rising costs.

"Farmers are clearly concerned about the rising cost of farm inputs," says Jim Mintert, a Purdue agricultural economist who authors the survey each month. "30% of the farmers in this month's survey said they expect to see farm input prices over the next year rise by at least 8% or more. And in fact, 17% of the farmers in our survey said they expect to see farm input prices rise by 12% or more.

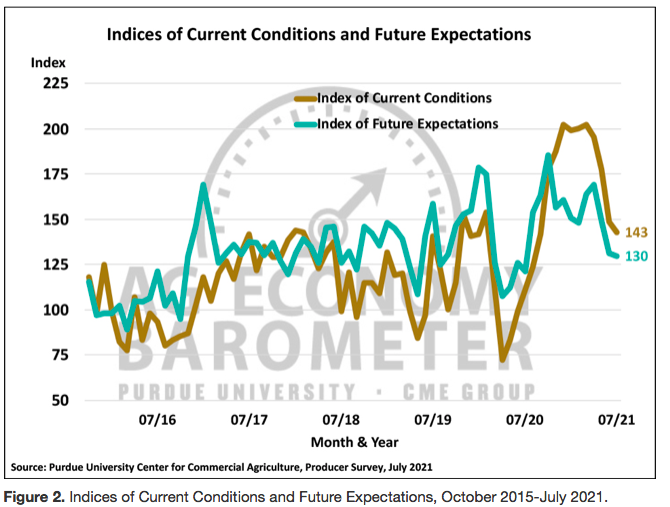

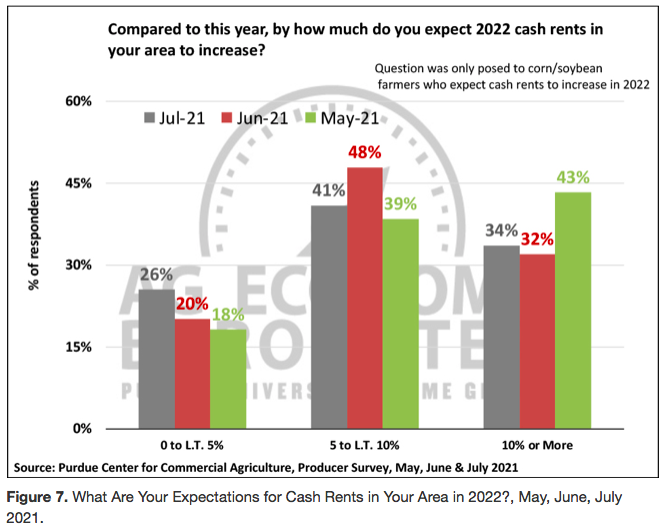

Farmers remain bullish about farmland values, although recent value increases could be making some producers more cautious about where land values are headed in the next 12 months. Cash rents are another cost concern, as nearly half of corn and soybean farmers surveyed say they expect farmland cash rental rates to rise in 2022, which is unchanged from the June survey.

Other key findings by Mintert and the survey authors found regarding cash rents include:

- More than 40% of corn/soybean growers who expect rates to rise think the increase will range from 5 up to 10%,

- Fewer producers in July (34%) said they expect a rate rise of 10% or more, compared to 43% in May.

- More producers in July (26%) said they expect a moderate rate increase of less than 5%, compared to 18% in May.

Mintert points out concerns over future financial performance and the ability to make large investments also saw increasing concerns. For the second straight month, the barometer asked producers about expectation for farm input prices, and the survey found:

- 51% of the producers surveyed expect input prices to rise 4% or more over the next year,

- Three out of ten expect costs to rise 8% or more

- Nearly one out of five (18%) expect input prices to rise by 12% or more.

- These expectations are markedly higher than the rate of 1.8% per year that input prices rose over the last decade