The Inflation Equation: Should You Lock in Rates Now?

Prices for just about everything are rising at the fastest pace in nearly 40 years.

Beyond what you pay for food and consumer goods, inflation impacts your balance sheet. Many income tax rates, exemptions and deductions are adjusted each year for inflation.

The annual inflation numbers are based upon the year ended Aug. 31. This gives the IRS enough time to determine the actual inflation number for the following year.

“Inflation had been fairly tame for the 20 years leading up to 2020,” says Paul Neiffer, CPA and partner with CLA. “However, the pandemic has certainly changed this, and the change has been dramatic.”

AMPLIFIED RISK

Review your farm’s loan rates and debt load now, says Luke Schultz, relationship manager for Conterra.

“Risk is amplified during inflationary times,” he says. “We are seeing lines of credit get really tight. You may want to restructure your balance sheet to pump more liquidity into your business.”

Visit with your lender to understand your options, Schultz

suggests. Even if loan rates aren’t as favorable now as they were a year ago, six months from now, today’s rates could be gone.

“You want to take advantage of long-term fixed rates while the opportunity still exists,” he says.

Analyze Your Interest Rate Risk

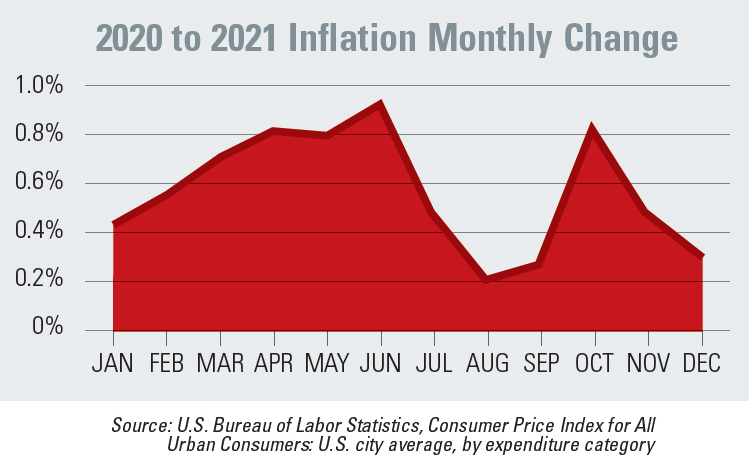

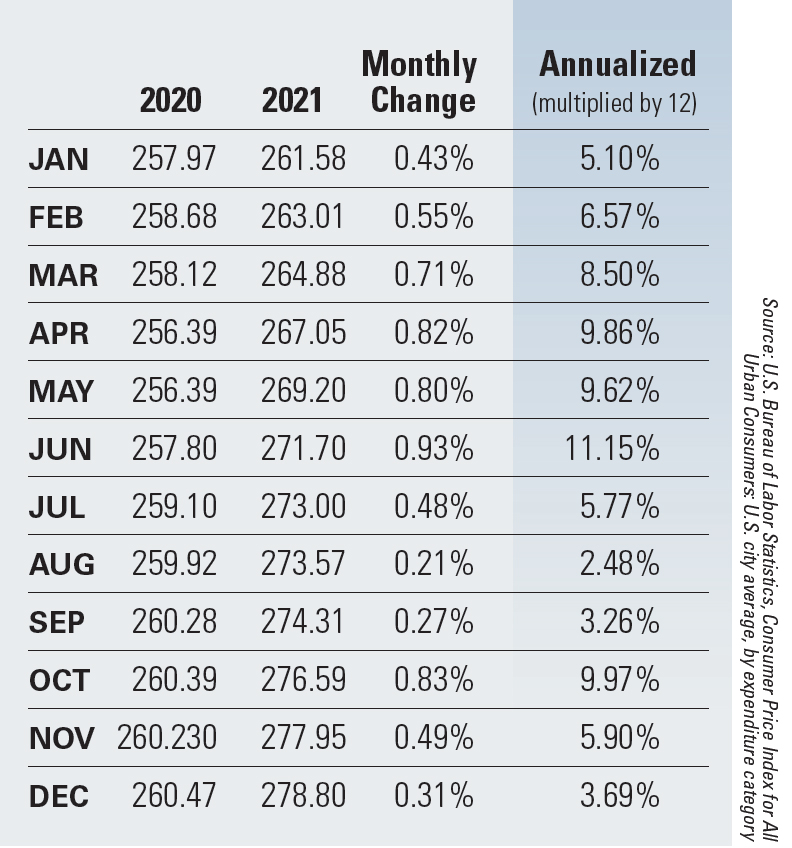

This table shows inflation numbers, the monthly change and the amount of inflation if that month’s number was annualized (ex: multiplied by 12). The final inflation number for 2021 was 6.7%

“As you can see the trend of inflation in 2021 was not linear,” says Paul Neiffer, partner with CLA. “The Federal Reserve finally has realized this may not be transitory, and we will likely see at least four increases in the discount rate, and each increase may be larger than normal.”

This could result, Neiffer says, in interest rates being 2% to 3% higher at the end of 2022 than at the beginning.